Bitcoin Price More Weakness Than You Might Think

Currencies / Bitcoin Sep 06, 2014 - 01:38 PM GMTBy: Mike_McAra

In short: we don’t support any speculative positions in the market.

In short: we don’t support any speculative positions in the market.

Charlie Shrem, the founder of BitInstant, a New York based Bitcoin exchange, has pleaded guilty to aiding an unlicensed money-transmitting operation, we read on the Reuters website:

A man who helped to promote bitcoin wants to remain in the business despite pleading guilty Thursday to indirectly helping send more than $1 million in the digital currency to users of the illicit online marketplace Silk Road, his lawyer said.

Charlie Shrem, 24, pleaded guilty at a hearing in New York federal court to one count of aiding and abetting an unlicensed money transmitting business.

A co-conspirator, Robert Faiella, 54, separately pleaded guilty to operating such a business. Both men face up to five years in prison when they appear again in court in January.

(…)

Prosecutors said Faiella, 54, operated an underground bitcoin exchange on Silk Road under the name "BTCKing," providing currency for users engaged in illicit drug trafficking.

Shrem processed transactions for Faiella through BitInstant despite knowing the bitcoin would eventually find their way to Silk Road, where the funds would be used for drugs, he said in court.

The next time Shrem and Faiella appear in court, the sentences will be handed down. This might end the story. It might also mark an end of a phase in the life of Bitcoin. Following the uncertainty surrounding Shrem’s involvement with Faiella, and after the fall of Mt. Gox it seems that we’re seeing less news associating Bitcoin with any kind of criminal activity and more stories linking Bitcoin to private equity and a technological breakthrough.

This is a positive sign, since Bitcoin is making its way to being perceived as a new payment system, without negative connotations. More legal clarity is definitely helping and so is the general greater awareness of what Bitcoin is and what it’s not.

For now, let’s look at the charts.

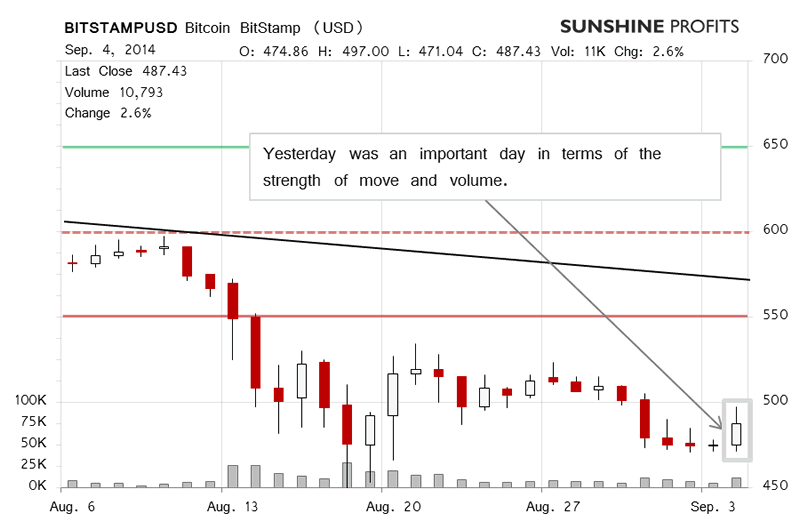

On BitStamp, we saw a great deal of activity yesterday. Bitcoin shot up to almost $500 before settling at a lower level around $485. The volume was relatively significant, particularly compared with the previous days. The events we saw yesterday may have been influenced by the ECB and its announcement of further interest rate cuts and new asset purchase programs. Yesterday, we wrote:

Today is a completely different story. Why? Bitcoin shoot up (this is written around 10:30 a.m. ET) to almost $500. This came after the ECB announcement of further interest rate cuts and of new purchase programs for bonds and asset-backed securities. It is unclear whether this is the direct cause of the surge in Bitcoin. Following conventional wisdom, one could argue that the more aggressive movements by the ECB are making Bitcoin more attractive as an alternative asset (as one would “expect” to be the case with gold). However, as you know, we are not inclined to jump to easy conclusions. The ECB announcement might have induced traders to act but this is not certain.

One way or another, Bitcoin is up, rebounding strongly and seemingly breaking the recent depreciation. The volume is already up from yesterday. This would normally constitute a strong indication of a possible trend reversal. Such a cue is weakened by the fact that the currency has not gone above $500 (at the moment of writing).

As it turned out $500 was not reached, which immediately makes yesterday’s move less significant than it looks at first sight. Today, we haven’t seen a conclusive move to the upside yet (this is written before 10:30 a.m. ET). Is it possible that, in spite of the lack of strong action, today might hold important cues for traders? An answer will follow in this alert.

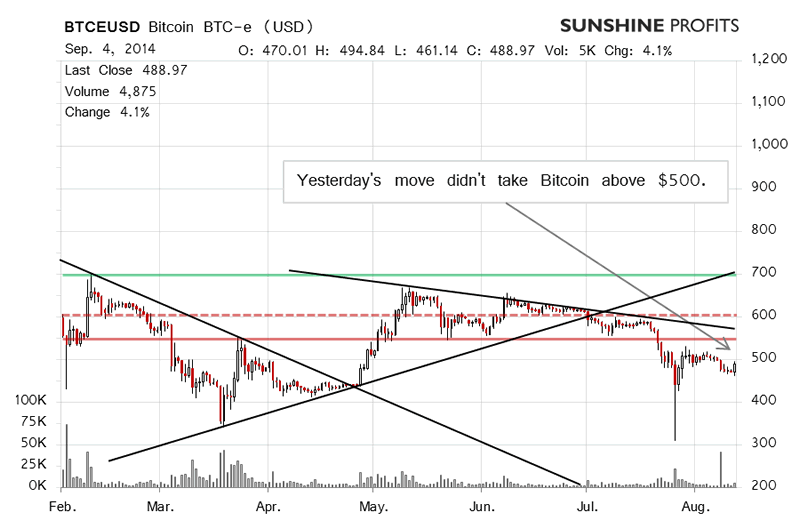

On BTC-e, we saw action similar to the moves on BitStamp. Bitcoin didn’t go above $500 yesterday and our previous comments were upheld:

Today’s appreciation is not yet visible but it has been significant. Bitcoin went to almost $495 before taking a breather. Again, this might be the comments of the President of ECB. Bitcoin hasn’t gone above $500 yet, which partly undermines the implications of the move up.

For now, it seems that $500 is the barrier to watch. If Bitcoin appreciates above this level and stays there, we might be in for a rally. On the other hand, the fact that we’ve only seen one day of strength and it might be event-driven, makes are anxious about the strength in the market in the sense that in might only be temporary.

Consequently, we don’t think that it’s time to go long, at least not yet. We would prefer to see Bitcoin stay above $500 before making a bullish call.

Today hasn’t brought a move above $500 either. The volume is generally down again and it seems that yesterday’s appreciation might be a one-time event. If we look at both the short-term and the medium-term trends, they seem to be down so a bet on a continuation of these trends might be worth considering.

On an administrative note, due to personal leave I will be absent Sept. 8 – Sept. 22 and no Bitcoin Trading Alerts will be posted during this period. Bitcoin Trading Alerts will resume on Sept. 23, 2014.

As previously discussed, I will now describe broad scenarios and the actions that might be, in our opinion, appropriate in each case, so that you remain guarded even while I’m away.

Generally, we consider two scenarios here. In the first one Bitcoin is to appreciate above $500. If the currency falls below this level afterwards, a third daily close below $500 or a decisive move down could be the sign to open shorts with a stop-loss at $515 and a take-profit order at $440. If Bitcoin stays above $500 for a week or moves above this level strongly without any major events (like the ECB announcement), longs could be appropriate with a stop-loss at $490 and a take-profit at $580.

The second broad scenario is one where Bitcoin stays below $500 for a week from now (without major moves) or moves lower sharply. In such a scenario, shorts could be appropriate with a stop-loss at $515 and a take-profit at $440.

Summing up, we don’t support any speculative positions in the Bitcoin market now.

Trading position (short-term, our opinion): no position.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.