US Dollar and British Pound Update

Currencies / British Pound Sep 05, 2014 - 06:03 PM GMTBy: Jonathan_Davis

First, a recap of what I said a month ago. Full post here.

First, a recap of what I said a month ago. Full post here.

4 August 2014:

“So, the US $ is to collapse, so say the inflationistas, the gold bugs, the Anderson shelter types etc.

Yet the $ index, against a generally accepted basket of currencies, has failed to collapse for over 2 years and, indeed, is rising again, from multi year support.

This is the reason why the GB£ has recently been falling – not because of anything internal to the UK.

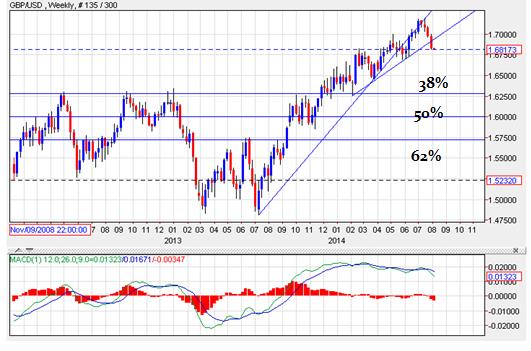

1.70/72 was 20 year resistance, apart from the extreme period of 2003-2007. As I told clients, from 1.70/72 £ could rise further 20% or fall 20% to 1.35. Falling so far. On verra.

The £ has fallen recently due to $ strength and has broken below rising support, since February. It seems fair to suggest the break will hold. Next support down at 1.63.”

Now the update:

The US $ (index) is in a multi year uptrend. There is no getting round that fact, whatever your opinions of what ‘should be’. The trend up started in mid 2011, paused for a very long 2 years and, indeed, may still be pausing ie moving horizontally. Until it breaks up, sustainably, above 85 or below 78 it is pausing in the trend.

The fact is though it is approaching the top of the channel, since mid 2012. So, there is a slightly greater likelihood of a reversal from around here than a continued rise up. It would be easier for the market to stop at this resistance than break through.

The high RSI signifies overbought status.

However, longer term, unless and until the trend reverses the multi year uptrend of the US$ is the trend. That is unlikely to be good for stocks and commodities. Unlikely to be inflationary. Likely to be supportive of deflation and government bonds.

As for Sterling vis-a-vis the US$, in the British press all and sundry are blaming a recent fall in the £ on a rise in support of Scottish Independence (on which I had something to say here.) Nonsense! The recent polls were last week. A) The US$ started rising rapidly in June. B) the recent fall in the £ started over 2 months ago. The fall in Sterling has NOTHING to do with the polls or potential for Scottish Independence. Economics and Political Media. MEH!

Note, I said, on 4 August it seemed likely the first major support (and point for reversal back up) would be around 1.63. That is where we are now. It is no coincidence that it coincides with a potential reversal of the short term surge in the US$. I told clients that a strengthening £, since last Summer, would not be immune to a generally strengthening US$ ie the £ was not uniquely strengthening and it would not continue to do so if the US$ started to rise. That has proven to be correct.

That UK house prices are softening, the timing for a Base Rate rise gets put further and further back (Quelle Surprise!), that household earnings remain weak, that disinflation remains true etc etc these are amongst the reasons I have held the view that a strengthening pound was strange. (As many things in the markets are.)

It is also noticeable that the £ has bounced hard off the very long term resistance of $1.70/72, as I pointed out previously.

What seems likely is a rebound from here and it may go back up to the $1.70/72 level again. Whatever it does on the rally, that will be the retest of the $1.72 high. If the US$ is to break up above 85 expect the £ to be lower than now in the medium term, whatever may happen in the short term.

Nothing in these articles can be taken as financial advice. Neither Jonathan Davis nor Jonathan Davis Wealth Management will be held responsible for action taken or not taken from reading these articles.

We recommend investors seek bespoke advice before acting.

By Jonathan Davis

http://jonathandaviswm.wordpress.com/

25+ year veteran of the world of financial services, the last 10 doing the same thing under his own name. We work with families all over the UK and in Switzerland and, indeed, on 2 other continents. If interested in our Wealth Management work, cast a glance at the firm’s website.

From time to time media folk call me and ask me to rant live or in the press. JD in the media.

I don’t buy hype. I don’t believe it’s the end of the world but I do believe, within a generation, the West will have no welfare state. The maths don’t lie. We’re toast. It’s obvious if you think about it.

© 2014 Copyright Jonathan Davis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.