U.S. Inflation Pressures in Core Food Components

Commodities / Inflation Sep 02, 2014 - 12:54 PM GMTBy: EconMatters

Inflation Isn`t Moderating, It is Consolidating before the Next Leg Up

Inflation Isn`t Moderating, It is Consolidating before the Next Leg Up

Inflation numbers of late have been helped by the drop in fuel costs, the agricultural grains have been brought down in the futures market by the overplanting of corn, but eating out for the weekend where shrimp, steak, other seafood and vegetables are consumed at dinner brings home the idea that restaurant costs are only going up on the whole, and expect menu prices to continue to be raised at your favorite restaurant.

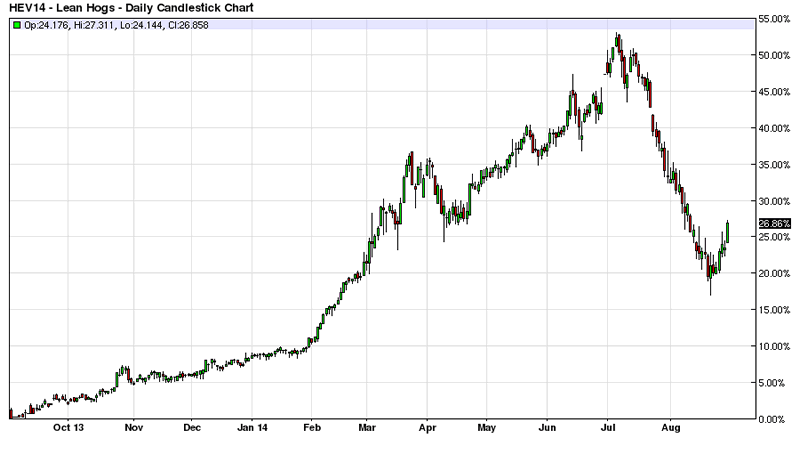

Lean Hogs

Lean hogs are up 26% year over year even after a sizable pullback in the futures market, the pork industry really got hit by a killer pig virus, but the trend in other meats for the year indicates that costs for this segment are broader based than just the disease specific issues.

Read More >>>Mixed Emotions for the Gold Market

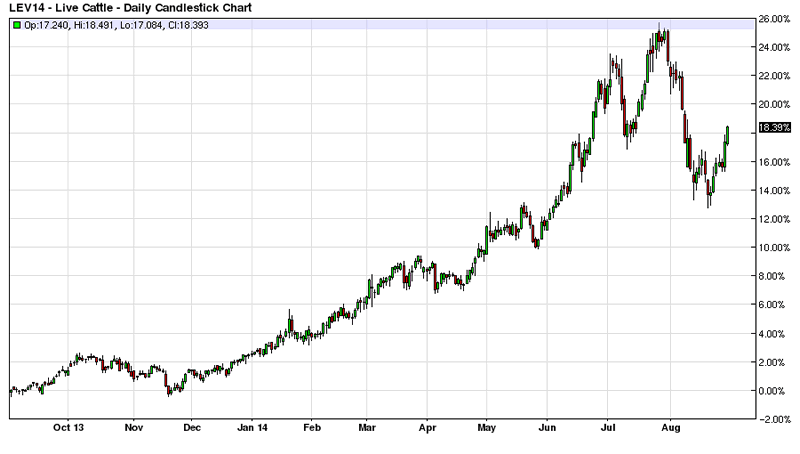

Cattle Herds

For example, Live Cattle futures are up 18% year over year due to a multi-decade low in cattle herds, it seems it is much harder, and the margins are much lower raising livestock compared with planting corn for farmers which makes sense when you factor in all the underlying costs from veterinary bills, feed and electricity, to transportation and regulatory related costs.

Read More >> Inflation Watch: $245,000 to Raise a Child in United States

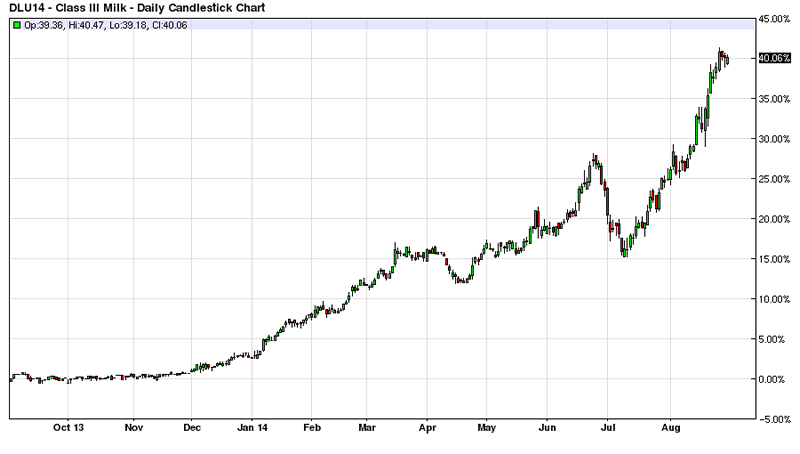

Milk Prices

The Dairy Industry hasn`t escaped the inflation pressures with a strong global demand for dairy and protein, producing cows are a robust asset these days. Milk prices have also been hurt by the drought for farmers on the West Coast to stronger demand for Greek Yogurt for alternative protein sources we see Class III Milk futures up a robust 40% year over year with no immediate pullback on the charts.

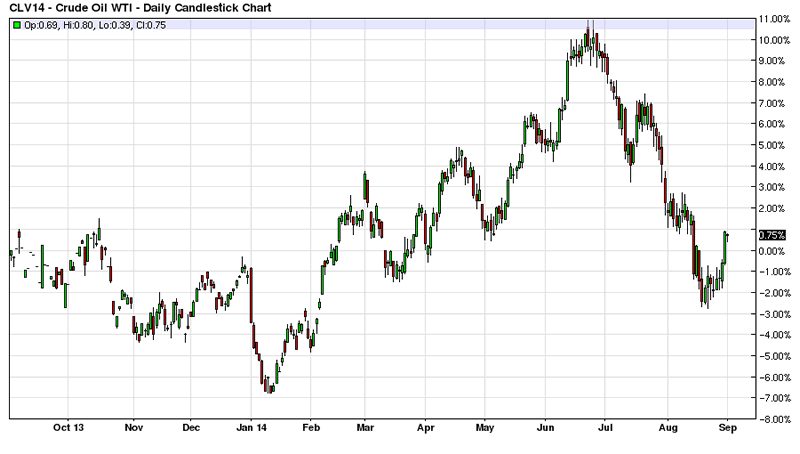

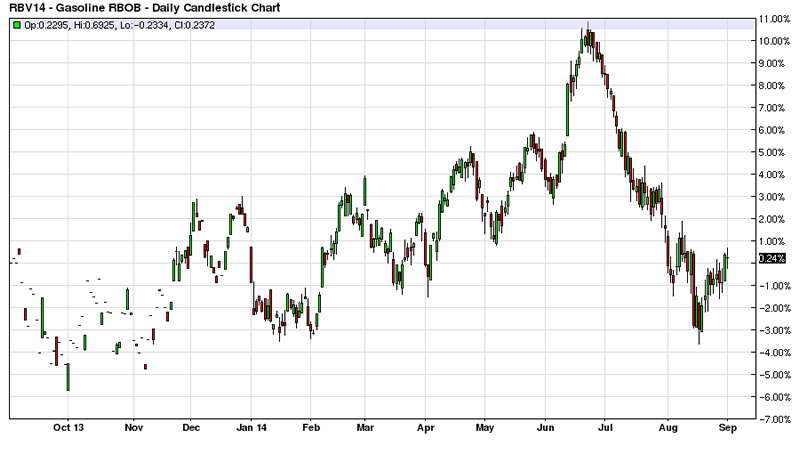

Oil & Fuel Prices

Oil and fuel prices have dropped but the costs associated with getting it out of the ground are still inflationary from the equipment costs to skilled labor and regulatory related costs so it will be interesting to see how the price of oil shakes out many crosscurrents from stronger demand on an improving economy, geo-political concerns, robust production output domestically, higher fuel efficiency in developed countries, more cars on the road in china, and global pollution and infrastructure constraints with a price that basically has moved between $80 and $120 for WTI/Brent since the financial crisis.

Read More >>> The Inflation Era Has Arrived!

Normal Trading Range

It is too early to read anything regarding the recent pullback in prices because as just some of the shorts covering caused a $4 a barrel spike in prices off the recent bottom, and the oil market goes on runs both up and down in price that can be anywhere from $10 to $30 and can happen in and out of season although they usually center around seasonal demand as a rule of thumb.

The Bull & Bear Case for Oil Prices

I can make a case for the last 6 years being the pullback in oil prices, i.e., no real price breakouts. And similarly I can make an entire other case that oil will pull back even further on production increases globally, higher efficiency standards globally, alternative fuel technologies, and changing driving behaviors.

Oil Supply Chain Inflation Alive & Well

But the costs associated with the industry should continue to rise from an inflation standpoint because component parts, equipment, labor, medical, regulatory, transportation logistics and other costs in general are rising at a steady clip for the last 5 years, and look to continue rising going forward for the next five years.

Wages Will Never Keep Up With Inflation on the Average

For some places in the economy inflation is red hot smack in the face of the consumer, in other places it slowly creeps up on the consumer without them realizing, but regardless of what the official inflation reports that the Fed follows indicates, real inflation pressures in the economy continue to rise every year, and a good steak is going to cost consumers a higher hourly wage rate.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.