Gold and Silver Internationalization Are The Antidote To The Keynesian Endgame

Commodities / Gold and Silver 2014 Sep 03, 2014 - 01:36 PM GMTBy: GoldSilverWorlds

When looking at today’s economic situation, it is amazing how the debt situation remains underexposed. It is truly the “elephant in the room”. In this article we will review the most recent economic data and what that data could mean for the coming years.

When looking at today’s economic situation, it is amazing how the debt situation remains underexposed. It is truly the “elephant in the room”. In this article we will review the most recent economic data and what that data could mean for the coming years.

When asked about his view on the economic situation, Claudio Grass, managing director of Global Gold, answered with this quote from German economist Wilhelm Röpke:

“The theories men construct, and the words in which they are framed, often influence their mind more strongly than the facts presented by reality”.

This sentence nicely describes today’s mindset amongst most people in the Western word since we are raised in amounts to a government-controlled educational system! We are not taught to question [authority].The problem is that the actual system we live in focuses only on the effects but never discloses the underlying causes, let alone tries to connect the dots. This research needs to be taken upon by the individual. However, research requires a healthy portion of curiosity and bravery, as well as independence and self-confidence to stand up for one’s own opinion, which will be in contrast to the story we are told by governments and the mainstream media.

Linking this view to today’s economy, it goes without saying that anyone with a basic level of curiosity can find the following data:

- The U.S. currently has total debts outstanding (incl. unfunded liabilites) which are close to 900% of its GDP.

- America hasn’t passed a budget since April of 2009.

- As a country, the U.S. has had a budget deficit in 42 out of the last 47 years.

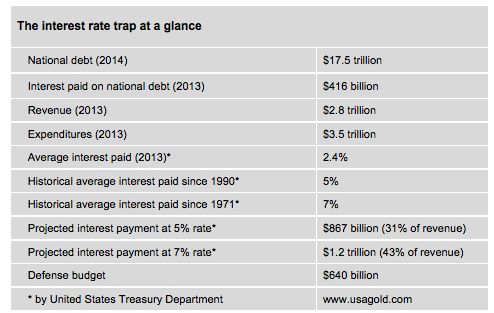

- The U.S. has paid 14.8% of its yearly revenue to servicing its debt (interest payments).

- Suppose interest rates would go back to an historic average of say 5%, then the U.S. would be paying one-third of its revenues only to interest.

- America expects to double its debt within the next 10 years.

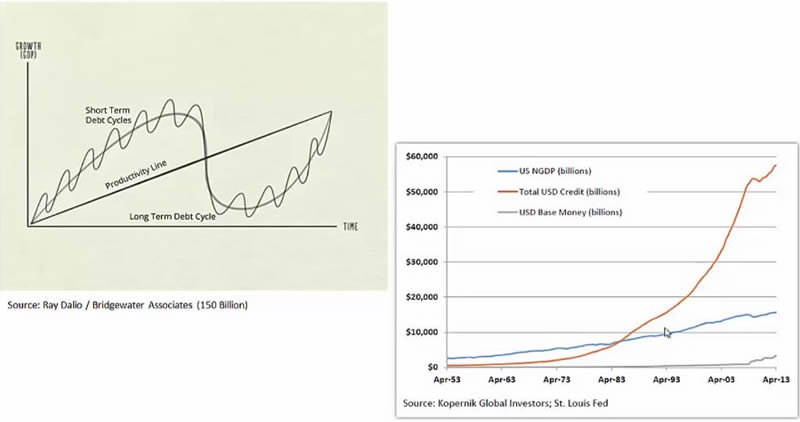

The debt situation has spiraled out of control, according to some market observers. Mr. Grass points out that the debt levels in the financial system, represented as “total US Dollar credit” by the red line in one of the following charts, is clearly decoupled from the real economy. Our current monetary system induces credit, although the marginal effect keeps on decreasing exponentially. Moreover, looking at the following chart on the left-hand side, according to Ray Dalio’s debt model, it appears we are close to the end of a long-term debt cycle. It is likely that we will see deflationary shocks in the (near) future. Most likely, central banks will continue to fight these problems by creating even more debt which probably lead to hyperinflation at a certain point in the future. A deflationary collapse becomes more likely the more the system is centralized.

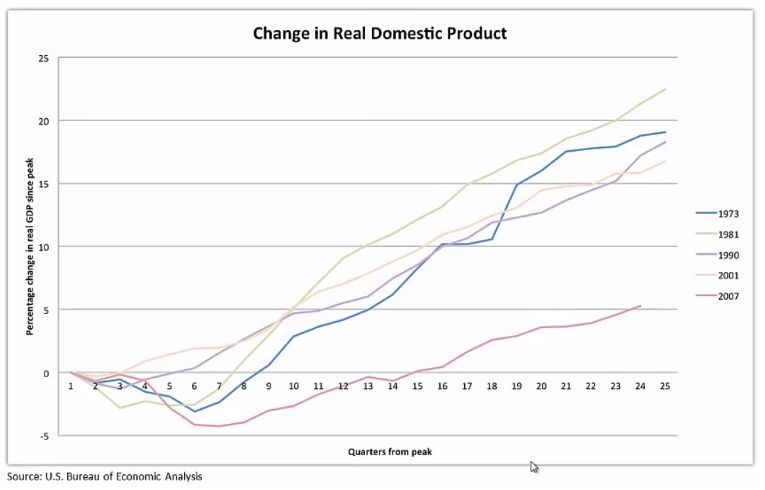

Some would argue that this is not true, as the economies around the world, and in particular the U.S., are reporting good economic data. Nothing could be further from the truth. While it is correct that the reported headline numbers which appear in the media appear to be good, the underlying strength is not there. What’s more important, there is a deeply concerning disconnect between the efforts by governments (creating unprecedented levels of debt) and the pace of the recovery. The next chart makes that point: it shows that the current “recovery” is by far the worst recovery when compared with the previous ones in past decades.

Looking closer into the debt situation in the U.S., gold market expert, Michael Kosares, rightfully notes that the country is ensnared in a trap from which it will be difficult to extricate itself from. “Pundits and market analysts alike might believe that the Fed is going to raise interest rates at some point in the future, but the reality of higher interest rates might bring far worse consequences than can be achieved by simply staying the course. Some small, even token, rate hikes are tolerable, but a return to historical norms could reap consequences in the general economy far beyond the direct effect on the federal government’s fiscal status.”

Mr. Kosares did the following calculations, which do not require additional explanations, nor any comments.

Another way to look at the debt situation is to consider the so-called “sustainability gap.“ It takes the implicit debt into account, on top of the already reported explicit government debt. According to Ronald Stoeferle, publisher of the annual In Gold We Trust report, the implicit debt is the “difference between all the future services and entitlements, which according to currently applicable law must still be paid to all generations living today, as well as future generations”. In other words, the sustainability gap shows how big a reserve is needed in order to continue to finance today’s level of services in the future. These hidden debts consist mainly of those services that the government owes to its citizens and the working population in the form of retirement payments, care services or health insurance.

The following chart, courtesy of Incrementum Liechtenstein, shows the sustainability ranking of the most important European nations. Two things are especially conspicuous: since implicit debt is significantly higher than explicit debt, the traditional, past-oriented debt perspective paints a far too optimistic picture. Due to demographic trends, expenditure on health, retirement and care is going to markedly increase in practically all industrialized nations. In addition, the number of people of working age, who bear the bulk of social security contributions and the tax burden, is concurrently falling. A further increase in government debt is thus impossible in practice without a massive consolidation effort.

This should be very disturbing to anyone using common sense, but not to those using outdated theoretical economic models (like the ones used in the central banking meeting rooms). Mr. Grass points out that, based on history, “we know that when governments run out of money, people’s sovereign rights to wealth and independence get increasingly trampled”. What the world has experienced in the last 100 years is an ongoing centralization, especially in terms of credit – the so-called monetary system – and political power in the hands of a few. This is only financeable if existing wealth is redistributed from the bottom to the top, through inflation and taxation. Since 2007, the average U.S. family’s wealth plunged 40%. Back in 1913, the average government quota was less than 10%. Today, depending on the country, government quotas are between 50-70%. The trend is very clear!

This risk is very obvious in the U.S. As evidenced by the following table, a political powershift has been going on during the past decade. The US has lost more than 30% of world GDP over the last 10 years; the same applies to Japan and, to a slightly lesser degree, the UK.

The importance of diversification and risk mitigation of one’s wealth…with Switzerland still in the front seat

Based on the trend discussed above, it is mandatory to mitigate risk by diversifying assets out of countries with unproportionally high debt figures. According to Frank Suess, CEO and Chairman of BFI Capital Group, international wealth management offers the counter-balanced protection needed for the worsening debt situation. BFI Capital Group is based in Switzerland and is operating under Swiss law, so Mr. Suess has his finger on the pulse of international investing and the status of Switzerland as a financial center.

In the following paragraphs, Mr. Suess elaborates on Switzerland’s continued role as a financial center and the benefits, and opportunities, that still remain for investors. One might perceive that with the loss of banking secrecy, Switzerland’s financial services and banking industries might be hit with a considerable capital outflow resulting in the demolition of the Swiss financial center. However, as you’ll see, the story is actually quite the contrary.

Switzerland continues to be the world’s leader in cross-border wealth management and private banking

For many years, Switzerland held the largest global market share in the realm of cross-border wealth management and private banking. In 2012, 26% of the total market was captured by Swiss financial institutions. As depicted in the following chart, no other country even comes close. In aggregate, Singapore and Hong Kong only hold a second ranking with half of the market share of Switzerland.

The question is whether this is merely a legacy of former more glorious days when you consider the recent years since the UBS crisis and since America’s Department of Justice has locked Switzerland in to its crosshairs.

Of particular interestis the volume of assets held within accounts of Swiss banks. It is probably the most reliable and relevant indicator of what smart money is doing. You may be surprised to know that it has seen substantial growth over the past three years.

From 2011 to 2013, total securities held within Swiss banks have grown from CHF 4.113 trillion to CHF 5.097 trillion, an increase of 24%. The value of securities held for foreign clients have grown even more, from CHF 2.162 trillion to CHF 2.768 trillion, an impressive 28%.

This growth, by the way, is not substantiated by investment performance. Overall, the investment performance of client portfolios during the past three years has been shifted down to a lower gear, or has remained stable at best.

One can firmly conclude that the assets on deposit and under management with Swiss banks continues to grow. In fact, after a few years of stagnation and retreat prior to 2009, the growth has picked up again over the past few years. So, despite all the bad news, despite all of the Swiss-bashing and the spectacular, albeit largely irrelevant, hunt for “tax evaders”, international investors continue to seek the safety and solidity of Switzerland’s banking center.

You will undoubtedly have noted that the largest growth by far has taken place in the institutional investors sector. From 2011 to 2012, that market sector has grown from CHF 1.512 trillion to 2.107 trillion, a whopping 39%! Institutional investors – funds, trusts, asset managers, pensions, etc. – are depositing their assets in Switzerland, and they are doing it in big numbers.

Meanwhile, private investors indeed may have successfully been “scared away” from Switzerland. The numbers there show a stagnating picture. From 2011 to 2013, the value of securities held in Swiss banks for private investors grew by less than 3%. And, from 2012 to 2013 there was no growth at all. It is quite safe to assume that the same can be expected from the coming year.

And finally, we should also never forget why Switzerland, a small country with a small domestic market and no natural goods, became a safe haven in the first place. This phenomenon’s foundation came in the base concept of trading property rights and self-determination with as little interference from the government as possible. Switzerland, in its long history, grew up with the understanding that the national states were not the ultimate gods in which the people had to serve or even sacrifice their lives. The basis for such a concept has been, and still remains, mutual respect, deep belief in private property rights based on self-responsibility, hard work, and to respect and comply with the adherence of mutually agreed contracts. The Swiss confederation is the last remaining direct democracy based on the principles of decentralization. These values have been instilled over Switzerland’s 700 year history and remain part of our cultural DNA today. And it is these same values that have us at BFI and Global Gold convinced why will continue to see Switzerland as a leader in offering the best protection for private wealth.

So, while Switzerland certainly faces a number of challenges and risks ahead, it is not at all on the road to demise. Very much on the contrary, the Swiss economy is doing amazingly well in the midst of economic uncertainty. And, its financial sector continues to grow thanks to the fundamental strength of the Swiss system – its direct democracy, its independence and neutrality, its decentralized confederate structure, fiscal control, and tax competition.

Where does that leave the investor? Why should investors move their assets out of their home country and still consider Switzerland…or other solid offshore jurisdictions for that matter?

Contrary to popular opinion, it’s not about saving taxes, although proper planning can certainly entail tax efficiencies. And let’s face it, the days of keeping your affairs private from your government are numbered, certainly for Americans. The FATCA regime is making sure of that. And, other nations are following suit quickly. The UK has adopted rules to copy the US lead and has already signed a first FATCA-like agreement with Isle of Man.

There are a number of reasons why wealthy families should consider diversifying their wealth jurisdictionally, amongst them litigation risk, political risk, investment risk and institutional risk. Properly structured, your wealth is afforded a higher degree of protection offshore, and Switzerland can still serve that role.

Litigation risk, particularly in America, is unfortunately an old and all-too-well-known story. America is clearly known as being a litigious society. From a European perspective, the legal system and crazy lawsuits common in America appear unreasonable. Yet they are a fact of life and real risk for wealthy Americans. Since U.S. courts don’t have jurisdiction overseas, offshore planning keeps you away from the US court system and the caprices of those courts.

A growing number of clients are worried about the financial system, about confiscation, capital controls – the whole enchilada. They’re concerned about where the US government and the US society as a whole are headed. There are considerable socialistic tendencies. Redistribution of wealth and financial repression in all its hidden and overt forms are on the minds of a growing constituency of wealthy Americans

Yet some might scoff at these concerns. America is one of the safest countries and nowhere will you find more freedom than here. I guess that could really turn into a philosophical discussion.

“What if?” is the question to ask. Even if you’re utterly optimistic in regard to US fiscal matters, its tax regime, economic health, etc., what happens if you are wrong? What is the downside of putting part of your wealth in a sheltered structure offshore? I know from experience: there is none. As long as your follow the rules and file your forms properly, there are really only upsides.

In meeting with a group of very wealthy Californians earlier this year, I found that none of them had ever invested offshore. In fact, there was a certain level of anxiety regarding the idea of sending money abroad, out of their network of trusted bankers and managers. Yet, they also recognized the need to manage risk and not keep “all of the eggs in one basket”. We’ve all heard of “too big too fail”and recent history has sure taught us a good lesson about institutional diversification.

Last but not least, investment diversification is also more critical than ever before. I think many would agree that investing in the US stock market – at least going into the markets today – is an idea riddled with bullet holes. Many have done well. But again, “what if?”. Spreading investment risk will help ensure that when the markets take that inevitable tumble, you’ll still have other areas to fall back on. If you think of your wealth like being on a see-saw, wouldn’t it be nice to have the plan in place to counter-balance the other side if it should suddenly move lower?

Getting your hands on the Antidote to the Keynesian Endgame

Mr. Suess hit it on the head: internationalizing your assets is imperative to protecting your wealth… on numerous levels. While it might be easy to say, the other side of the coin has many wondering if it is even possible to do, particularly for American investors. The good news is that it is still possible and BFI has made international wealth diversification and wealth preservation for their clients an integral part of their over 20+ year history. BFI serves as a one-stop shop for your offshore investment needs, all while still keeping in mind the rules of their client’s jurisdictions.

And yes, even still for Americans. In fact all of the subjects covered in this article will be discussed in great detail at the upcoming BFI Inner Circle Wealth Forum taking place at the JW Marriott resort in Summerlin-Las Vegas on September 29th and 30th.

Frank Suess will be there along with a small team from BFI’s asset management and client relationship teams. Claudio Grass will also be part of a strong panel that will cover the in’s and out’s of offshore investing for US citizens.

For a keynote address, the Forum will be honored to have Jeff Deist, president of the Ludwig von Mises Institute joining in.

For more information on the Wealth Forum, visit www.bfiwealth.com, or click here on the BFI Inner Circle Wealth Forum.

While we can’t predict the future, we sure can prepare ourselves for it. Take your first steps by joining BFI and Global Gold at the BFI Inner Circle Wealth Forum.

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.