Top 3 Internet IPOs of the decade

Companies / Internet Sep 16, 2014 - 06:06 PM GMTBy: Submissions

Amigobulls writes: Alibaba Group, the e-commerce behemoth, is set to make its initial public offering. Alibaba will start trading on the New York Stock Exchange on the 19th of September, 2014 under the stock symbol ‘BABA’. We take a look at the top 3 IPOs of the decade.

The social media company made its debut on May 18, 2012. Facebook priced its IPO at $38 a share and made history by raising $16 billion at a valuation of more than $100 billion, making it one of the largest internet IPOs. Facebook’s IPO was considered a disaster owing to several factors like flooding the market with extra shares, increasing the value per share to $38 which was far above its fair value, insiders dumping their holdings at IPO, and concerns regarding mobile monetization led to FB shares losing 20% in the initial weeks. However, with strategic acquisitions like Instagram, Whatsapp coupled with successful mobile monetization the company has come a long way.

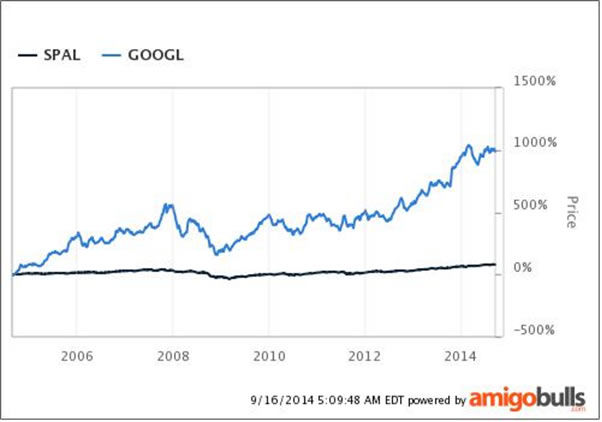

Google went public on Aug 19, 2004 in a Dutch auction IPO. The company got listed on Nasdaq with stock symbol GOOG. The search engine giant was valued at around $23 billion at the time of its IPO and went public at a time when several tech IPOs had been postponed or canceled as Nasdaq was at its lows for the year. Google had to reduce the number of shares it was selling and lowered its pricing to $85 per share due to weak demand. The company sold 22.5 million shares and raised just $1.9 billion. Google’s IPO too was considered a disaster at the time. It must be noted Google was profitable at the time of its IPO with annualized revenue of $2.7 billion and profits of $286 million. Ten years later this stock has returned more than 1000% for the long term (or buy and hold) investor and continues to remain a growth stock.

Source: Google 10 year price movement

PS: Google completed 10 years in August 19, 2014 this year.

Alibaba

China’s biggest retailer and probably the world’s biggest, has set the date and price range for its highly awaited initial public offering. The company will be listing on NYSE under the ticker BABA. With an offering of 320 million shares priced in the range of $66 to $68 per share, Alibaba is valued at around $160 billion. Early investors Yahoo and Softbank will benefit from this IPO with a stake of 22.4% and 34.1% respectively.

Is Alibaba really worth it? Last year, Aliababa properties saw sales more than $240 billion which is 60% bigger than eBay and Amazon combined. Alibaba’s recent Q2 results were extraordinary with a QoQ revenue increase of 46%, and profits tripling to $1.99 billion. The Alibaba IPO is touted to be one of the biggest US tech IPOs and only time will tell which way this Chinese juggernaut will go.

Amigobulls specializes in technology stock analysis. We offer stock picks from internet industry based on fundamental analysis. We write in-depth articles on stock valuations and publish stock analysis videographs. Join our community on amigobulls.com for discussions on tech stocks.

© 2014 Copyright Amigobulls - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cann

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.