Hedge Funds Surpass 2007 Leverage; New Era of 'Permanent Investigations' Confirms Imminent Reversal

Stock-Markets / Stock Markets 2014 Sep 24, 2014 - 12:13 AM GMTBy: EWI

By Elliott Wave International

Editor's note: The following article was republished here with permission from the co-editors of the September issue of The Elliott Wave Financial Forecast, a publication of Robert Prechter's Elliott Wave International, the world's largest financial forecasting firm. From Sept. 25 to Oct. 1, EWI is throwing open the doors to all of its investor services 100% free. Click here to join EWI's free Investor Open House now.

Editor's note: The following article was republished here with permission from the co-editors of the September issue of The Elliott Wave Financial Forecast, a publication of Robert Prechter's Elliott Wave International, the world's largest financial forecasting firm. From Sept. 25 to Oct. 1, EWI is throwing open the doors to all of its investor services 100% free. Click here to join EWI's free Investor Open House now.

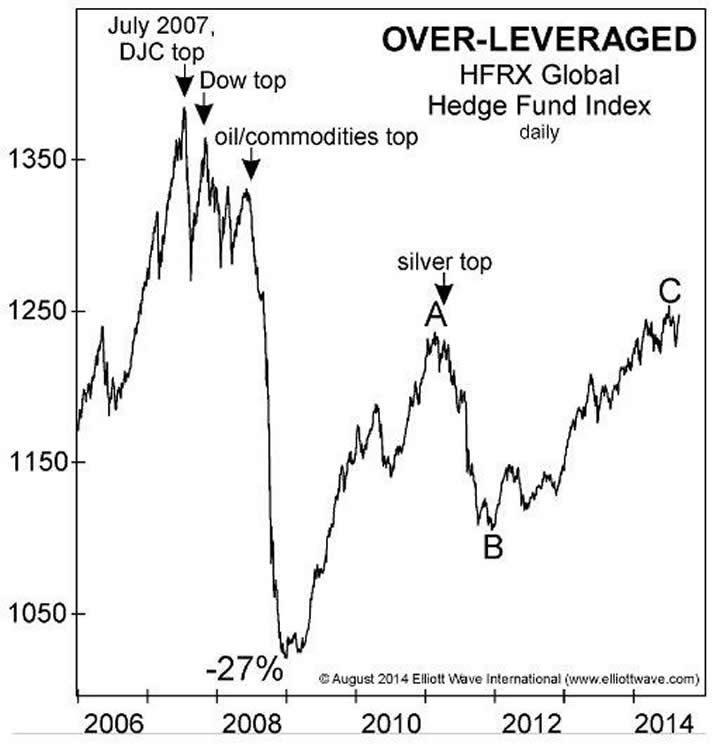

Hedge funds are further out on the same limb they occupied in 2007, right before the collapse shown on this chart of the HFRX Global Hedge Fund Index.

According to Eurekahedge, a global hedge fund monitoring service, hedge funds' gross assets hit 170% of capital in January, which surpasses the previous peak of 168% in 2007.

Leverage at many of the largest hedge funds is far higher.

For instance, in April, the New York Post noted that Citadel Investment Group, one of the 25 biggest US hedge funds, had implied leverage of about 8.8 times its total investment capital. The Post also noted that Citadel's "leverage last came under scrutiny in 2008, when it had to unwind a leverage of 8.2 times as the financial crisis unfolded."

The Elliott Wave Financial Forecast asserted in April that hedge funds will be even more of a focal point for losses in the next wave down. The chart of the HFRX Index shows that global hedge fund performance has been essentially flat since 2011. The A-B-C rally from 2009 has now retraced 63% (5/8) of the decline from 2007-2008, so an even more precipitous downtrend seems near for hedge funds.

The U.S. Senate's Permanent Subcommittee on Investigations confirms the imminence of a reversal.

In July, Congress opened a major probe into the inner workings of the hedge fund industry. A report from one set of hearings is titled "Abuse of Structured Products: Misusing Basket Options to Avoid Taxes and Leverage Limits." The subcommittee recommended that regulators "take steps to examine complex financial arrangements."

It never fails. When a mania ends, the instruments of the uptrend are often subject to recrimination and "reform."

In the early 1930s, there was the Pecora Commission, which led to the Glass-Steagall Banking Act of 1933. This is a bigger peak, so the politicians will extract more than just their average pound of flesh.

To continue reading Hochberg and Kendall's 10-page issue of The Elliott Wave Financial Forecast, click here to join EWI's free Investors Open House now.

This article was syndicated by Elliott Wave International and was originally published under the headline Hedge Funds Surpass 2007 Leverage; New Era of 'Permanent Investigations' Confirms Imminent Reversal. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.