Gold Model Projects Prices From 1971 – 2021

Commodities / Gold and Silver 2014 Sep 04, 2014 - 06:32 PM GMTBy: DeviantInvestor

Gold persistently rallied from 2001 to August 2011. Since then it has fallen rather hard, down nearly 40% at one point, but it currently looks ready to rally for the balance of this decade.

Gold persistently rallied from 2001 to August 2011. Since then it has fallen rather hard, down nearly 40% at one point, but it currently looks ready to rally for the balance of this decade.

WHY SHOULD WE EXPECT THAT GOLD WILL RALLY?

The answer, in my opinion, can be found in my gold pricing model that has accurately replicated AVERAGE gold prices after the noise of politics, news, high frequency trading, and day to day “management” have been removed by smoothing.

WHY DO WE NEED A GOLD PRICING MODEL?

Most of us do not know if a current market price is “low,” about right, or “high.” A few of the difficulties are:

- Major “Too-Big-To-Fail” banks are promoting paper, not gold, so they consistently issue bearish reports on the prospects for gold.

- Rising gold prices are viewed by many as the “canary in the coal mine” regarding loss of faith in the currency and as an early warning sign of consumer price inflation. Hence the “powers that be” want gold prices suppressed.

- Many well-known gold experts disagree about future prices – so much that some can’t even agree as to whether gold prices will be higher or lower in three years.

- It has been well documented that a massive quantity of gold has been shipped east to China, Russia, and India from the west in the past decade. It probably benefits both Western and Asian countries, in the short term, to encourage lower gold prices. This phase of selling western gold and shipping it east may be nearly finished.

- Much of the official gold may have been “leased” or sold and many vaults, such as the Bank of England, NY Federal Reserve, and Fort Knox may be partially or nearly empty. With no transparency regarding gold in official vaults it is difficult to say conclusively what gold remains. But acknowledgement that central bank gold is “missing” could drive prices much higher.

- More radical individuals believe gold prices can and will “go to the moon” any day. Similarly, others believe $250 per ounce is coming soon. Who and what should we believe regarding rational and defensible projections for the price of gold?

My empirical model accurately calculated all major trends in smoothed gold prices since 1971 based on several macro-economic variables. This model is, I believe, a good tool for projecting future prices.

MODEL RESULTS:

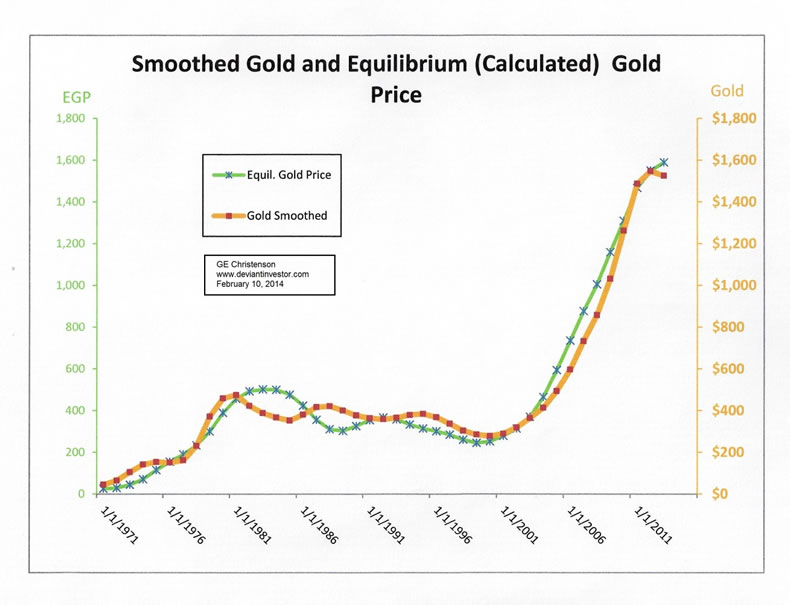

a) The calculated Equilibrium Gold Price (EGP) had a statistical correlation of 0.98 with the smoothed gold price from 1971 – 2013.

b) The model was both simple and robust. It worked effectively, on average, during gold bull and bear markets, stock bull and bear markets, blow-off tops and crashes, volatile oil prices, Y2K and 9-11, QE, Operation Twist, ZIRP, various hot and cold wars, occasional peace, gold leasing, gold manipulations, and high frequency trading distortions in many markets.

c) In August of 2011 gold was priced about 30% ABOVE the EGP.

d) In contrast, the December of 2013 gold price was about 26% BELOW the EGP.

GRAPH NOTES:

a) Smoothed gold prices (smoothed with two moving averages) are shown in a “gold” color. This is a long-term valuation model, not a trading model.

b) Calculated equilibrium gold prices (EGP) are shown in green.

c) The long-term trend from 1971 – 1981 was up, from 1981 – 2001 the trend was down, and from 2001 to 2012 the trend was up. (Actual gold market high price was August 2011.)

d) Nixon closed the “gold window” in 1971, removed any semblance of gold backing for the dollar, and thereby enabled the creation of significantly more dollars into circulation. The various measures of “money” supply, official national debt, Dow Index, price of gold, many commodities, and most other prices increased exponentially between 1971 and 2013.

FUTURE PRICES FOR GOLD per the EGP Model

Assumptions:

- Macro-economic variables continue to increase and decrease as they have for the past 42 years.

- The U.S. economy continues along its typical path with government expenses growing more rapidly than revenues, as they have for decades. National debt rises inevitably.

- Congress continues its multi-decade habit of borrowing and spending, talking about change, and changing little. The Fed supports the stock and bond markets and continues “liquidity injections” as it deems appropriate to benefit major banks and the financial and political elite.

- Monetary, political, and fiscal policies will NOT be materially different from what they have been during the past 42 years.

- The U.S. will NOT be subjected to global nuclear war, Weimar hyperinflation, or an economic collapse, while we will continue to be subjected to the same Keynesian economic nonsense that has created many of our current “challenges.”

Given the above assumptions, a reasonable projection for the EGP (a “fair” price for gold) in 2017 is $2,400 – $2,900. Remembering that market prices can spike significantly above or crash below the EGP for many months, we are likely to see a spike high above $3,500 in 2016-2018. Extraordinary events such as a global war, dollar melt-down, or an economic crash and the resultant massive increase in QE from global central banks could push gold prices higher and sooner.

My book (“Gold Value and Gold Prices From 1971 – 2021”) describes my gold price projection model in detail, and discusses many other topics such as QE, counter-party risk, gold cycles, price projections from other writers, price bubbles, ratios to the Dow and silver, and when to sell gold. My book is now available at my retail site and at Amazon in paperback and eBook.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.