Strong U.S. Dollar Weakens September Gold Price

Commodities / Gold and Silver 2014 Sep 10, 2014 - 01:00 PM GMTBy: Frank_Holmes

Last week I wrote about the historic correlation between the month of September and the strength of gold. Now it appears that this September might be shaping up as one not to remember but forget.

Last week I wrote about the historic correlation between the month of September and the strength of gold. Now it appears that this September might be shaping up as one not to remember but forget.

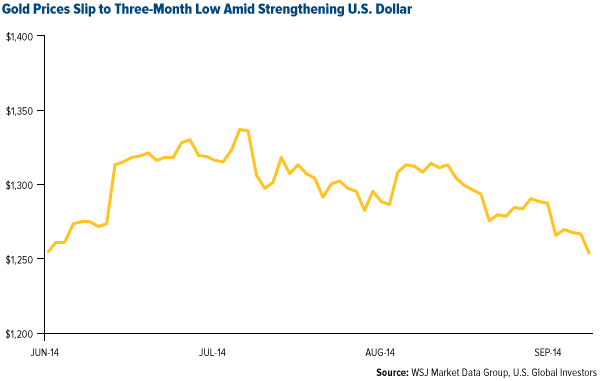

Based on data reaching back to 1969, gold rises 2.1 percent on average in September. Ten days into this year's month, however, the precious metal has lost 2.6 percent, slipping from $1,288 to $1,254.

As I pointed out last week, a dip such as this might be common in other months, but it's somewhat rare in September. In the last 20 years, there have been only five Septembers in which gold prices ended lower than they started at: 1996, 2000, 2006, 2011 and 2013. Although we remain optimistic, 2014 might see another such down September.

So What Gives?

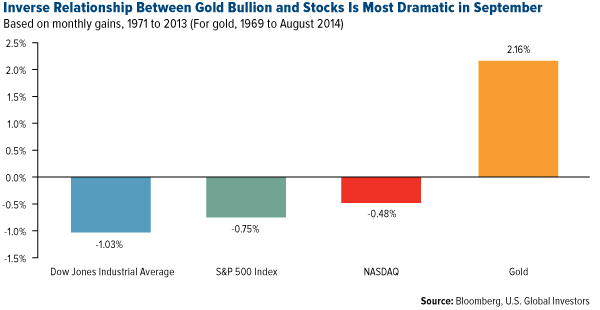

September is statistically both the best month for gold and worst month for stocks. Though there isn't an absolute certainty that each September will be as equally kind to gold, decades' worth of data support this inverse relationship. Investors, aware of the probability, typically move some of their stock positions into gold.

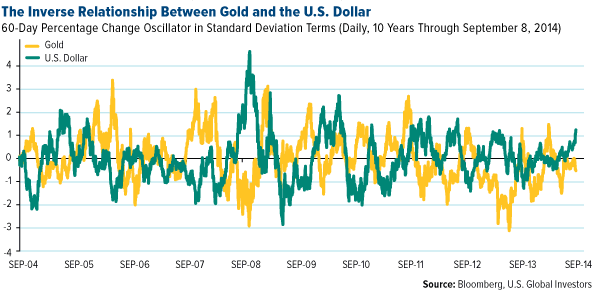

But another inverse relationship exists that also influences gold's performance: the relative strength of the U.S. dollar. When the dollar does well, many investors choose greenbacks rather than yellow metal as a reliable safe haven from volatility.

This month, the inversion has only intensified as the U.S.'s ISM Manufacturing Index for August rose to a three-year high of 59.0, strengthening the dollar. While a jump in the ISM index is a welcome event, commodities such as gold tend to take it on the chin.

Another factor weighing on the metal is the weakening euro, which statistically has the opposite effect. When the euro is down, so too is gold because dollar-denominated gold becomes more expensive for Europeans and other non-Americans. Recently the eurozone's currency hit 14-month lows against the dollar.

Again, even though this particular September has thus far fallen below expectations, we remain bullish on gold in our Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX). As I've frequently written about, the Love Trade is a reliable occurrence around this time of year that helps bolster the metal's performance.

And as always, we at U.S. Global Investors recommend a 10 percent weighting in gold: 5 percent in bullion, the other 5 percent in gold stocks, then rebalance every year.

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.