Another Miserable Week for Gold and Silver

Commodities / Gold and Silver 2014 Sep 19, 2014 - 01:32 PM GMTBy: Alasdair_Macleod

Gold and silver drifted lower over the course of the week, with a challenge to the $1200 level for gold becoming a distinct possibility. Silver is struggling to hold $18.50. Mainstream opinion has been negative for commodities generally, with a strong dollar undermining them. Brent crude, for example, is now well under $100.

Gold and silver drifted lower over the course of the week, with a challenge to the $1200 level for gold becoming a distinct possibility. Silver is struggling to hold $18.50. Mainstream opinion has been negative for commodities generally, with a strong dollar undermining them. Brent crude, for example, is now well under $100.

It is important to understand the connectedness between different asset classes in today's markets. Hedge funds, and bank traders sell one asset and hedge it by taking a position in another. Furthermore, the majority of traders rely on technical analysis instead of rational value-based price assessments. Instead of markets correcting anomalies, this often leads to added momentum behind trends, ultimately increasing market instability. We can see this everywhere today, and precious metals are not immune to this problem.

That is the reality of markets, but as I've written before history shows us that the most successful investors are value investors, and those experienced in precious metal markets are currently happy to buy the dips. Meanwhile, with the majority of momentum traders being short of physical gold and silver, it is hardly surprising they talk these metals down.

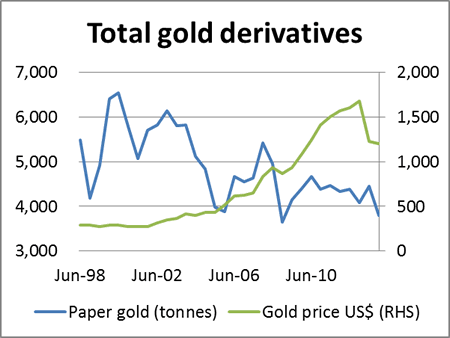

The long-term chart below of total OTC forwards, swaps and Comex futures quantifies this effect. The OTC numbers are derived from the Bank for International Settlements statistics, and futures are from the Commitment of Traders Reports released by the CFTC. The total shown is half the gross to reflect the paper equivalent of physical demand, the other half being supply. It is in effect the sum total of derivatives on the LBMA and of US futures up to December 2013. Note that these figures do not include options.

The tonnage equivalent of outstanding derivatives has fallen dramatically over the last fifteen years. To some extent this was due to the rise in the gold price, but with an accelerated dip in 2008, the year Lehman went bust. But since the peak in the gold price three years ago, these outstanding positions have declined with the price.

At only 3,800 tonnes last December, total derivatives were the lowest they have been with the exception of the Lehman crisis panic. No wonder the average bullion bank is negative on gold: they reflect a decline in investor interest, consistent with an extended bear trend.

The point is these are the market conditions sought by value investors looking to buy into unloved markets.

The other big news this week was the Scottish referendum on independence, the result of which became clear a few hours ago: panic over.

Next week

Monday. Eurozone: Flash Consumer Sentiment. US: Existing Home Sales.

Tuesday. Eurozone: Flash Manufacturing PMI. UK: Mortgage Approvals, Public Sector Borrowing. US: Flash Manufacturing PMI Wednesday. US: New Home Sales.

Thursday. UK: Nationwide House Prices. Eurozone: M3 Money Supply. US: Durable Goods Orders, Initial Claims. Japan: CPI (Core).

Friday. US: GDP (3rd est.), GDP Price Index (3rd est.), Personal Income, Personal Spending

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.