Turning Japanese

Economics / Deflation Sep 04, 2014 - 07:55 AM GMTBy: Jonathan_Davis

A theme I have written of many times, during the last few years, is how we, in the West, may be #turningjapanese. What this refers to is Japan’s lost TWO decades between 1989 and 2012 when Japan had Deflation and a slow growing or mostly falling economy – in other words a generational Depression. During this period their stock market and their real estate valuations collapsed 80% each.

A theme I have written of many times, during the last few years, is how we, in the West, may be #turningjapanese. What this refers to is Japan’s lost TWO decades between 1989 and 2012 when Japan had Deflation and a slow growing or mostly falling economy – in other words a generational Depression. During this period their stock market and their real estate valuations collapsed 80% each.

In the West we have had practically zero interest rates (Base Rates) for several years now, yet… contrary to consensus economists’ prognostications, not only is inflation not rising but actually we are positively in at least DISinflation (falling inflation) or, in some countries in the EU, in downright DEflation – falling PRICES.

We have long said this may happen and we have long said we are probably nowhere near the end of this particular road.

THIS is the INEVITABLE result of the debt mania we have had for many years. Eventually, there is so much debt that whatever governments and central banks do they CANNOT avoid deflation. Don’t listen to me, it’s what the Finance Minister (think UK Chancellor) Herr Schäuble of Germany said last week German Finance Minister on Bloomberg TV (5m 15s in).

I repeat, we have been saying similar for years.

So the new Bogeyman is Deflation.

Politicians and Central Banks tell us we MUST avoid it at all costs because, after all, look what happened to Japan during its deflationary Depression, they utter.

Except Japan did not have a Depression BECAUSE of Deflation, it was Deflation and Depression which AROSE FROM the fallout of a massive debt bubble which burst in the late 80s.

Also, what did Japan do to come out of Depression? They borrowed more. And more. And more. They are now the most heavily indebted country in the developed world. And, though, they are now moving to INFlation, they remain in Depression. Google Einstein to see his definition of insanity.

And, look at that, whatever mistakes Japan did for now 25 years, the West has been making exactly the same ones since 2009. Solution to the huge Recession in 2008 from the initial bursting of the debt bubble…? Borrow massively more. Again and again and again. It’s called Quantitative Easing.

You Couldn’t Make It Up.

So our economy will go the same way as Japan. That is our prognosis based on the experience of Japan and we are doing as they did.

It seems the ‘smartest’ investors in the World agree with little us – the Bond market is deemed more canny than those in the stock market. And when Bond prices are rising it suggests falling interest rates and falling inflation and slowing or falling economies.

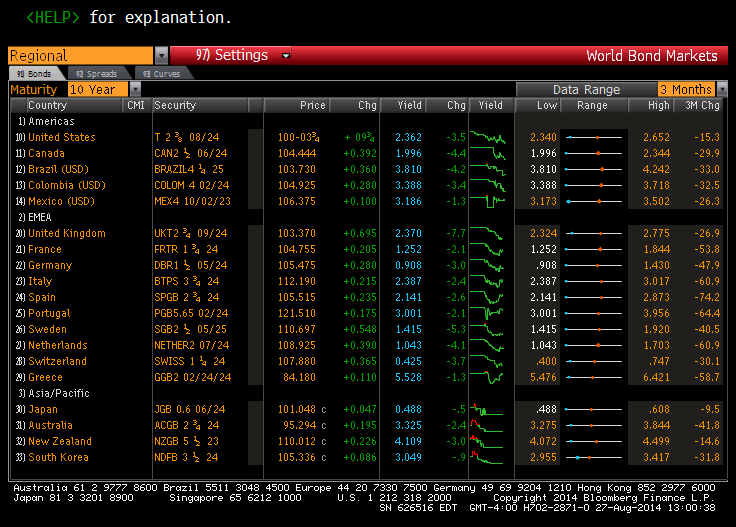

When bond prices rise, their associated yields (or interest rates) fall (do ask if you wish a detailed explanation). The table below, from Wednesday 27 August, shows the real time prices and yields from across the World. The blue dot – to the left of the range – shows where yields are now, compared to the range over the last year.

Almost all of the blue dots ie almost all government bond yields are at year lows.

Don’t listen to me (the bulk don’t!), listen to the likes of The Finance Minister of a little country called Germany AKA The EU’s Sugar Daddy and the MultiHundred TRILLION $ market which is government bonds.

WE ARE IN AT LEAST DISINFLATION AND PROBABLY OUTRIGHT DEFLATION.

As I am often wont to say on Twitter we are #turningjapanese.

NB. There are those who believe that inflation is what Japan desperately needs. Forget reform of the banking system, uncompetitive labour laws, immigration (or lack of it), demographics.

Yes, it’s all about inflation. You Couldn’t Make It Up!

Remember GDP percentages are, normally, gross. Take off the inflation and you’re left with reality.

Nothing in these articles can be taken as financial advice. Neither Jonathan Davis nor Jonathan Davis Wealth Management will be held responsible for action taken or not taken from reading these articles.

We recommend investors seek bespoke advice before acting.

By Jonathan Davis

http://jonathandaviswm.wordpress.com/

25+ year veteran of the world of financial services, the last 10 doing the same thing under his own name. We work with families all over the UK and in Switzerland and, indeed, on 2 other continents. If interested in our Wealth Management work, cast a glance at the firm’s website.

From time to time media folk call me and ask me to rant live or in the press. JD in the media.

I don’t buy hype. I don’t believe it’s the end of the world but I do believe, within a generation, the West will have no welfare state. The maths don’t lie. We’re toast. It’s obvious if you think about it.

© 2014 Copyright Jonathan Davis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.