Are U.S. Cars About to Crash?

Companies / US Auto's Sep 27, 2014 - 12:18 PM GMTBy: John_Rubino

New car sales have been one of the bright spots of the US recovery. And they’re still at it:

New car sales have been one of the bright spots of the US recovery. And they’re still at it:

September U.S. auto sales to rise 10 percent: JD Power, LMC

(Reuters) – Strong demand drove U.S. new car and truck sales 10 percent higher in September, adding momentum to the industry’s best August in more than a decade, consultants LMC Automotive and J.D. Power said on Thursday.Sales rose to 1.248 million new vehicles, or a seasonally adjusted annualized rate of 16.5 million vehicles. This follows a 17.5 million annualized rate in August.

“The strength in automotive sales is undeniable, as August sales performance was well above expectations and there is no evidence of a payback in September, suggesting that the auto recovery still has some legs,” LMC forecaster Jeff Schuster said.

LMC raised its full-year forecast for 2014 to 16.4 million vehicles from 16.3 million vehicles

Why have cars been so strong when housing in particular and consumer spending in general have been relatively limp? Two reasons. First, subprime lending has found a home in this market:

In a Subprime Bubble for Used Cars, Borrowers Pay Sky-High Rates

(New York Times) – Rodney Durham stopped working in 1991, declared bankruptcy and lives on Social Security. Nonetheless, Wells Fargo lent him $15,197 to buy a used Mitsubishi sedan.“I am not sure how I got the loan,” Mr. Durham, age 60, said.

Mr. Durham’s application said that he made $35,000 as a technician at Lourdes Hospital in Binghamton, N.Y., according to a copy of the loan document. But he says he told the dealer he hadn’t worked at the hospital for more than three decades. Now, after months of Wells Fargo pressing him over missed payments, the bank has repossessed his car.

This is the face of the new subprime boom. Mr. Durham is one of millions of Americans with shoddy credit who are easily obtaining auto loans from used-car dealers, including some who fabricate or ignore borrowers’ abilities to repay. The loans often come with terms that take advantage of the most desperate, least financially sophisticated customers. The surge in lending and the lack of caution resemble the frenzied subprime mortgage market before its implosion set off the 2008 financial crisis.

Auto loans to people with tarnished credit have risen more than 130 percent in the five years since the immediate aftermath of the financial crisis, with roughly one in four new auto loans last year going to borrowers considered subprime — people with credit scores at or below 640.

The explosive growth is being driven by some of the same dynamics that were at work in subprime mortgages. A wave of money is pouring into subprime autos, as the high rates and steady profits of the loans attract investors. Just as Wall Street stoked the boom in mortgages, some of the nation’s biggest banks and private equity firms are feeding the growth in subprime auto loans by investing in lenders and making money available for loans.

The extra demand generated by allowing (apparently) anyone with a heartbeat to buy has supported the price of used cars, making new cars more attractive by comparison. Which in turn makes leasing seem like a good deal for all concerned:

The Mystery Behind Strong Auto “Sales”: Soaring Car Leases

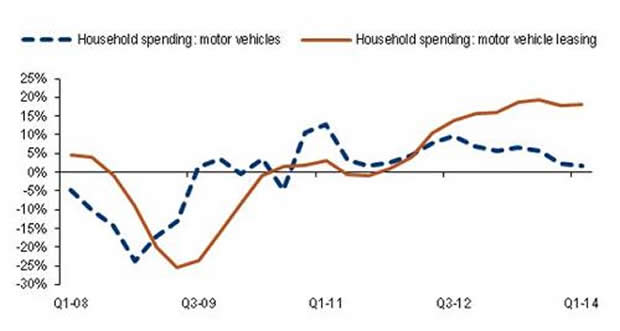

(Zero Hedge) – When it comes to signs of a US “recovery” nothing has been hyped up more than US auto companies reporting improving, in fact soaring, monthly car sales. On the surface this would be great news: with an aging car fleet, US consumers are surely eager to get in the latest and greatest product offering by your favorite bailed out car maker (at least until the recall comes). The only missing link has been consumer disposable income. So with car sales through the roof, the US consumer must be alive and well, right? Wrong, because there is one problem: it is car “sales” not sales. As the chart below from Bank of America proves, virtually all the growth in the US automotive sector in recent years has been the result of a near record surge in car leasing (where as we know subprime rules, so one’s credit rating is no longer an issue) not outright buying.From BofA:

“Leasing soars: Household outlays on leasing are booming at a 20% yoy pace – a clear sign that demand for vehicles is alive and kicking. With average lease payments lower than typical monthly ownership costs and with a down-payment not typically required to enter into a lease, the surge in vehicle leasing is likely a sign that financial restraints are still holding back some would-be buyers. Thus, as the economy improves, bottled-up household demand for vehicles could translate to higher sales.”

Chart 1: Households go for the low capital option: leasing soars (yoy growth rate, inflation-adjusted)

It could also translate into even higher leases, which in turn bottlenecks real, actual sales.

Of course, the problem is that leasing isn’t buying at all. It is renting, usually for a period of about 3 years. Which means that at the end of said period, an avalanche of cars is returned to the dealer and thus carmaker, who then has to dump it in the market at liquidation prices, which in turn skews the ROA calculation massively. However, what it does do is give the impression that there is a surge in activity here and now… all the expense of massive inventory writedowns three years from now.

Which is precisely what will happen to all the carmakers as the leased cars come home to roost. But what CEOs know and investors prefer to forget, is that by then it will be some other management team’s problem. In the meantime, enjoy the ZIRP buying, pardon leasing, frenzy.

The above prediction is already coming true:

Falling used-car prices roil the auto market

(USA Today) – Used-car prices are sliding, a boon to penny-pinchers, but troubling for new-car sales.The auto industry sales recovery in recent years means millions of used cars, many coming off lease, are starting to flood the market. The result is a decline in used-car prices that zoomed sky-high after the recession. And the decline is leading to talk that new-car auto sales growth may be peaking.

“We’re going to see a tremendous increase in used-car supply over the next couple of years,” says Larry Dominique, an executive vice president of auto-pricing site TrueCar.

That used-car cascade could dampen new-car sales in three ways:

•Less valuable trade-ins. Car shoppers may find their trade-ins are worth less than they expected when they go to buy new vehicles. That means they’ll have to shoulder larger new-car loans or forgo the purchases.

•More expensive leases. Lease rates for new vehicles are based on predicted resale value. As resale prices fall, automakers adjust predicted depreciation schedules and have to raise lease prices.

Wholesale prices were down 0.4% in August vs. a year ago, down 1.6% from July and “prices should continue to trend down as supply outpaces demand,” writes Tom Kontos of Adesa Analytical Services, which tracks wholesale prices for used cars, in a note to the industry.

At retail, the average used car sold at a franchised auto dealership went for $10,883 last month, down 1.6% from a year ago and 2.4% from July, says CNW Research.

So falling used car prices will lead to massive write-downs by the auto companies now being forced to take back all those leased vehicles. Which means the currently rosy earnings projections for GM, Ford and the other automakers playing these games are wildly overoptimistic and will have to be scaled back in an, um, unruly fashion during the next couple of years.

This sudden unpleasant surprise will come just as the Fed has ended its last round of debt monetization and is hoping that the economy will be able to grow without help. But housing, the main linchpin of the consumer economy, is already flat-lining in much of the country (see Why Isn’t Housing a Bubble?). Add the auto industry to the negative column and there won’t be many bright spots by the end of 2015. And the Fed, no matter what it says today, will have no choice but to open the spigot once more.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.