The Myth of Lower Oil Prices Ahead

Commodities / Crude Oil May 17, 2008 - 07:06 PM GMTBy: Ty_Andros

Confusion reigns supreme as the mainstream financial press throw thoughts and headlines at you as they WISH THEM TO BE, instead of how they truly are. They do this to FLEECE you and get you to invest in products which serve their interests instead of yours. Never, ever invest based upon headlines splashed in front of you. They are almost always false. Daily activity in the markets provides lots of solid trading opportunities, but these opportunities rarely are consistently successful unless it is within the long-term trends and macro economic picture of the GLOBE, not just the G7. Invest based upon the picture within the US and you will be severely injured. The US must only be considered based upon the larger global economic pictures.

Confusion reigns supreme as the mainstream financial press throw thoughts and headlines at you as they WISH THEM TO BE, instead of how they truly are. They do this to FLEECE you and get you to invest in products which serve their interests instead of yours. Never, ever invest based upon headlines splashed in front of you. They are almost always false. Daily activity in the markets provides lots of solid trading opportunities, but these opportunities rarely are consistently successful unless it is within the long-term trends and macro economic picture of the GLOBE, not just the G7. Invest based upon the picture within the US and you will be severely injured. The US must only be considered based upon the larger global economic pictures.

Opportunities are abundant on the horizon as the freight train of public perception and belief chugs the G7 towards it demise. Many investment assumptions which have worked for generations are no longer true. Many that are timeless beckon investors with wonderful opportunities, as truth and the “laws of nature” always win the long-term investing race.

Tedbits gives you short-term insights but only within the long-term picture. What's the long-term picture, you ask? We are in the early stages of a “Crack up Boom” as outlined by Ludvig Von Mises (see Tedbits archives at www.TraderView.com ). Globalization is the evolution of the global economy and political systems as Mother Nature rewards the strongest and smartest with abundance, and punishes the weakest and dumbest with their unfolding demise to make way for the evolution of man and the world.

Billions of people in the emerging world are ascending from subsistence and poverty to more modern lifestyles, which include adequate nutrition, running water, electricity, education and upward mobility. This are things which will enrich us all, as the world's huddled masses become contributors to a more abundant future . They are doing what creates great futures—creating “more for less” money. This is the recipe for growing economies, businesses and personal incomes.

Don't look now, but many of the emerging markets are back on their highs and economic growth has hardly been interrupted. The G7 is barely growing at all. Factor in massaged economic numbers and it is in a deep INFLATIONARY recession known as stagflation. G7 Growth is NEGATIVE, interest rates are NEGATIVE, and inflation is running away and will continue to do so. It is false to interpret those pullbacks in emerging market stock markets to mean the G7 is still the dominant economic force or that decoupling is not occurring in the world. Markets are floating along on firehouses of hot money spewing forth from G7 central banks as they try to rescue their financial and banking systems from the malinvestments (see Von Mises) in which they have participated and funded.

Hardy new economies are emerging around the globe using the recipe of wealth creation known as AUSTRIAN economics and capitalism to create the future that our forefathers did in the formerly industrialized economies of the G7 industrialized world. Economic decoupling is upon us as the emerging BRIC's ( Brazil , Russia , India , China and the Middle East ) have no external deficits to speak of, huge and growing pools of savings, emerging consumers and robust investment in infrastructure. On top of this the G7 developed world is EXPORTING almost 2 trillion dollars a year of additional money to fuel future growth requirements of the emerging world. This is set to continue FOREVER until the “Crack up Boom” runs it course over the next decade.

The G7 has de-industrialized and no longer creates wealth. Instead it prints wealth, drives asset prices higher and misstates inflation, creating the illusion of growth and new wealth. The parasites known as the G7 public servants, elites and government have destroyed the futures of their economies and are firmly in the grip of the “something for nothing” social trend which has been the demise of every great empire. It is reflected in all levels of their societies: individual, municipal, state, and federal levels. All believe they can have something for nothing and live as if they can repeal the law of nature that you must produce more then you consume in order to grow, create wealth and savings. To believe you can create vibrant growing economies based on consuming more then you produce and borrowing to buy it, rather then producing more then you consume is to believe in the Tooth Fairy and Santa Claus.

The policies of insolvency are firmly entrenched in the G7 as socialism continues its march to its ultimate destination of barren futures and harvests. Misery is spread in ever widening circles as public servants have regulated (destroying innovation and adding uneconomic costs to production), taxed and spent every dime of the investment seed corn required for future economic harvests. I just returned from the U.K. and it is a basket case. Fees are up over 100% as government cannot raise taxes directly, only indirectly. That source of revenue is now not enough to serve the parasites of the government sectors which take a dollar and spit out a dime. The next indirect tax which they are trying to increase is on corporate and international business and will be the next step in driving capitalism and finance OFF SHORE, further diminishing current and future growth prospects.

Make no mistake: corporations do not pay taxes; their customers do in the price they pay for the product (indirect stealth taxation). These costs are passed right through to you in higher prices . Also contrary to popular belief is the FACT that the higher you tax a company the lower the wages of the employees. Tax off shore earnings and the company INSTANTLY becomes uncompetitive in the global marketplace. Halliburton has moved to Dubai , as have many others. The exodus accelerates as productive enterprises and people VOTE with their feet leaving behind the unproductive and their public serpents—er, servants. Shades of FRANCE !

The parasites of the G7 public sectors are now in the endgame of destruction of the host private wealth-creating sectors. As they do so the printing press of FIAT money and credit creation have to substitute for WEALTH creation which begets rising TAX revenues and savings (producing more then you consume) for future investment. Driven by the “something for nothing” mobs which control their reelection hopes, public policies are now going the direction of the most destructive policies. Rising tax revenues now are from income creep caused by runaway inflation.

The stage is rapidly being set for a rise of a Hitler type of populism and a 4 th Reich, as REAL (not to be confused with nominal) rising incomes and wealth creation now resides in other parts of the world and inflation spreads misery in every widening circles.

Understand that those that utter the words “commodity bubble” are the pushers of paper products in blistering bear markets of lost purchasing power (which has only just begun). Ignorant of the implications of globalization they pass their GUIDANCE to you based on a bygone era of the industrialized wealth creating G7 economic dominance. Those assumptions are now FALSE . Paper FIAT wealth can only hold its value if it is backed by something that is growing (economies) and REAL. Supply-constrained, demand-led bull markets do not yield to diminished economic activity in one corner of the world or higher interest rates (which are not on the horizon) in the G7 where growth is nonexistent. Only the recipe of capitalism will deliver lower prices as the virtuous activity of delivering “more for less” will create the disinflation a fiat monetary system MUST have. High prices lead to lower prices in a capitalist system unless the solutions are mandated prescriptions of paying “more for less” of whatever is required.

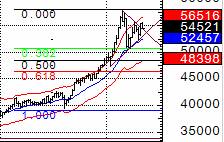

A significant breakout is occurring in the commodity markets. A clearly corrective pattern signals the trend of higher commodity prices resuming. Take a look at this weekly chart of the continuous commodity index formerly known as the CRB (commodity research bureau) basket of commodities. It begins in 2007:

2007 2008 |

I have put in two technical studies for perspective. The first is a Fibonacci retracement of the latest mega run which commenced in mid-August and peaked in the first week in March. Notice how the sector has traced out a symmetrical pennant which it is now just breaking out to resume the trend?

This pattern is active and signals a measured move of almost 20% higher. The retracement off the highs has retraced a picture perfect Fibonacci 38% of the previous move, and 10-plus weeks of corrective action correcting previous speculative EXCESSES! Contrary to bubble territory, this market is the picture of HEALTH! Expanding open interest, volume on rallies, confirmed long-term internals on monthly and quarterly charts. Market moves end when there are internal divergences, volume wanes and open interest contracts. The longer they utter “bubble” the farther it's going to go.

The financing and credit crisis just throw supply solutions farther into the future as solutions to the problems can't be financed and regulatory uncertainty constrain investment. Prices have to rise to force public servants to change policies.

Everybody knows the tremendous global infrastructure build-out required in the emerging world, but keep in mind the earthquake which has just devastated many places in Central China . The devastation there exceeds Hurricane Katrina. The economy and country in those areas will have to be completely rebuilt, adding to future demand and generating MORE internal growth in this emerging economic powerhouse. And when completed, more modern infrastructure will be in place to compete in the global race for prosperity. Now let's debunk the myths.

The Myth of Lower Oil Prices

Contrary to the belief of investor and G7 financial pundits, the G7 NO LONGER is the engine of growth in the global economy. It has regulated, taxed and mandated the factory rooms that created its wealth to the emerging world, where capital is combining with inexpensive labor to create the recipe of wealth creation—“more of everything for less money”. Consumers are doing only what is rational and choosing those products which provide the most for themselves and their families.

Consumption of oil in the emerging economies is now roughly equivalent to the developed economies. Oil use in the developed world is flat or declining at a 1% rate. Oil use in the developing world is rising at about 8% per year; add the two together and divide by 2 and you get 3.5% growth in demand. Now let's reduce demand increase by half that number due to improved productivity, for every unit on energy input generates more. Demand is actually growing at 1.75% per year globally.

Globally, spare capacity is about 2 million barrels or 2.3% of daily demand. The spare capacity resides in only 1 country: Saudi Arabia . Production is flat or declining in all the other OPEC nations including Iran , Iraq , Nigeria , Venezuela , Mexico , etc. as all these countries have NATIONALIZED their oil companies. Modern field maintenance is a dream as public servants and governments take the maximum income and do not invest in future production or maximizing current production capacity. They take the money and run. Ever seen a business where you don't invest in that business' future? It is quickly on the road to ruin and a recipe for steadily diminishing income and production. It is where the global oil industry now resides.

Look no further then Venezuela , Mexico and Russia for a glimpse of the future. Petróleos de Venezuela , S.A. ( PDVSA ) , the national oil company of Venezuela used to be a model of operation with an eye on the future, nationalized by Hugo Chavez. All the management has left the country in the hands of political appointees creating ever diminishing current production. Nationalization of the Russian oil industry under Vladimir Putin has resulted in stunting the tremendous promise of Russia 's natural resource and energy industry and ownership has gone to the NEW oligarchs residing in the government.

Anyone signing contracts with these two governments must be prepared for them to be signed in DISAPPEARING ink. Ecuador , the largest producer of natural gas, has nationalized its energy sector and is well on the way to reneging on deals with Brazil 's Petrobras, who has invested billions. These governments DO NOT have the expertise to properly develop and maintain their current and future prospects so they have NONE except the prospect of declining ones. No one trusts them to keep their agreements in any way, so there will be fewer of them.

Nigeria is tortured by indigenous rebels known as “MEND” ( Movement for the Emancipation of the Niger River Delta) , which is dedicated to reclaiming the oil fields and their wealth from the corrupt central government and the international oil companies which operate there. Production is plummeting and regularly under attack, subjecting oil producers to regularly cancel oil delivery contracts due to force majeure.

In order to develop a new oil field, it takes almost 5 to 7 years from point of discovery to delivery of supplies. If oil demand is growing at 1.75% per year and there is only 2.3% of excess capacity the world WILL NOT be able to meet demand in about a year and a half. Supply IS NOT growing at 2% per year. Substituting other sources of energy production is not an option in the United States or Europe as development of conventional power plants powered by CLEAN coal or nuclear is basically prohibited by environmental regulations and pending global warming legislation.

The substitution of biofuels is not a long term solution and they have entered the supply stream in sufficient quantity that if withdrawn or reduced by half the world will fall into deep deficit on a daily basis sending crude oil skyrocketing .

In the United States and the G7, refineries have not been built in decades as NIMBY (not in my back yard) has destroyed the incentives for investment in future capacity. Look no further then the state of California , which imports large amounts of its energy because it is impossible to produce under current and future regulatory requirements. In California a beautiful nuclear facility was built about a decade ago:

“Rancho Seco Nuclear Generating Station. Opened in 1975, it was capable of generating over 900 megawatts (MW) of electricity, enough to power upward of 900,000 homes. Fourteen years after powering up, the nuclear reactor shut down, thanks to fierce antinuclear opposition. Eventually, the facility was converted to solar power, and today generates a measly four MW of electricity.” (Courtesy of the Wall Street Journal )

A recent editorial in the Wall Street Journal outlines the LEADERSHIP and good fiduciary behavior of our public servants to meet the future needs of the nation. Let's take a look:

Wind ($23.37) v. Gas (25 Cents)

May 12, 2008

Congress seems ready to spend billions on a new "Manhattan Project" for green energy, or at least the political class really, really likes talking about one. But maybe we should look at what our energy subsidy dollars are buying now.

Some clarity comes from the U.S. Energy Information Administration (EIA), an independent federal agency that tried to quantify government spending on energy production in 2007. The agency reports that the total taxpayer bill was $16.6 billion in direct subsidies, tax breaks, loan guarantees and the like. That's double in real dollars from eight years earlier, as you'd expect given all the money Congress is throwing at "renewables.” Even more subsidies are set to pass this year.

An even better way to tell the story is by how much taxpayer money is dispensed per unit of energy, so the costs are standardized. For electricity generation, the EIA concludes that solar energy is subsidized to the tune of $24.34 per megawatt hour, wind $23.37 and "clean coal" $29.81. By contrast, normal coal receives 44 cents, natural gas a mere quarter, hydroelectric about 67 cents and nuclear power $1.59.

The wind and solar lobbies are currently moaning that they don't get their fair share of the subsidy pie. They also argue that subsidies per unit of energy are always higher at an early stage of development, before innovation makes large-scale production possible. But wind and solar have been on the subsidy take for years, and they still account for less than 1% of total net electricity generation. Would it make any difference if the federal subsidy for wind were $50 per megawatt hour, or even $100? Almost certainly not without a technological breakthrough.

By contrast, nuclear power provides 20% of U.S. base electricity production, yet it is subsidized about 15 times less than wind. We prefer an energy policy that lets markets determine which energy source dominates. But if you believe in subsidies, then nuclear power gets a lot more power for the buck than other "alternatives."

The same study also looked at federal subsidies for non-electrical energy production, such as for fuel. It found that ethanol and biofuels receive $5.72 per British thermal unit of energy produced. That compares to $2.82 for solar and $1.35 for refined coal, but only three cents per BTU for natural gas and other petroleum liquids.

All of this shows that there is a reason fossil fuels continue to dominate American energy production: They are extremely cost-effective. That's a reality to keep in mind the next time you hear a politician talk about creating millions of "green jobs." Those jobs won't come cheap, and you'll be paying for them.

Frightening reading, isn't it? Looks to me like they have given lots of thought to this problem and really prioritized this in an effective manner to meet the practical needs of today and the future! Practical, affordable solutions are NOT being considered in any way. Thank you, special interests that have bought and paid for these Public Serpents— er, Servants, through campaign donations. Policies to benefit the few at the expense of the broad public. Can you say immoral? Can you say public corruption?

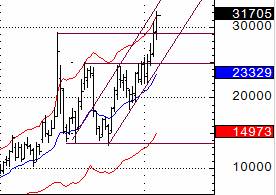

Take a look below at this monthly chart of re-blended gasoline:

2004 2008 |

This is a mega pattern built over 3 years. It is global macro and an overriding picture to the dailies. This chart has an objective of about $4.50 per gallon in the near future and since no refineries are being planned or constructed, it can only be a matter of time before it is even higher. A refinery HAS NOT been built in the United States in over 3 DECADES. They are virtually outlawed. Great planning by our elected representatives.

2004 2008

Attacks on speculators is a canard for populous politicians to hide behind. I just finished listening to a report on oil prices on national public radio here in the United States . The house media organ for left leaning liberals everywhere, it covered NOTHING of the issues except the dollar dropping and said the dollar is down 10% and oil is up 80%, not mentioning the outlawing of exploration by regulation, lack of refinery investment, steadily increasing demand and stagnant worldwide capacity. All this to fool the electorate into supporting the public serpents—er, servants raid of responsible domestic oil companies and their shareholders using the word SPECULATORS, building upon then preying on the ignorance of their constituents. Thomas Jefferson said that without an educated public the republic will not stand.

Look no further then the recent proposals to punish independent oil companies who are owned by your neighbors in their stock portfolios and in the nation's pension funds. Last week legislators proposed WINDFALL profits taxes on big national oil companies who make on average 9 cents a gallon of profit on a gallon of gasoline and paid over $50 billion dollars in taxes last year with margins less than McDonalds makes on hamburgers .

U.S. legislators, who take on average $.51 cents a gallon in TAXES, propose robbing the major oil companies of their capital budgets and redirecting them in the direction of the editorial outlined above. These are not real solutions. Tthey are the figment of a politician's demented imagination and permanently distort the marketplace and increase prices for all energy.

Dennis Gartman of www.thegartmanletter.com reports the U.S. has enough oil for 47 days of use, the same as last year when crude was in the $60 dollar area. Short-term supplies are adequate; it's the long term picture which HAS to be priced in to make sure we have 47 days in storage in 3 YEARS! Do not invest in the little picture, invest in the BIG one!

Let's see, enough excess capacity to meet demand growth for the next year and a half and it takes 5 to 7 years AFTER discovery to get into production. Practical exploration and development is basically outlawed and taxed to death in the G7. Chinese oil companies can explore on the continental shelf off the Florida coast and US oil companies can't. Attacks on the profits of people who wish to invest to meet these needs. What's wrong with this picture?

How can leading oil analysts not know these things and tell them to you? The answer isn't pretty.

I can go on and on: OIL WILL NOW HAVE TO RISE TO A POINT WHERE THE PUBLIC DEMANDS PRACTICAL SOLUTIONS. Short-circuit the price rise and penalizing investment will delay the day when prices come down from new supplies. The major oil companies will move offshore soon if the “something for nothing” mob comes at them! Add global warming nonsense to any solution and the price rise will be 50% HIGHER . Practical solutions only lie at a price which precludes politically correct ones….

Prediction: Oil is headed to a price which will ration new consumption until new supplies can be found and developed and guarantee a return on investment. There is not any investment in meeting the demand in 2 to 7 years; it must be started now if it is materialize. $150 is clearly on the near term horizon(6 months to a year), but $300 dollars a barrel is in the cards. Nothing less will get the public servants to act in a responsible manner, not an ideological one. When the public REVOLTS is the day public servants will listen and create practical policies for the future and not a day sooner….

In conclusion: Notice how I have not leaned on the dollar as the cause of the woes? It's because it is only a SMALL element of the problem. Oil is rising against ALL currencies as “currencies don't float; they just sink at different rates”. There is no excess capacity to produce or reserves in storage of almost EVERYTHING (natural resources, commodities, energy supplies, etc.) in a world that is growing immensely in some places and not at all in others. Who cares if the G7 is stagnating and not growing? The rest of the world is and on a purchasing power basis it is BIGGER then the G7. There is no constituency for the policies of solvency, wealth creation and growth in the G7. If you don't believe me ask Ron Paul!

Commodities and energy supplies are not increased in a short period of time, such as a year or two. Price controls, attacks on markets and taxes are only going to postpone or cancel the actions which are required to bring prices back down. Prices will have to go high enough to FORCE public servants to create the policies which allow for more of them. Higher taxes and price controls only send the signal to the investors and oil companies that to meet the needs of the globe is to suffer the penalty of “confiscation of their return on investment” and despair. Ask the farmers in Argentina . There can be no hint of this if the needs are to be met anytime in the next 5 years .

High prices are the elixir which leads to lower prices!

It is the genius of how capitalist markets solve supply and demand imbalances. NO ONE is withholding supply to boost prices at $125 dollars. That's an absurd statement when1 million barrels of crude a day generates $40 billion dollars in income. If they had it, they would sell it . Whatever excess capacity is ALL very sour and hard to refine, and as I said they don't build refineries anymore so there is no capacity to refine it.

Commands from centralized government, bureaurats–er, crats–idiot lawyers and public serpents— er, servants, have NEVER met a problem which they cannot make worse to benefit one special interest or another.

I can't convey the profound effect the Pandora's Box known as BIOFUELS is set to release on the energy sector. Reduce them and crude oil immediately is in deep deficit of supply in terms of demand. It's the law of unintended consequences in action as with all government solutions. Markets find solutions, not governments . So it's damned if you reduce biofuels, or it's damned if you don't. Either at the grocery store or the pump, prices are headed higher! Erupting South American volcanoes insure diminished grain production this year.

There is no going back for the emerging world. They no longer have to be externally financed and their ability to finance themselves is only going to grow as the ability to provide the daily needs of the G7 lie outside its borders and POLITICAL grasp. Within the G7's grasp the policies to generate wealth are but a memory of past generations and not considered. G7 public serpents manage according to the next election cycle and in the emerging world they plan for a decade from now. Which method do you think leads to better long term outcomes? Riots and the threat of public violence keep emerging world politicos focused on growth, while G7 politicos focus on the next public fleecing benefiting their special interest supporters. This is on BOTH sides of the aisle, right and left.

The opportunities are GARGANTUAN and limitless at this time. Stocks, bonds, commodities, natural resources, and energy markets are but a few of the markets that are going to be blown a long way from these levels in both up and down directions. The printing press of FIAT money and credit creation in the G7 is set to increase “ad infinitum”. Volatility is decreasing at this time due to money creation which is galloping along WORLDWIDE. The “Crack up Boom” is in its infancy as the bills are unpayable unless inflation is the policy of government. Do your homework on how to capture these opportunities and thrive. You must learn to short circuit the printing press and turn it to your advantage!

Gold is near record lows in price versus crude. In fact, this price has only been seen 33 days in fifty years, consider buying it ! Thank you, James Turk, for this gem. www.fmgr.com

In the U.K. , a showdown looms between “Sold the gold” Gordon Brown and Chancellor of the Exchequer Alistair Darling (aka no friend of the public and the taxman), versus the public. The expansion of the public sector at the expense of the private sector is reaching a boil. Foolish regulations, fees and the fleecing of London are now at the intolerable stage. In their eyes, government spending is essential and your family's spending isn't. I was surprised not to hear the old Beatles song about the Taxman.

The regulation of the British economy has become straight jacket, as it is throughout the G7. It destroys innovation and wealth creation and makes government a stealth partner and micromanager in EVERYTHING. With government at the decision-making wheel of EVERYTHING the outcome is certain: disaster. Their solutions don't solve problems. They make them worse. Of course this is to “protect you” FROM YOURSELF! What a laugh. How the public servants think they can make better decisions then those confronted with them on a daily basis is a testimony to their hubris and contempt for their constituents.

Pinocchio's spin meisters are working overtime as the most recent CPI, GDP and retail sales data were such a joke that even the main stream financial media were embarrassed to hang their hats on them. In the private sector this would be labeled PREMEDITATED fraud and you and I would be charged with disseminating false and misleading information to investors.

Please remember that beginning the first week in June subscribers will receive Tedbits two to three days before it is posted on the web. Subscribers will also start getting guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.