Global Economy Heading for Economic Slump for 2008-09?

Stock-Markets / Financial Markets May 18, 2008 - 09:19 AM GMT

(Bloomberg ) – “The Federal Reserve's direct loans of cash to commercial banks climbed to the highest level on record in the past week as money-losing lenders increasingly turn to the central bank for funds.” Is this a good thing, as the article implies? Banks are eager to borrow “cheap money” from the Federal Reserve because there isn't any to be had elsewhere. Many financial institutions that are painfully aware of their own bad paper and losses are unwilling to trade paper in the commercial markets due to general distrust among themselves. (“Maybe their paper is more toxic than our paper.”) Instead of money (IOUs) flowing freely between institutions, these IOUs have become the sludge that gums up the works because there is no market for it. The only source of funds is now the Federal Reserve Board, who is growing more concerned about their inability to keep the banks afloat.

(Bloomberg ) – “The Federal Reserve's direct loans of cash to commercial banks climbed to the highest level on record in the past week as money-losing lenders increasingly turn to the central bank for funds.” Is this a good thing, as the article implies? Banks are eager to borrow “cheap money” from the Federal Reserve because there isn't any to be had elsewhere. Many financial institutions that are painfully aware of their own bad paper and losses are unwilling to trade paper in the commercial markets due to general distrust among themselves. (“Maybe their paper is more toxic than our paper.”) Instead of money (IOUs) flowing freely between institutions, these IOUs have become the sludge that gums up the works because there is no market for it. The only source of funds is now the Federal Reserve Board, who is growing more concerned about their inability to keep the banks afloat.

The Feds had their first “ NET MISS' on May 14 th . That means that their own reserves were inadequate to meet projected requirements. Fed holdings of U.S. Treasury securities fell $22.3 billion for a daily average of $520.1 billion. The central bank had about $713 billion of Treasuries two months ago. It may mean that even the Federal Reserve may not be able to meet the growing demand for funds by banks. That may be why Bernanke is urging the banks to attempt to get additional capital from outside investors by selling stocks or financing through bond issues.

The Fed is doing its part by auctioning treasury securities to firms so that buyers can raise capital. The problem is that they are auctioning these treasuries to investment firms, not banks. Since when is the Federal Reserve supposed to bail out investment firms? Are they perhaps sticking their finger in yet another hole in the dike to stem the floodwaters?

Here's what Forbes had to say, “Wanting to avert a broader panic that could endanger the entire U.S. financial system, the Fed agreed last month to temporarily let investment firms obtain emergency loans directly from the central bank - a privilege previously limited to commercial banks. The decision marked the broadest extension of the Fed's lending authority since the 1930s.” Haven't they done enough already?

Someone else finally noticed …

Last week I took apart the employment numbers to show that things aren't as rosy as the Department of Labor makes it seem. This week CNNMoney reintroduced the concept of the “Misery Index” which was last heard of in the 1980's. “The official numbers produce a current Misery Index of only 8.9 - inflation of 3.9% plus unemployment of 5%. That's not far from the Misery Index's low of 6.1 seen in 1998. But using the estimates on CPI and unemployment from economists skeptical of the government numbers, the Misery Index is actually in the teens. Some worry it could even approach the post-World War II record of 20.6 in 1980.”

A crisis in confidence?

NEW YORK ( MarketWatch ) -- U.S. stocks fell on Friday for the second day in five as crude oil prices broke to another record high and consumer confidence slumped, darkening earlier cheer triggered by an unanticipated rise in April home construction.

U .S. consumer sentiment declined further in May to 59.5 in the preliminary report from Reuters/University of Michigan , with the reading the weakest since June 1980. Is there a crisis in confidence brewing?

Skeptical about inferred relationships.

U.S. Treasury debt prices fell on Friday after the biggest monthly jump in housing starts in two years hinted that the housing market might not be crumbling as much as expected, taking bond traders by surprise.

U.S. Treasury debt prices fell on Friday after the biggest monthly jump in housing starts in two years hinted that the housing market might not be crumbling as much as expected, taking bond traders by surprise.

One should remain skeptical about the new housing starts, since they simply reflect “holes in the ground” and not the finished product. The other thing to beware of is any relationship inferred between housing starts and the bond market.

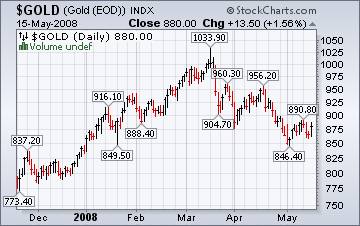

Is $900 a ceiling for gold?

Gold futures climbed past $900 an ounce Friday to their highest level in three weeks as crude oil's rally to a fresh record high near $128 a barrel boosted the precious metal's appeal as an inflation hedge.

Gold futures climbed past $900 an ounce Friday to their highest level in three weeks as crude oil's rally to a fresh record high near $128 a barrel boosted the precious metal's appeal as an inflation hedge.

Gold is back on the traders' screens as “safe haven” buying against inflation , which shot up last month. Depending on which number you use, inflation shot up 7.2% to 8.4% on an annualized basis in April. The cost of food rose at a much higher 10.8% in April. Note; gold closed the week below $900.00.

The gain chasers were set up for a disappointment.

TOKYO — Japan's key stock index rose to its highest in four months Wednesday as investors welcomed the dollar's stability and upbeat earnings reports from telecommunications giant NTT and other companies.

TOKYO — Japan's key stock index rose to its highest in four months Wednesday as investors welcomed the dollar's stability and upbeat earnings reports from telecommunications giant NTT and other companies.

It was thought that the rising dollar would add to the profitability of Japan 's manufacturing sector. If, however, the U.S. economy slows, the rising dollar may not provide as much stimulus as is hoped for.

China has a mess to clean up.

SHANGHAI , China — Cracked dams and buckled roads, collapsed buildings and toppled factories -- China has begun tallying losses from the calamitous earthquake that struck earlier this week, with estimates ranging to over $20 billion.

SHANGHAI , China — Cracked dams and buckled roads, collapsed buildings and toppled factories -- China has begun tallying losses from the calamitous earthquake that struck earlier this week, with estimates ranging to over $20 billion.

With the death toll from the disaster forecast to rise as high as 50,000, China 's main focus Friday remained on rescue and relief for survivors of the 7.9 magnitude quake that hit Sichuan province on Monday.

It's still called the “short-lived comeback.”

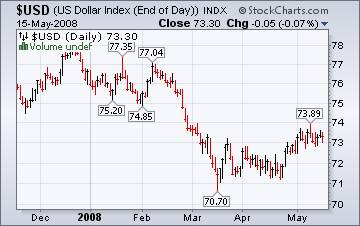

The sick dollar may be getting a little healthier - but it is far from making a full recovery, according to CNNMoney.

After slipping to record lows against the euro in April, the greenback has recovered in recent weeks, helped in part by expectations that the Federal Reserve's aggressive rate-cutting campaign may have reached a stopping point

Note; there is no relationship between the Fed Funds Rates and the dollar. It is confidence in the economy that has a bigger sway with the dollar. What if the other world economies are worse off than we are?

Housing Blues over? You ain't seen nothing yet.

Banks with mortgages over 90 days overdue failed to file foreclosure notices in 2007. This was done to 1) limit losses in the 4 th quarter, and 2) buy more time to unload the burgeoning inventory of unsold homes already being carried on the books. A new cottage industry is springing up. People like Angel Gutierrez , will buy a dozen bad mortgages at a discount, then goes to negotiate new payments with the mortgagees. If they cannot pay, he pays them to move, freeing up the real estate for a new buyer at a lower price.

Banks with mortgages over 90 days overdue failed to file foreclosure notices in 2007. This was done to 1) limit losses in the 4 th quarter, and 2) buy more time to unload the burgeoning inventory of unsold homes already being carried on the books. A new cottage industry is springing up. People like Angel Gutierrez , will buy a dozen bad mortgages at a discount, then goes to negotiate new payments with the mortgagees. If they cannot pay, he pays them to move, freeing up the real estate for a new buyer at a lower price.

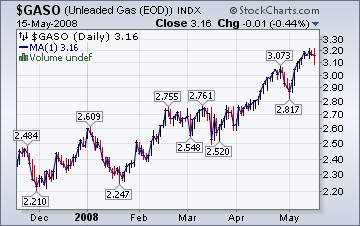

Another record high for gasoline prices.

NEW YORK ( CNNMoney .com) -- Retail gas prices hit record highs for the eighth day in a row, auto group AAA's Web site showed Thursday.

NEW YORK ( CNNMoney .com) -- Retail gas prices hit record highs for the eighth day in a row, auto group AAA's Web site showed Thursday.

The nationwide average for a gallon of regular unleaded hit $3.776, up from the previous high of $3.758.

The Energy Information Administration's This Week In Petroleum tells us that; “This was the seventh consecutive week where the price rose, with the cumulative increase totaling 46.3 cents. On a regional basis, prices increased throughout the country with the East Coast swelling by 10.3 cents to 371.3 cents per gallon, some 73.2 cents above the price a year ago. The average price in the Midwest was 373.6 cents per gallon, surging up by 15.7 cents, the largest increase for any region.”

Economists are scratching their heads, trying to figure out how the cost of fuel did not register an increase in the Consumer Price Index last month!

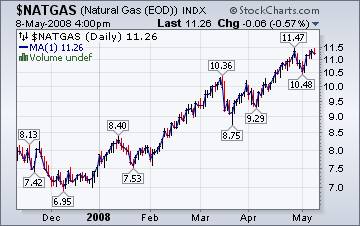

Relief could be on the way.

The Natural Gas Weekly Update claims that “ Concerns over natural gas supplies and high crude oil prices continued to drive price increases. As the price of crude oil reached a record-high of $125.94 per barrel last Friday (May 9), natural gas at the Henry Hub traded at $11.29 per MMBtu. The elevated prices of both commodities continued for most of the trading week, although the price of crude oil lessened somewhat to $124.21 by Wednesday, May 14.”

The Natural Gas Weekly Update claims that “ Concerns over natural gas supplies and high crude oil prices continued to drive price increases. As the price of crude oil reached a record-high of $125.94 per barrel last Friday (May 9), natural gas at the Henry Hub traded at $11.29 per MMBtu. The elevated prices of both commodities continued for most of the trading week, although the price of crude oil lessened somewhat to $124.21 by Wednesday, May 14.”

The global slump of 2008-09 has begun?

Ambrose Evans-Pritchard is the International Business Editor for the London Telegraph. His observations are always welcome. He believes that we are now on “borrowed time.” Literally. In his view, the markets may be able to stay up until June, but don't count on it.

“The avalanche of bankruptcies has begun. Six US companies of substance have defaulted on bonds over the past fortnight, against 17 for the whole of last year.

As a "non-believer" in the instant rebound story, I am not easily shocked by gloomy reports. But the latest note by Standard & Poor's - The Bust After The Boom - gave me a fright.

The sick list is varied, though most for now are victims of the housing crash: Linens 'n Things, ($650m), Kimball Hill ($703m), Home Interiors ($310m), French Lick Resorts ($142m), Recycled Paper Greetings ($187m), and Tropicana Entertainment ($2.49bn).”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

I am now a regular guest on www.yorba.tv every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.