Silver Buyers Keep Stacking And Demand Higher Despite Falling Prices

Commodities / Gold and Silver 2014 Sep 18, 2014 - 04:39 PM GMTBy: GoldCore

The silver price has remained subdued this year, falling just less than 5% year-to-date, and is now near a 14 month low. Naturally, investor psychology has been affected by the price weakness.

The silver price has remained subdued this year, falling just less than 5% year-to-date, and is now near a 14 month low. Naturally, investor psychology has been affected by the price weakness.

Quoted today in Bloomberg News, Mark O’Byrne, director of GoldCore said that “sentiment remains quite bad in the silver market.”

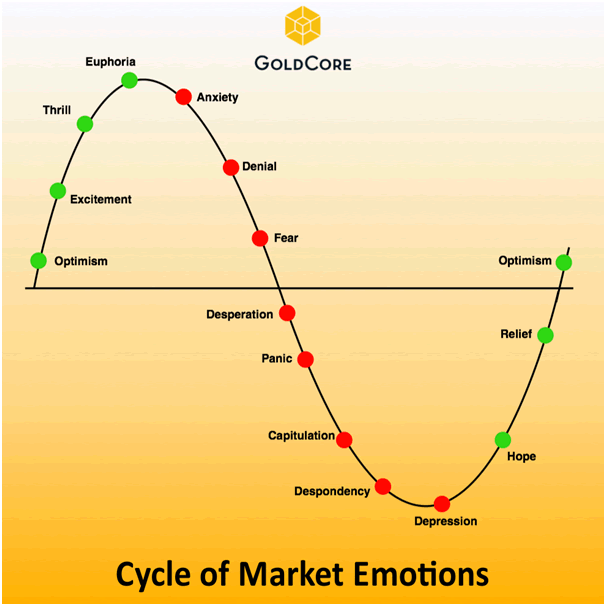

Its well accepted that investors in the financial markets are known to experience cycles of emotion, from excitement and euphoria, through to fear and panic, before the cycle turns again after despondency and goes back to hope and optimism.

Although the silver price weakness has damaged psychology, some interesting trends have emerged which appear to be signalling that the core silver retail and indeed institutional investor remains resilient and is even using the current price weakness as a further buying opportunity.

The overall trend in the silver market currently appears to be, when prices weaken, investors continue to hold and in some cases buy more. While the price has fallen, overall holdings of the silver ETFs still remain near an all-time high. This would suggest that silver investors are now expecting higher prices again due to continued industrial and investment silver demand.

Total Global Silver ETF Holdings - 2006 - September 2014 (Thomson Reuters)

Globally, 26,000 tonnes of silver are mined each year and about 7,000 tonnes of silver is recovered through recycling and scrap. Industrial demand accounts for 14,500 tonnes, jewellery demand for 8,000 tonnes, coin demand for 2,500 tonnes and photography for 1,700 tonnes.

This totals nearly 27,000 tonnes so leaves about 6,000 tonnes as a residual, some of which goes into the physically backed silver Exchange Traded Funds (ETFs).

The investor base in physically backed silver ETFs is predominantly retail, one element being that silver is more affordable than gold to retail investors. Gold ETFs have a higher proportion of institutional and hedge fund investors. For US based silver ETFs, retail investors account for 80% of holdings.

Retail investors tend to have a longer term investment horizon and these silver ETF investors are mostly long term buy and hold investors. Recent updates on the flows into these ETFs and their total holdings point to continued accumulation across-the-board by these retail investors. It appears that the current price weakness in the silver price has if anything, encouraged these retail investors to accumulate additional holdings.

Reuters calculated this week that the world’s six largest silver ETFs saw an additional 104 ton inflow last week and now hold 17,135 tonnes of silver in total between them. The massive iShares Silver Trust represents over 60% of this total. The iShares ETF recently reported its biggest one day inflow in the last 4 months.

Bloomberg calculates similar data but includes more silver ETFs than Reuters in its calculations. Bloomberg reports today that the holdings of silver Exchange Traded Products (ETPs) that it tracks have now reached 19,900 tons, which is near the all-time high of 20,121.5 tons which was reached in October 2013. According to Bloomberg, ETP holdings have risen 2.7% in 2014. Silver ETFs did not see any large outflows in 2013, unlike in gold where gold ETF holdings fell by more than 30% in 2013.

The latest Bloomberg survey of silver analysts shows a median price estimate averaging $20 for the last quarter of 2014, increasing to $20.40 next year.

Some silver mining companies have hedged part of their output so that they can sell their output at specific prices, even if the price falls, such as at $18 for Coeur Mining. Likewise hedging can backfire as prices rise and they remain committed to sell their output at a lower price.

At the Denver Gold Summit, yesterday, Keith Neumeyer, president and CEO of First Majestic Silver Corp pointed out that after all the talk by the London Bullion Market Association (LBMA) of greater transparency for the new LBMA Silver Price and wider market participation in the auction, nothing much has changed:

“Any time you have a small group of people fixing a price, it’s prone to manipulation,” he said. “There’s no change from how it was done before to the way it’s done now – it’s just a different group of players and now they do it on a computer.”

To that we would add that the “group of players” is still not all that different since only one player has changed. The old Silver Fixing process had three participants, HSBC, ScotiaMocatta and Deutsche Bank. When Deutsche Bank announced in April that it was pulling out of the Silver Fixing, it precipitated the move by the LBMA to create the new Silver Price.

Then, when the new auction was launched on August 15, HSBC and ScotiaMocatta reappeared as participants, bringing Mitsui on board in place of Deutsche Bank. So it’s still the same old usual suspects continuing to fix the silver price each day in London, and there is still little or no transparency about the auction beyond a few netted out buy and sell volume figures.

It remains to be seen when if ever the LBMA Silver Price auction will allow in a wider range of direct participants such as mining companies and refiners.

In the meantime, the retail silver investor, as indicated by the silver ETF flows, appears to be taking advantage of the lower price environment to accumulate additional metal. This is also true in the silver coin and bar market.

Conclusion

In any period of price weakness there will always be some nervousness and fear. But market history invariably shows that this point in the cycle is usually the time when price expectations start to turn upwards.

Silver remains undervalued vis a vis gold with gold silver ratio at over 66. At $18.59, it is some 63% below the record nominal price of $50/oz in 1980 and again in April 2011.

We could see further weakness in the short term as momentum is clearly down. Support is at $18 and below that at $15.

We believe both gold and silver remain undervalued and are in the process of bottoming. We remain confident gold and silver will see new record highs in the coming years. Both will continue to act as hedges and safe havens against the considerable risk in the world today.

Recent interview - 'Get REAL: Silver' Recent research and charts on silver here

MARKET UPDATE

Today’s AM fix was USD 1,223.00, EUR 949.61 and GBP 749.99 per ounce. Yesterday’s AM fix was USD 1,236.50, EUR 954.22 and GBP 758.71 per ounce.

Gold fell $13.90 or 1.13% to $1,221.60 per ounce and silver slipped $0.22 or 1.18% to $18.49 per ounce yesterday.

Silver In U.S. Dollars, 2 Years

Overnight, spot gold in Singapore rose slightly after the 1% drop yesterday. Premiums in China advanced Thursday, climbing to $5-$6 an ounce, up from about $4 in the previous session. Silver was up 0.2% at $18.49/oz, having hit its lowest level since June 2013.

Gold was nearly unchanged in London this morning after hitting an 8 month low as the Fed increased their interest rate estimates (1.375% for end of 2015 versus June’s forecast of 1.125%) and cut monthly asset purchases to $15 billion aiming to finish the program in October.

Platinum reached its lowest price this year. Platinum fell 1.17% to $1,350 while palladium was 1.65% lower today at $830.

HSBC analyst James Steel wrote “Expectations of higher policy interest rates going forward is gold-bearish, if the dollar remains firm, gold should stay on the defensive. Further declines may elicit emerging-market demand, notably, but not exclusively, from China and India.”

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.