Monetary Policy Weighs on Gold and Silver

Commodities / Gold and Silver 2014 Sep 18, 2014 - 03:26 PM GMTBy: Bob_Kirtley

Background

Background

Gold has an inverse relationship with the US Dollar so when the dollar declines gold rises. The dollar is affected by monetary policy as decided by the various central bankers across the planet. We recently covered the effect of the European version of QE with an article entitled; ‘Why ECB QE Is Bearish For Gold Prices’ so today we will take a quick look at the ramifications for the precious metals sector emanating from the monetary policy meeting of the Federal Reserve held today.

A brief overview of the Feds actions

The two most important points to come out of today’s meeting were firstly that the tapering of QE would continue and finally come to an end in October 2014. The second point was the wording that surrounded interest rates whereby the Fed Chairperson, Janet Yellen, talked along the lines of the following:

The decisions that the committee makes regarding the appropriateness of the time to commence increasing its target for the federal funds rate will be data dependent. Should the goals set by the Fed look to be accelerating in terms of being achieved earlier, then it is likely that the federal funds rate rise could be introduced earlier than expected.

Uncertainty about economic projections would appear to be the order of the day with a policy of steady as we goes rather than hard and fast actions set to a solid timescale.

So there we have it, still data dependent but the door has been opened, if required, for rates to rise sooner. There is no real indication of when this might happen but we have been warned that it could be sooner than we first thought. The markets responded instantly with the US dollar being the main beneficiary, gaining 0.52 or 0.62% on the US Dollar Index, gold closing $12.00 lower, silver down $0.16 and the HUI down 5.39.

Gold, Silver and the HUI.

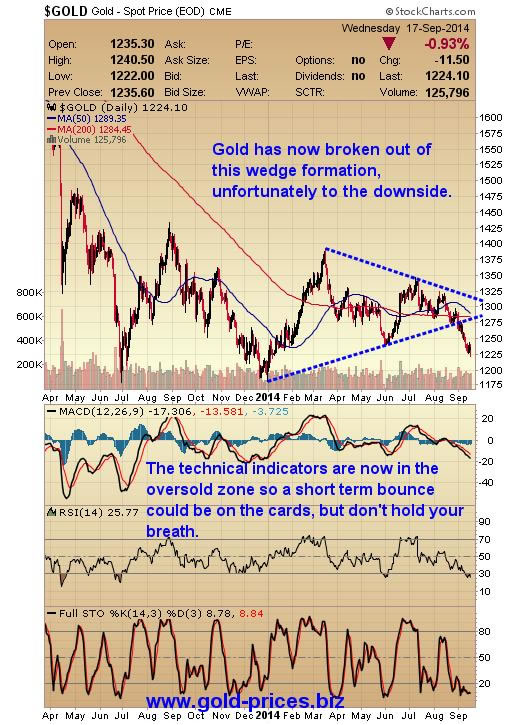

Gold, silver and the mining sector have suffered from a sell off recently to the point of being oversold. A bounce was on the cards from a technical viewpoint as nothing goes down in a straight line.

The coming end of QE brings with it the end of the dilution of the dollar as no more money will not be produced in this manner. As we know the dollar has refused to collapse and of late has been gaining in value when compared with a basket of the other major currencies. With QE more or less behind us, for now at least, the focus is on the prospect of interest rate increases and the timing thereof. The Fed have indicated that they will be small and that the increase will be gradual and as per usual; data driven. This leaves the situation open to interpretation; it could be that we get two rate increases of 25 basis points in 2015 or five increases of 50 basis points. Either way, a better return on cash deposits will tempt investors into cash and hence the dollar will continue to strengthen.

It should be noted that the Japanese and the Europeans are doing their best to push down their own currencies down which has the effect of putting upward pressure on the dollar. If the dollar does continue to trek north then any rally in precious metals will be restricted to say the least.

On the positive side for the PMs is that the last jobs numbers report was somewhat of a disaster in terms of new jobs created coming in at 142,000 instead of 200,00 plus. This maybe an aberration with the trend being resumed next month, but if we continue to get poor jobs numbers then the Fed, being data driven, might be tempted to take action. This action could be in the form of a reintroduction of QE and/or a delay in rate rises, it’s a tad too early to call. We are of the opinion that the reintroduction of QE is unlikely and that the Fed will continue with their strategy of tapering as planned.

Conclusion

I am a precious metals bull, but not a perma-bull, as such a position does not allow the flexibility a trader needs in order to generate profits. By adopting a flexible stance whereby we can be bearish or bullish in any market sector, our options trading team has generated a profit of 895.42% in just 5 years. The super bulls will continue to snort but as retail investors we have to see things as they are and not as we would like them to be.

We are now of the opinion that gold will trade lower and re-test the $1180/oz level, silver; if it breaks below $18.00/oz, then it would experience a severe drop to the $15.00/oz level and the miners as represented by the Gold Bugs Index, the HUI, will test the low of 190 that it made in December 2014 and possible go on to test the 150 level formed in 2008.

The current environment favors the bears so a short trade would be better than a long trade.

We believe there are times to be fully invested and times to exercise the utmost caution. At the moment we are finding it difficult to acquire stocks in this market sector, however, should they keep falling then the bargain buys will present themselves. Having the cash available for such an event is top priority for us and so that’s where the lion’s share of our funds is placed today.

Finally, given what we know today it is hard to see what the catalyst will be that would ignite gold prices and drive a substantial rally. Money printing, political turmoil, terrorism, protests, demonstrations, riots, separatism, sanctions, air strikes, et al have done nothing for the precious metals sector of late.

Got a comment, then please fire it in whether you agree with us or not, as the more diverse comments we get the more balance we will have in this debate and hopefully our trading decisions will be better informed and more profitable.

Go gently.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.