The Alibaba IPO May Shine, But Gold is Glistening

Stock-Markets / Financial Markets 2014 Sep 20, 2014 - 09:58 AM GMTBy: Chris_Vermeulen

Scotland voted to remain part of the United Kingdom, Alibaba (BABA) is going to become the United States largest initial public offering (IPO), U.S. stock market indexes are up nearly 2% this week, Treasury yields are near lows, and gold and silver prices are getting bludgeoned in the paper market.

Scotland voted to remain part of the United Kingdom, Alibaba (BABA) is going to become the United States largest initial public offering (IPO), U.S. stock market indexes are up nearly 2% this week, Treasury yields are near lows, and gold and silver prices are getting bludgeoned in the paper market.

While U.S. financial prognosticators are raving over Alibaba and the IPO, the price action in precious metals and in the broader U.S. equity indexes showed signs of weakness about the time it was announced that Alibaba could start trading in the low to mid eighties.

The gold and silver charts shown below demonstrates the strange price action in silver futures after the announcement regarding Alibaba’s likely price increase at the open of trading in the stock today.

The chart below shows gold futures prices during the same time frame as the silver chart above.

The hype surrounding the Alibaba IPO is almost nauseating. However, it may provide an excellent trade entry into a long position in precious metals. Both gold and silver have been under major selling pressure for several weeks.

In silver, the selling pressure started around July 15th of this year and the selling has not stopped. Silver futures prices dropped from roughly $21.50 to $18.50 an ounce in about two months. This represents a near 14% decline in the price of silver over the past 2 months..

Gold prices have also seen strong selling over the same period from July 15th to present. Gold prices fell from around $1,340 per ounce to a recent low slightly below $1,220 per ounce. Gold prices dropped nearly 9%, showing some strong relative strength against silver futures.

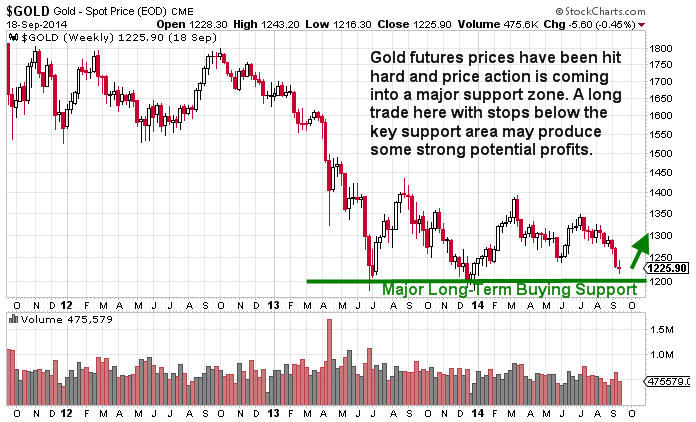

We have been watching the precious metals sector very carefully for several weeks and price action seems poised for a bounce as major support is underneath both silver and gold futures here. A break of these levels would trigger some potentially strong selling pushing metals prices considerably lower. The daily chart of gold futures is shown below:

The $1,180 – $1,200 price level has shown major support for gold futures prices which is clearly depicted on the weekly chart of gold futures shown above. We are contrarian traders and the price action in precious metals is ripe for a potential bounce. We view the opportunity more as a trading opportunity than an investment opportunity for now, but that could change in the longer term.

As an options trader, we will likely use a put credit spread using the gold ETF (GLD) as the underlying asset. The trade will have defined risk and will capitalize on higher gold prices, the passage of time, and reduced volatility in GLD options. Recently the options alert service from TheTechnicalTraders has put up some huge winning trades and the track record has been impressive thus far.

For just under $30 per month, members receive trade alerts nearly every day with probability of success per trade over 75%. The service boasts a track record over 3 years that has delivered strong profitability for members over any time period. For a trader looking for an option service geared totally around producing high probability, insanely profitable trades give TheTechnicalTraders’ option service a chance. Or join our automated investing service and have our index investing trades done for you. You will not be disappointed.

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.