Palladium Price Breaks Multi-Year High Over $900

Commodities / Palladium Sep 01, 2014 - 04:33 PM GMTBy: GoldCore

The palladium price made a new 13 year high today and reached $909/oz, its highest since February 2001. Markets fear that the global supply of palladium could be impacted by the threat of further sanctions against Russia.

The palladium price made a new 13 year high today and reached $909/oz, its highest since February 2001. Markets fear that the global supply of palladium could be impacted by the threat of further sanctions against Russia.

Palladium in U.S. Dollars - 20 Years (Thomson Reuters)

The Russian mining industry has not been the target of sanctions so far, but with the oil sector already affected and the gas sector possibly the target of upcoming sanctions by the EU, markets remain fearful.

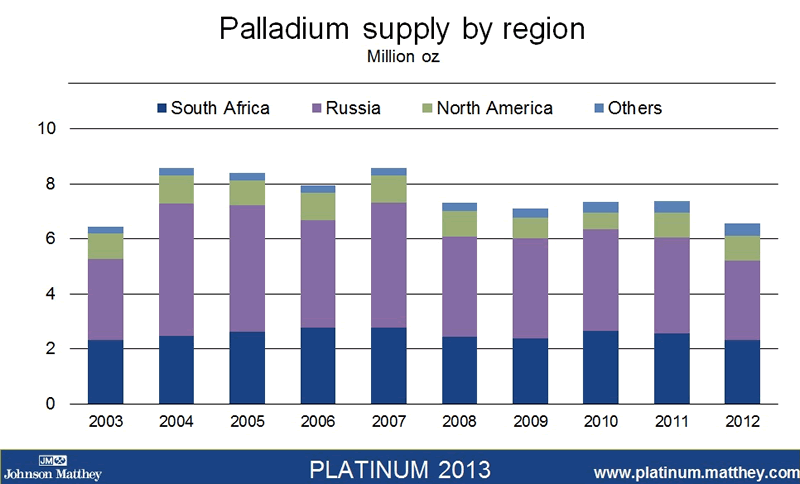

Russia is the world’s largest palladium producer accounting for over 40% of global production. This is mainly through Norilsk Nickel, the world’s largest mining company which mines nickel, copper and palladium in the area of Norilsk in Siberia, the world’s most northerly city. Palladium is mined as a by-product of nickel and copper mining.

The majority of palladium produced is used in automobile catalytic converters and demand has been buoyant recently due to higher sales in the auto industry. Recent miner strikes in South Africa have also disrupted supply for the big South African palladium producers, Amplats, Impala and Lonmin.

Investment demand for palladium has also been strong recently and as acted as a competing demand to industrial users.

EU Draws Up Further Sanctions Against Russia

Diplomatic fallout from the conflict in Ukraine continues to intensify. Amid claims and counter-claims by the Russian and Ukrainian sides concerning the fighting and incursions in Eastern Ukraine, the war of words has stepped up.

Russian President Vladimir Putin was quoted as saying last Friday that "I want to remind you that Russia is one of the most powerful nuclear nations. This is a reality, not just words." While visiting EU leaders in Brussels at the weekend, Ukrainian President Petro Poroshenko said “we are very close to the point of no return, which is full scale war.”

As fighting continues, European Union leaders met in Brussels yesterday and recommended that the European Commission draw up further economic sanctions against Russia that would be imposed unless Russia demonstrates a de-escalation of its involvement in the conflict in Eastern Ukraine.

The recommended proposal includes “a provision on the basis of which every person and institution dealing with the separatist groups in the Donbass will be listed.” Donbass is the region in eastern Ukraine that encompasses the Donetsk and Luhansk areas that are currently the scene of the heaviest fighting in the conflict.

Up until now, the EU’s sanctions against Russia have targeted specific individuals, and a number of companies in strategic industries such as the Russian financial sector and high tech oil sector equipment sector.

The next set of potential sanctions is believed to still focus on the energy and finance industries, but would extend to sectors such as Russia’s gas sector, and step up the financial sanctions.

In the financial area, there appear to be plans by the EU to continue to limit access for Russian companies to the western financial markets. Further financial sanctions have also been discussed such as attempting to limit Russian access to sovereign bond markets and access to syndicated lending deals but, for now, these broader financial sanctions appear to be in reserve.

Russia has already imposed a ban on EU food imports and the EU is still fearful of retaliatory economic sanctions from Russia, which could extend to the EU aerospace, shipbuilding and car manufacturing sectors. This could ignite a harmful trade war which is why some EU member states are hesitant on sanctions at this time.

Last week, the UK was said to be proposing that Russia be blocked from the international SWIFT bank transfer network. If this occurred it would essentially shut Russian banks and other companies out of the international banking network. SWIFT is a Brussels based organisation and so it is obliged to follow any sanctions that are imposed by the European Commission.

However, the very fact that a proposal even exists to shut out Russia from the SWIFT network shows that the Ukrainian crisis is now taking on a more ominous tone, and that geopolitical risk is set to rise from here unless diplomatic intervention can somehow retrieve the situation.

With a heightened terror threat level being imposed in the UK, a potential ratcheting up of sanctions on Russia, and the threat of a larger trade and currency war on the horizon, September should be an interesting month for the precious metals markets.

by Ronan Manly, GoldCore Consultant. Editor Mark O’Byrne of GoldCore

Sources available on request - info@goldcore.com

MARKET UPDATE

Today’s AM fix was USD 1,287.25, EUR 979.34 and GBP 774.47 per ounce.

Friday’s AM fix was USD 1,285.75, EUR 975.83 and GBP 774.55 per ounce.

Gold fell $2.00 or 0.16% to $1,287.30 and silver slipped $0.05 or 0.26% to $19.48 per ounce Friday. For the week, gold was up 0.54% while silver remained unchanged.

Today, the U.S. markets are observing a national holiday for Labor Day.

Platinum is trading at $1,424, unchanged from Friday. Palladium is again up strongly at multi-year highs at $909, up 1.5% from Friday’s $895.

With the Labor Day holiday today in the US, markets are expected to be quieter than usual, but given that it’s now September, the remainder of the week is set to see higher volumes and more market activity as traders return and refocus following what is traditionally considered the holiday month of August.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.