Gold, Silver Market Strong Reversal Augurs for Rough September

Commodities / Gold and Silver 2014 Sep 05, 2014 - 04:02 PM GMTBy: Jordan_Roy_Byrne

In recent weeks we wrote about the ongoing consolidation in precious metals miners. We touched on the history of September, not as a bullish month but as an important inflection point. With the miners holding up well and Gold still holding its lows we thought a breakout could be coming. Yet we've been whipsawed before. Several times over the past year (and as recently as late July) we've written about the possibility of a final low in Gold to precede the next impulsive advance in the miners. These scenarios came to a major head this week and the nasty decline across the entire sector suggests the bears are back for one last time.

In recent weeks we wrote about the ongoing consolidation in precious metals miners. We touched on the history of September, not as a bullish month but as an important inflection point. With the miners holding up well and Gold still holding its lows we thought a breakout could be coming. Yet we've been whipsawed before. Several times over the past year (and as recently as late July) we've written about the possibility of a final low in Gold to precede the next impulsive advance in the miners. These scenarios came to a major head this week and the nasty decline across the entire sector suggests the bears are back for one last time.

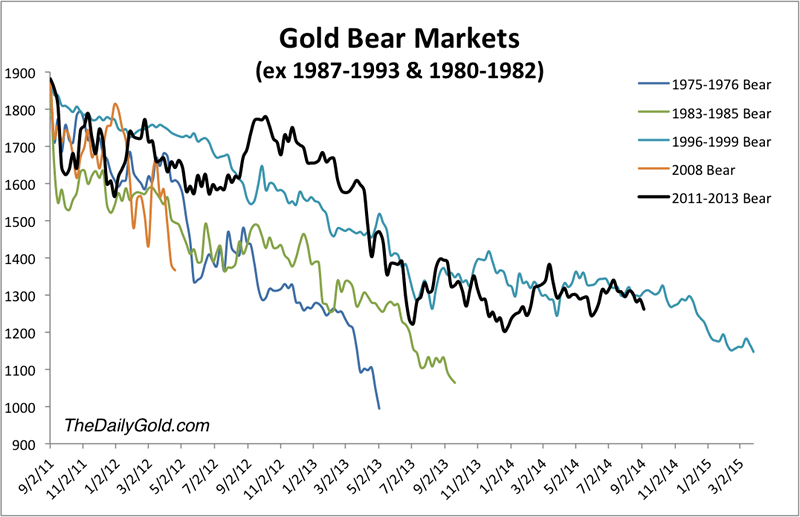

Below is our chart for Gold's bear markets which are scaled to the 2011 peak. We exclude the two extreme bears (one lasted six years while the other was the post bubble crash). Longer bears tend to be less severe in price whereas the most severe bears in price tend to be short in time. Examples of that include the 1975-1976 and 1983-1985 bears. The 1987-1993 bear (the longest) only shed 35% while the 1996-1999 bear, which lasted three and a half years bottomed well above $1100 on the current scale. History makes a strong argument that while a new low is likely, anything much below $1100 appears unlikely.

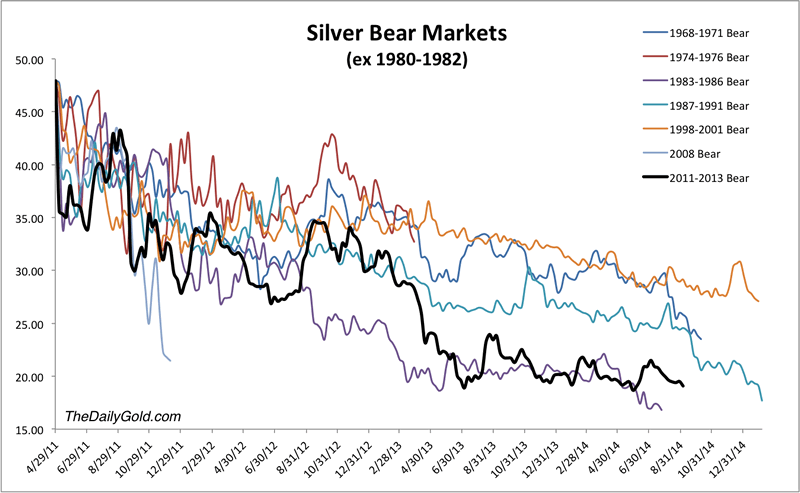

The next chart shows all of the bear markets in Silver sans the 1980-1982 bubble crash. A close below $18.82 would mark a new weekly low. This analog makes a very strong case that Silver's bear is likely to end in the coming weeks or months.

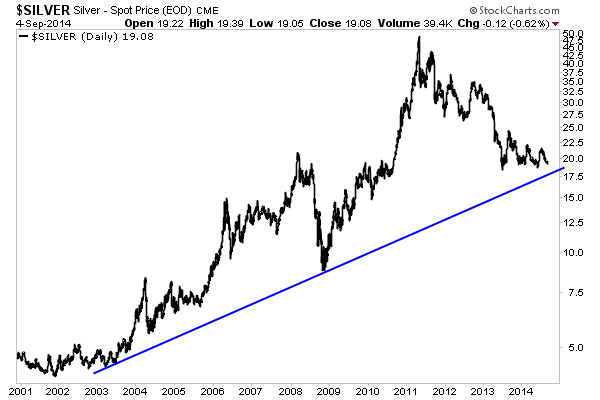

Staying with Silver, we note that while Silver could make a new low it would soon find 11-year trendline support. This is another reason we will be very bullish on Silver if it breaks to a new low.

So how does affect the miners?

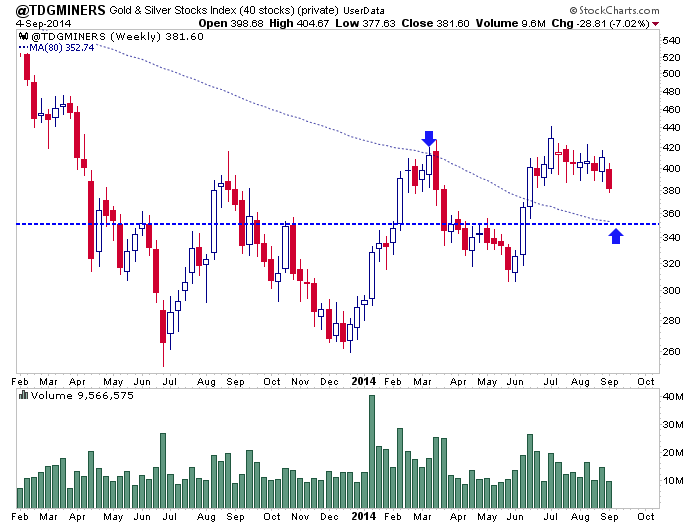

Until days ago the miners looked very strong and on the cusp of a breakout. That possibility has gone out the window. The chart below shows a nasty reversal in our top 40 index which is down 7% on the week and officially broke its consolidation low on Thursday. The index closed Thursday at 382 and the next strong confluence of support is near 350.

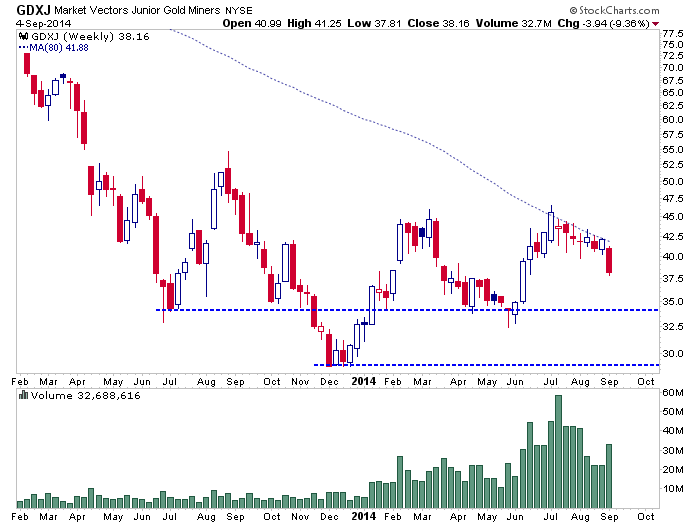

GDXJ is down 9% this week and sliced through support on big volume. The next strong support is the previous low around $33. There is nearly 15% downside to that strong support.

Going forward, $1240 Gold and $1200 Gold on a weekly basis are key levels to watch. The miners are very oversold in the short-term and should bounce along with Gold (from $1240). However, the bears have regained control. The bear analogs are quite clear and the miners have suffered major damage which implies more downside. I don't envision a buying opportunity for the miners until Gold and Silver make new lows. This week could mark the start of that final plunge that has eluded us several times over the past year.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.