Gold Bullish Central Banks Should Give Money Directly To The People - Helicopter Janet?

Commodities / Gold and Silver 2014 Aug 29, 2014 - 03:03 PM GMTBy: GoldCore

Last week, a very radical proposal appeared in the pages of the influential ‘Foreign Affairs’ magazine, the publication arm of the equally influential Council on Foreign Relations (CFR) think-tank based in New York.

Last week, a very radical proposal appeared in the pages of the influential ‘Foreign Affairs’ magazine, the publication arm of the equally influential Council on Foreign Relations (CFR) think-tank based in New York.

An article “Print Less but Transfer More - Why Central Banks Should Give Money Directly to the People”, that has been picked up widely in the media argues that given that monetary stimulus measures such as quantitative easing and near zero central bank interest rates have failed to boost economic growth, a new radical monetary approach is needed. That approach is to print currency and give the cash directly to consumers and households as required so as to remedy insufficient consumer spending and in order to prevent recessions.

The article is authored by Mark Blyth and Eric Lonergan. Blyth, originally from Scotland, is an economist at Brown University in Rhode Island. Lonergan, originally from Ireland, is a fund manager of global macro strategies at M&G Investments in London.

The article is authored by Mark Blyth and Eric Lonergan. Blyth, originally from Scotland, is an economist at Brown University in Rhode Island. Lonergan, originally from Ireland, is a fund manager of global macro strategies at M&G Investments in London.

Although ‘Foreign Affairs’ publishes various sides of important debates, policy articles in ‘Foreign Affairs’ have tended to influence US economic and political policy over the years, so the ‘cash transfer proposal’ is worth watching.

Hoped For Benefits Of "Free Cash"

Blyth and Lonergan argue that the slow economic growth and low inflation rates being currently witnessed in Western developed economies call for more extreme government and policy maker approaches so as to get people spending again, thereby stimulating economic growth and encouraging inflation.

To them, deflation is a key threat that the unconventional low interest rates and quantitative easing has not managed to tackle. Therefore in their eyes this needs to be countered by directly making consumers spend more by actually handing over cash to them.

Blyth and Lonergan draw on Ben Bernanke and Milton Friedman to support their cash transfer argument and openly say that it is now “well past time” for policy makers in the US and also in other developed countries to try the helicopter cash drop approach.

Helicopter Mark?

In 1998, after Japan suffered a lost decade of growth, Ben Bernanke, a then university economist at Princeton, advocated that Japan provide direct cash transfers to consumers in order to encourage them to spend more. Previously, Milton Friedman had viewed direct money transfers as analogous to dropping cash from helicopters. This would go on to create the famous expression of Helicopter Ben (Bernanke) dropping cash from a helicopter.

In 1998, after Japan suffered a lost decade of growth, Ben Bernanke, a then university economist at Princeton, advocated that Japan provide direct cash transfers to consumers in order to encourage them to spend more. Previously, Milton Friedman had viewed direct money transfers as analogous to dropping cash from helicopters. This would go on to create the famous expression of Helicopter Ben (Bernanke) dropping cash from a helicopter.

Blyth and Lonergan advocate direct cash transfers either to all households equally, or possibly just to the lowest 80% of households. They say that lower income households would use this cash in a variety of ways, either to repay consumer debt, or to spend and consume, or to save. If a certain cash sum, say $1000, was not seen to be effective, households could, in their view, be given more, for example $3000 or $4000.

Blyth and Lonergan say that it’s hard to measure the direct impact on consumer spending of instruments such as lower interest rates, but that the impact of direct cash transfers are more measurable.

In their view, inflation won’t be an issue since central banks can continue inflation targeting.

Real Risks Of “Free Cash” However, in our view, there are a number of flaws with this proposal. Direct cash transfers have a danger of putting consumers further into debt. If a cash transfer is not effective, and an even bigger transfer is then handed out by governments, this will create the danger of consumer dependency on the cash transfer mechanism.

Helicopter Mario?

The argument that the level of inflation created by cash transfers can be controlled is untested. Since this direct cash transfer approach has never been used, it is in uncharted territory and could lead to unanticipated inflation. How the measurement of direct cash transfers is more accurate than the measurement of the effect of low interest rates and quantitative easing is unclear.

The argument that the level of inflation created by cash transfers can be controlled is untested. Since this direct cash transfer approach has never been used, it is in uncharted territory and could lead to unanticipated inflation. How the measurement of direct cash transfers is more accurate than the measurement of the effect of low interest rates and quantitative easing is unclear.

With economies already facing record money supply growth from expanded central bank balance sheets, new cash transfers flowing into the global economy could lead to an out of control velocity of money and possible hyperinflation. How would this extra liquidity ever be drained from the system again?

This new cash transfer money would also be printed out of thin air, thus diluting the existing money supply and eroding its purchasing power. Since all fiat currency is merely debt anyway, the creation of new money to finance the direct cash transfers would add to the existing debt burden of already struggling nation states.

GoldCore Conclusion

In many austerity hit countries, there are is an increasing tax burden with very high income taxes, sales taxes and many stealth taxes.

Does it make sense for central banks to be printing money that will in many cases be used to pay taxes, stealth taxes or even pay down credit card, loan and even mortgage debt?

This measure will likely further worsen the debt to GDP ratios in many already indebted industrial nations. With interest rates set to rise in the coming months and years, giving free money to consumers may bankrupt already vulnerable states.

Would it not be more prudent to have debt write offs and debt forgiveness at sovereign level so that countries can lower the tax burden on suffering citizens? Rather than compounding the problem by increasing sovereign debt levels through giving out "free" cash to indebted consumers?

There is a real risk that this could end up being another ‘soft bail-out’ for banks as much of the cash would probably end up being used to pay down the huge debts incurred in recent years and would come full circle to banks in the form of debt repayments and governments in the form of taxes.

The real solution to the global debt crisis is not more debt in the form of “free currency” and increasing sovereign debt. The real solution remains to implement significant debt forgiveness for consumers and debt restructuring for institutions, banks and nations in a modern debt jubilee.

Were such an extreme scenario to be implemented and a further and deliberate debasement of currency, there is a real risk of significant inflation and stagflation. Even hyperinflation in a worst case scenario. Alan Greenspan’s warning of “fiat money in extremis” becomes more real by the day. This underlines the vital importance of having an allocation to gold in a diversified portfolio.

Gold will maintain its purchasing power in the coming years, as it has always done throughout history.

by Ronan Manly, GoldCore Consultant. Editor Mark O’Byrne of GoldCore

MARKET UPDATE Today’s AM fix was USD 1,285.75, EUR 975.83 and GBP 774.55 per ounce. Yesterday’s AM fix was USD 1,288.00, EUR 975.54 and GBP 776.28 per ounce.

Gold rose $7.30 or 0.6% to $1,289.30 per ounce and silver rose $0.09 or 0.4% to $19.53 per ounce yesterday. Overnight, gold in Singapore was flat and stayed near the $1,290/oz level prior to ticking lower in London.

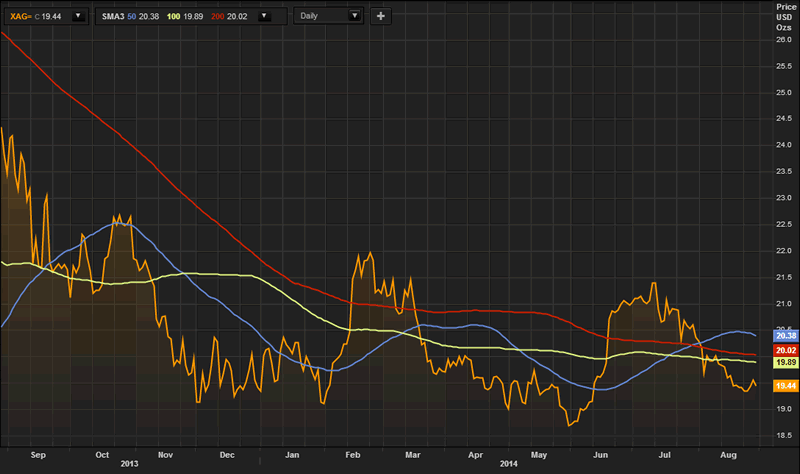

Silver in U.S. Dollars - 2 Years (Thomson Reuters)

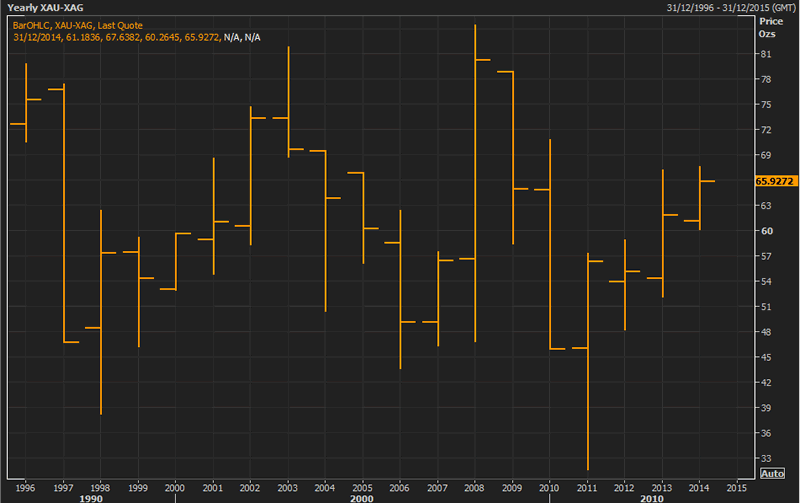

Silver for immediate delivery advanced 0.2 percent to $19.5525 an ounce. Silver looks set to end six weeks of losses. The gold/silver ratio is at 65.9 ( 1285.00/19.50 ) and near a one year high showing silver remains very good value versus gold. We expect the gold silver ratio to test the 30 level again in the coming years (see chart below).

Gold Silver Ratio - Annually 1995 to 2014 (Thomson Reuters)

Spot platinum was at $1,425.18 an ounce from $1,424.50, heading for the first back-to-back monthly drop since June 2013. Palladium was little changed at $896.90 an ounce and is set for a seventh month of gains as supply and demand impacts the market. Palladium remains near record 13 year nominal highs.

Gold has risen 0.3% this week and a fourth day of advances would be the longest rally since June. If gold closes above $1,282/oz today it will be a higher monthly close for August which will be positive as we had into gold's seasonal sweet spot and gold’s strongest month September.

Gold has bounced from a two-month low of $1,273.14 on August 21 due to the renewed geopolitical tension as the U.S. condemned what they said were incursions by Russia into Ukrainian territory.Gold remains on course to end two weeks of losses, as escalating tension between NATO and Russia and other geopolitical risks lead to safe haven demand.

Gold in U.S. Dollars - 1 Year (Thomson Reuters)

The United States openly accused Russia yesterday of sending combat forces into Ukraine and threatened to tighten economic sanctions, but Washington stopped short of calling Moscow's intensified support for separatist forces an invasion. Militants fighting the Syrian army have detained 43 U.N. peacekeepers in the Israeli occupied Golan Heights and trapped another 81 in the region, and the world body is working to secure their release, the United Nations said overnight

A truce between Israel and Gaza’s militant Hamas rulers was maintained for a third day yesterday, while President Barack Obama signaled there are no immediate plans to conduct airstrikes against Islamic State havens inside Syria and a strategy for confronting the group outside Iraq hasn’t been set.

Gold's small gains amid unrest in the Middle East and Ukraine have surprised many analysts.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.