Silver Price: A Collapse and a Rally

Commodities / Gold and Silver 2014 Sep 18, 2014 - 05:09 PM GMTBy: DeviantInvestor

Complaint From A Silver Bull

Complaint From A Silver Bull

The last 3 plus years have been difficult. My faith in the silver bull market and my fear of fiat currencies has been shattered. There is no joy in "Silverville" - nothing but worry and despair!

Boast From A Silver Bear

Investing in silver is dangerous and foolish. The last three years have proven that us "bears" are correct. Paper assets are the best!

We might as well discuss the success or failure of the "War on Terror," the "War on Ebola," and "ObamaCare." Their appearance of success or failure is largely a matter of perspective, time horizon, expectation, and personal bias.

Instead of dwelling upon these largely useless arguments, what does the DATA from the silver market tell us?

Sentiment

Sentiment for gold (and silver) is very weak - as low as it was at the bottom in June 2013. This suggests both gold and silver are again at or near a bottom.

Gold to Silver Ratio

The ratio is currently about 66 - near the high end of the slowly declining range for the past 27 years. See the graph and note that a high ratio indicates silver is too inexpensive in relation to gold. All of the ratio peaks (February 1991, March 1995, March - May 2003, October 2008, and July 2013) occurred at significant silver lows.

Over-Sold Technical Indicators

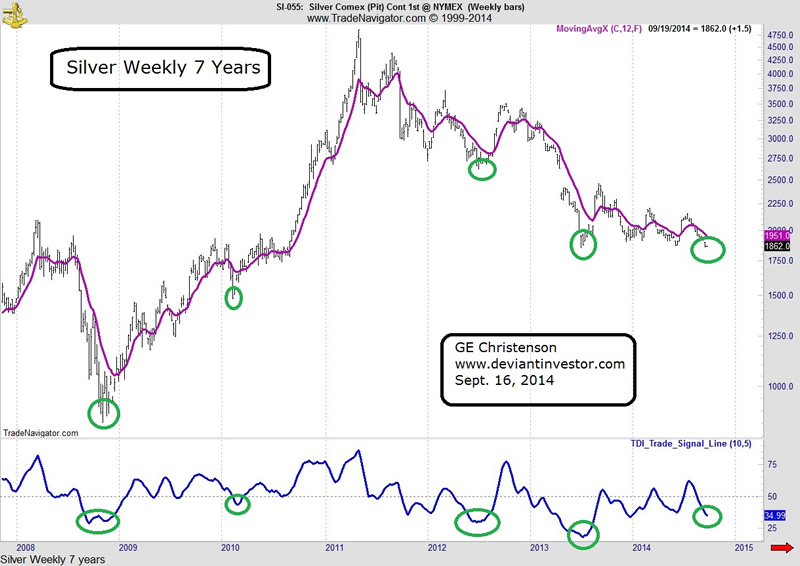

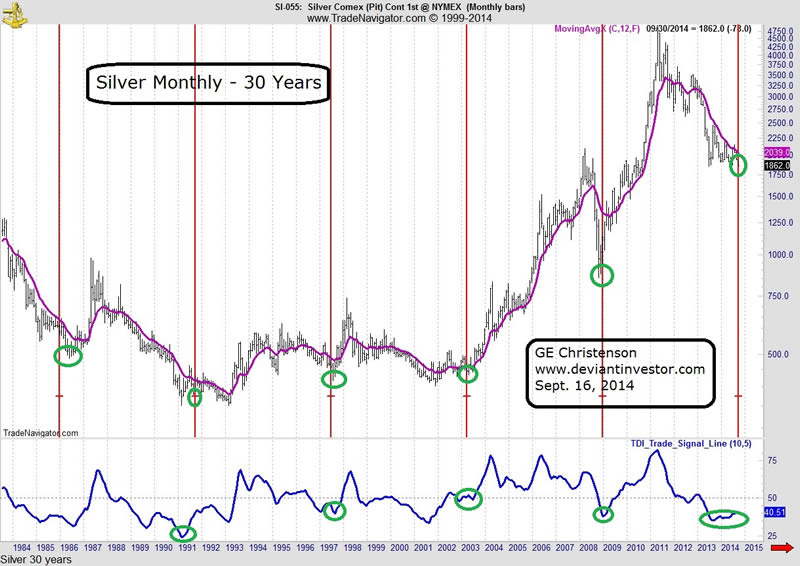

The silver market is "over-sold" once again, as it was in October 2008, June 2013, and December 2013. Note the chart of weekly silver and the low reading on the TDI_Trade_Signal_Line. Other weekly oscillators show similar readings. The daily chart and monthly chart for silver and the daily and monthly TDI oscillators also show "over-sold" conditions. Such "over-sold" conditions are (eventually) followed by rallies. This is not to say a market can't become temporarily more "over-sold" but the probabilities have shifted toward rally instead of decline.

Cycles

Monthly cycles are of little use for trading, but they do help with a big picture view for investors. Silver made an important low in July 1997, another low in March 2003, a major low in October 2008, and what appears to be a major low in September 2014. They are all approximately 5.75 years apart.

Debt

People have written about out-of-control and unpayable debt extensively. Since currency is created as debt, and most or all governments around the world run deficits and perpetually increase their debt, it is the basis of our current financial system. A quick review:

| Year | National Debt (Official) | Average Silver Price (from Kitco.com) |

| 1913 | $3 Billion | $0.58 |

| 1971 | $398 Billion | $1.39 |

| 2014 | $17,700 Billion | $20.07 |

National debt has increased exponentially since 1913 at about 9.0% per year, and since 1971 at about 9.2% per year. Silver has increased exponentially since 1913 at about 3.6% per year and since 1971 at about 6.4% per year. Also exponentially increasing, on average, are gold prices, crude oil prices, politician salaries, postage prices, the number of government programs, food prices, and military spending.

Do you believe that politician salaries, military spending, and national debt will continue increasing? So do I! Consequently I believe that consumer price inflation is alive and well, and that we should expect a much higher cost of living in the next few years. In the long-term, I believe the prices for gold and silver will increase even more rapidly.

Summary

Big Picture - the next decade: Prices for what we need, food and energy, will continue to increase as long as we live in a debt based fiat currency economy. Silver and gold prices will rapidly increase along with debt, the money supply, and politician promises.

Medium Term - several years: Silver cycles indicate another important low probably is occurring about now. Expect silver prices to rally in the next several years.

Monthly Prices: Silver is "over-sold" based on the charts, the TDI oscillator, and many other oscillators. Expect silver prices to rise. The gold to silver ratio is high which indicates relatively inexpensive silver prices and higher silver prices ahead.

Weekly Prices: Same as monthly prices - "over-sold" and ready to rally.

Daily Prices: They are also "over-sold" but pretty much controlled by the High Frequency Trading algorithms and the temporary needs of the "powers-that-be."

From Michael Pento: Why Goldman Sachs is Wrong on Gold.

"The Fed will not be raising rates anytime soon. To the contrary, Ms. Yellen will soon be forced back into the money printing business in an attempt to; force higher money supply growth, push real interest rates further into negative territory, keep the dollar from rising, and to make sure debt service payments remain under control.

Soon we will have a perfect storm in which gold will rise. The next phase in the gold bull market will include the four conditions of; negative real interest rates, rapid money supply growth, a falling dollar and skyrocketing deficits. Investors that have the foresight to realize this opportunity today stand to benefit greatly in the near future."

Believe it! Read my book: "Gold Value and Gold Prices From 1971 - 2021." (available at Amazon.com and GEChristenson.com)

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.