Where’s the Economic Growth?

Economics / Economic Theory Sep 26, 2014 - 12:01 PM GMTBy: John_Mauldin

In 1633 Galileo Galilei, then an old man, was tried and convicted by the Catholic Church of the heresy of believing that the earth revolved around the sun. He recanted and was forced into house arrest for the rest of his life, until 1642. Yet “The moment he [Galileo] was set at liberty, he looked up to the sky and down to the ground, and, stamping with his foot, in a contemplative mood, said, Eppur si muove, that is, still it moves, meaning the earth” (Giuseppe Baretti in his book the The Italian Library, written in 1757).

In 1633 Galileo Galilei, then an old man, was tried and convicted by the Catholic Church of the heresy of believing that the earth revolved around the sun. He recanted and was forced into house arrest for the rest of his life, until 1642. Yet “The moment he [Galileo] was set at liberty, he looked up to the sky and down to the ground, and, stamping with his foot, in a contemplative mood, said, Eppur si muove, that is, still it moves, meaning the earth” (Giuseppe Baretti in his book the The Italian Library, written in 1757).

Flawed from its foundation, economics as a whole has failed to improve much with time. As it both ossified into an academic establishment and mutated into mathematics, the Newtonian scheme became an illusion of determinism in a tempestuous world of human actions. Economists became preoccupied with mechanical models of markets and uninterested in the willful people who inhabit them….

Some economists become obsessed with market efficiency and others with market failure. Generally held to be members of opposite schools – “freshwater” and “saltwater,” Chicago and Cambridge, liberal and conservative, Austrian and Keynesian – both sides share an essential economic vision. They see their discipline as successful insofar as it eliminates surprise – insofar, that is, as the inexorable workings of the machine override the initiatives of the human actors. “Free market” economists believe in the triumph of the system and want to let it alone to find its equilibrium, the stasis of optimum allocation of resources. Socialists see the failures of the system and want to impose equilibrium from above. Neither spends much time thinking about the miracles that repeatedly save us from the equilibrium of starvation and death.

– George Gilder, Knowledge and Power: The Information Theory of Capitalism and How It is Revolutionizing Our World

And to that stirring introduction let me just add a warning up front: today’s letter is not exactly a waltz in the park. Longtime readers will know that every once in a while I get a large and exceptionally aggressive bee in my bonnet, and when I do it’s time to put your thinking cap on. And while you’re at it, tighten the strap under your chin so it doesn’t blow off. There, now, let’s plunge on.

Launched by Larry Summers last November, a meme is burning its way through established academic economic circles: that we have entered into a period of – gasp! – secular stagnation. But while we can see evidence of stagnation all around the developed world, the causes are not so simple that we can blame them entirely on the free market, which is what Larry Summers and Paul Krugman would like to do: “It’s not economic monetary policy that is to blame, it’s everything else. Our theories worked perfectly.” This finger-pointing by Keynesian monetary theorists is their tried and true strategy for deflecting criticism from their own economic policies.

Academic economists have added a great deal to our understanding of how the world works over the last 100 years. There have been and continue to be remarkably brilliant papers and insights from establishment economists, and they often do prove extremely useful. But as George Gilder notes above, “[As economics] ossified into an academic establishment and mutated into mathematics, the Newtonian scheme became an illusion of determinism in a tempestuous world of human actions.”

Ossification is an inherent tendency of the academic process. In much of academic economics today, dynamic equilibrium models and Keynesian theory are assumed a priori to be correct, and any deviation from that accepted economic dogma – the 21st century equivalent of the belief by the 17th century Catholic hierarchy of the correctness of their worldview – is a serious impediment to advancement within that world. Unless of course you are from Chicago. Then you get a sort of Protestant orthodoxy.

It’s About Your Presuppositions

A presupposition is an implicit assumption about the world or a background belief relating to an utterance whose truth is taken for granted in discourse. For instance, if I asked you the question, “Have you stopped eating carbohydrates?” The implicit assumption, the presupposition if you will, is that you were at one time eating carbohydrates.

Our lives and our conversations are full of presuppositions. Our daily lives are based upon quite fixed views of how the world really works. Often, the answers we come to are logically predictable because of the assumptions we make prior to asking the questions. If you allow me to dictate the presuppositions for a debate, then there is a good chance I will win the debate.

The presupposition in much of academic economics is that the Keynesian, and in particular the neo-Keynesian, view of economics is how the world actually works. There has been an almost total academic capture of the bureaucracy and mechanism of the Federal Reserve and central banks around the world by this neo-Keynesian theory.

What happens when one starts with the twin presuppositions that the economy can be described correctly using a multivariable dynamic equilibrium model built up on neo-Keynesian principles and research founded on those principles? You end up with the monetary policy we have today. And what Larry Summers calls secular stagnation.

First, let’s acknowledge what we do know. The US economy is not growing as fast as anyone thinks it should be. Sluggish is a word that is used. And even our woeful economic performance is far superior to what is happening in Europe and Japan. David Beckworth (an economist and a professor, so there are some good guys here and there in that world) tackled the “sluggish” question in his Washington Post “Wonkblog”:

The question, of course, is why growth has been so sluggish. Larry Summers, for one, thinks that it’s part of a longer-term trend towards what he calls “secular stagnation.” The idea is that, absent a bubble, the economy can’t generate enough spending anymore to get to full employment. That’s supposedly because the slowdowns in productivity and labor force growth have permanently lowered the “natural interest rate” into negative territory. But since interest rates can’t go below zero and the Fed is only targeting 2 percent inflation, real rates can’t go low enough to keep the economy out of a protracted slump.

Rather than acknowledge the possibility that the current monetary and government policy mix might be responsible for the protracted slump, Summers and his entire tribe cast about the world for other causes. “The problem is not our theory; the problem is that the real world is not responding correctly to our theory. Therefore the real world is the problem.” That is of course not exactly how Larry might put it, but it’s what I’m hearing.

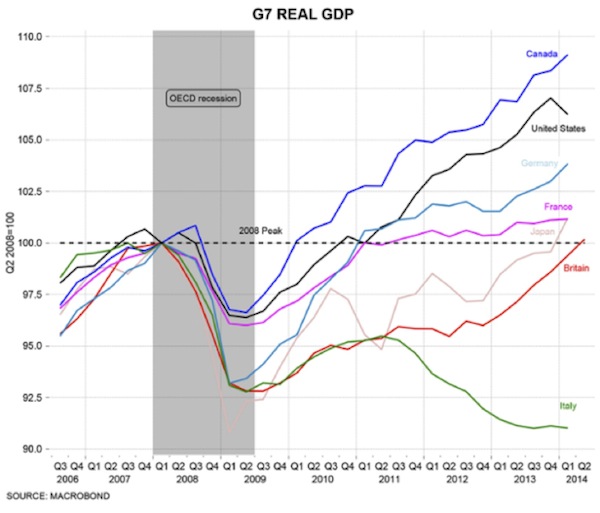

It’s been more than five years since the global financial crisis, but developed economies aren’t making much progress. As of today, the United States, Canada, Germany, France, Japan, and the United Kingdom have all regained their pre-crisis peaks in real GDP, but with little else to show for it.

Where orthodox neo-Keynesian policies like large-scale deficit spending and aggressive monetary easing have been resisted – as in Japan years ago or in the Eurozone debtor countries today – lingering depressions are commonly interpreted as tragic signs that “textbook” neo-Keynesian economic policy could have prevented the pain all along and that weak economic conditions persist because governments and central banks are not doing enough to kick-start aggregate demand and stimulate credit growth at the zero lower bound.

In places like the United States and Japan, where neo-Keynesian thought leaders have already traded higher public debt levels and larger central bank balance sheets for unspectacular economic growth and the kinds of asset bubbles that always lead to greater instability in the future, their policies have failed to jump-start self-accelerating recoveries. Even in the United States, when QE3 has been fully tapered off, I would expect to see the broader economy start to lose momentum once again.

We’ve tried countercyclical deficit spending to resist recessions, procyclical (and rather wasteful) deficit spending to support supposed recoveries, and accommodative monetary easing all along the way (to lower real interest rates and ease the financing of those pesky deficits); but growth has been sluggish at best, inflation has been hard to generate, and labor market slack is making it difficult to sustain inflation even when real interest rates are already negative.

Call me a heretic, but I take a different view than the economists in charge. To my mind, the sluggish recovery is a sign that central banks, governments, and, quite frankly, the “textbook” economists (despite their best intentions) are part of the problem. As Detlev Schlichter commented in his latest blog post (“Keynes was a failure in Japan – No need to embrace him in Europe”), “To the true Keynesian, no interest rate is ever low enough, no ‘quantitative easing’ program ever ambitious enough, and no fiscal deficit ever large enough.” It’s apparently true even as debt limits draw closer.

While the academic elites like to think of economics as a reliable science (with the implication that they can somehow control a multi-trillion-dollar economy), I have repeatedly stressed the stronger parallel of economics to religion, in the sense that it is all too easy to get caught up in the dogma of one tradition or another. And all too often, a convenient dogma becomes a justification for those in power who want to expand their control, influence, and spending.

Whereas an Austrian or monetarist approach would suggest less government and a very light handle on the monetary policy tiller, Keynesian philosophy gives those who want greater government control of the economy ample reasons to just keep doing more.

Schlichter expands his critique of the logic of pursuing more of the same debt-driven policies and highlights some of the obvious flaws in the pervasive Keynesian thinking:

Remember that a lack of demand is, in the Keynesian religion, the original sin and the source of all economic troubles. “Aggregate demand” is the sum of all individual demand, and all the individuals together are not demanding enough. How can such a situation come about? Here the Keynesians are less precise. Either people save too much (the nasty “savings glut”), or they invest too little, maybe they misplaced their animal spirits, or they experienced a Minsky moment, and took too much risk on their balance sheets, these fools. In any case, the private sector is clearly at fault as it is not pulling its weight, which means that the public sector has to step in and, in the interest of the common good, inject its own demand, that is [to] “stimulate” the economy by spending other people’s money and print some additional money on top. Lack of “aggregate demand” is evidently some form of collective economic impotence that requires a heavy dose of government-prescribed Viagra so the private sector can get its aggregate demand up again.

Generations of mismanagement have left major economies progressively weaker, involving

- dysfunctional tax/regulatory/entitlement/trade policies created by short-sighted and corrupt political systems,

- private-sector credit growth encouraged by central bank mismanagement, and

- government expansion justified in times of crisis by Keynesian theory.

But rather than recognizing real-world causes and effects, neo-Keynesian ideologues are making dangerous arguments for expanding the role of government spending in places where government is already a big part of the problem.

We are going to delve a little deeper into this thesis of “secular stagnation” posited last year by Larry Summers and eagerly adopted by Paul Krugman, among others; and then we’ll take a trip around the rich world to assess the all-too-common trouble with disappointing growth, low inflation, and increasingly unresponsive labor markets. Then I’ll outline a few reasons why I think the new Keynesian mantra of “secular stagnation” is nothing more than an excuse for more of the same failed policies.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.