It’s Not the Fed Taking Gold Down, but the Vote in Scotland

Commodities / Gold and Silver 2014 Sep 18, 2014 - 11:13 AM GMTSome of you might be wondering what happened to gold at the 4pm (MDT) open, particularly in light of the rather benign, steady-as-she-goes Fed announcement. This looks like it might have to do with the Scotland independence vote in the UK tomorrow. [One man's opinion] A late poll has the vote closing to 51% (No) – 49% (Yes). In other words a complete toss-up with the Yes vote gaining momentum going into tomorrow’s proceedings.

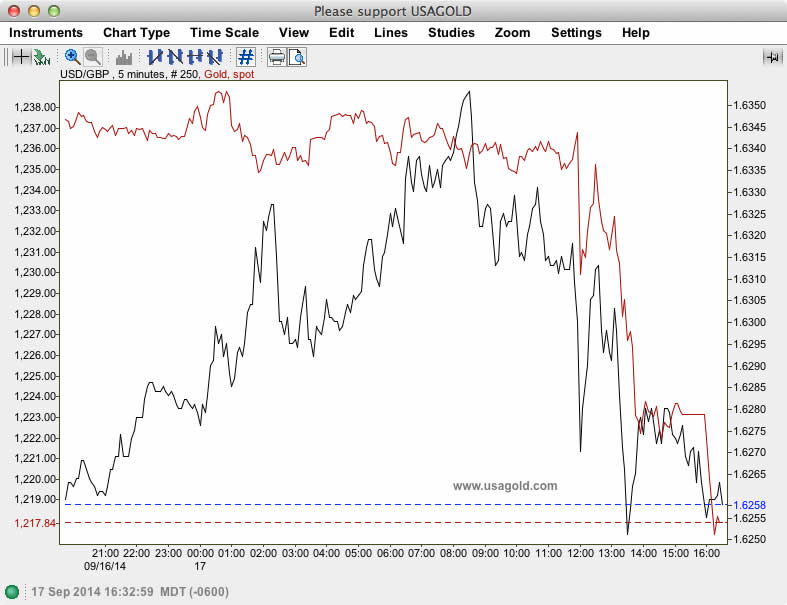

The pound is tanking (see chart), so is the euro and Swissie. There has to be market concern about others in Europe perhaps getting ideas. Mainstream media are focused on Catalan, Norther Italy, etc, but the real concern on the continent might be Greece, Italy, even France and the United Kingdom (the Tories appear dominant if Scotland breaks away and there is a clear movement within that party toward putting UK’s European Union attachment to a vote).

As a result the dollar’s on a crazy ride pushing gold south – with algos doing most of the damage. In my view this is all very temporary as far as gold goes. The monetary and financial market risks for all, including the United States, look much like the dump after the 2008 meltdown. That was temporary with respect to the gold price if you will recall (and an incredible buying opportunity).

There will be much discussion on all this starting tomorrow. . . . . . . . .Though the dollar looks to be an early beneficiary, in the long run the ensuing turmoil in financial markets is likely to cause a flurry of gold buying, particularly in Europe, once the smoke clears. There is much more to the vote in Scotland than meets the eye and the real dangers are within transnational financial institutions, just as they were in 2008. MK

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.