A History of Unlimited Money: Learn From It or Repeat Its Mistakes

Currencies / Fiat Currency Aug 29, 2014 - 10:37 AM GMTBy: Doug_Wakefield

Thursday, August 28, 2014. Is there anything special about this day? For some it may be an anniversary, marriage or work. For others it may be a birthday. However, chances are it is just another day of the week, following the same routine as last week for hundreds of millions of lives that depend on an economic and financial system they hope will stay predictable.

Thursday, August 28, 2014. Is there anything special about this day? For some it may be an anniversary, marriage or work. For others it may be a birthday. However, chances are it is just another day of the week, following the same routine as last week for hundreds of millions of lives that depend on an economic and financial system they hope will stay predictable.

For Americans today, the answer that has been presented to us repeatedly for years, and sadly seems to have been accepted as necessary to restore our capitalist system, is that the Federal Reserve will merely print up trillions more in debt in order to bring things back to "normal". History is replete with lessons for the Federal Reserve, Keynesian economists, and millions desperate to believe that maybe this time, with trillions more in debt, the temporary riches of the financial markets will become permanent and predictable. Frankly, the only thing predictable about this story is that history keeps repeating itself, and we do not show any desire to learn from our past.

In order that we are all clear that history is a great resource to avoid mistakes we continue to ignore today, we will start with two events in the 1700s that demonstrate why the "Icarus can print money to reach the stability sun" theory has already failed miserably. Remember, these stories are centuries old.

John Law and the Mississippi Scheme

John Law and the Mississippi Scheme are well documented for anyone interested in the history of finance. For that reason, I will focus only on a few points in this short synopsis. I encourage you to think about how this story relates to the world we have lived through merely since the start of the 21st century.

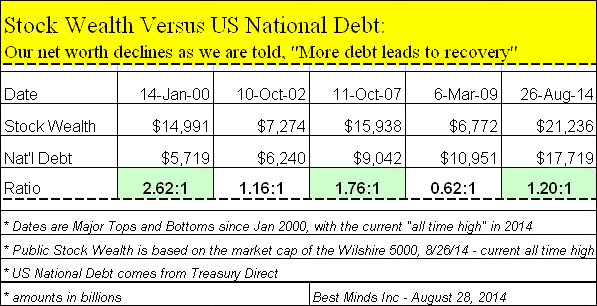

For years the investment mantra "Don't bet against the Fed", has been viewed as the elixir to almost unlimited riches for investors and money managers. And yet, twice in the last 15 years we have lived through the two most destructive deflationary periods in asset values in the history of finance. Even now, we have seen in the last 2 years the major central banks welcome ever-poorer quality collateral to back loans to speculators, (1) all in an ongoing effort to continue inflating global financial bubbles to even greater extremes in price and behavior.

None of us today can conceive of a world where currencies were backed by gold. And yet, the practical benefit of this was seen about a century before the Mississippi Scheme entered the history books.

In 1609, the Dutch set up the first central bank in the world, the Amsterdam Wisselbank. The bank kept bankers and investors separate, which proved crucial in 1637 when the Dutch Tulip Bulb mania collapsed. The bank paid no interest on deposits, and made no loans. It practiced 100 percent reserve banking, and notes were issued only against gold holdings. (2) Since the financial sector was separated from the banking and government areas, the damage from the wild speculation on tulip bulb prices impacted individual investors and the financial sector, but preserved the banking and government sector for the nation. In other words, there was no need for the citizens of Holland to be informed of an urgent need for a bailout of their banks or speculators. Oh that's right, we call ourselves "investors" today.

In 1694, the same year that the Bank of England was formed, a man named John Law fatally wounded a man in a duel, was convicted and sentenced to death, and fled to Europe to spend the next 20 years as a professional gambler. Sounds like an excellent person to have as the lead advisor to the King of France, don't you think? (3)

Law's ideas went into practice, when he responded to a public plea from Philip II for an astute financier who could save France from bankruptcy. It wasn't long before Law's ideas were put into practice in 1716, when the Banque Generale was founded. Philip II's uncle, the Duc d'Orleans, had been placed in charge of the royal finances, and the Duc declared that all taxes must henceforth be paid with notes issued by Law's bank. This was the first time in modern history that a government sanctioned paper money. (4) (5)

Unlike today's holders of paper currencies, Law declared that his notes were redeemable at site for the full amount in coins. This idea became the prototype of the gold standard used by the British, French, and the majority of European currencies through the 19th century.

The final phase of Law's plan, in theory, involved the backing of his paper money by land. Instead, Law convinced Philip II to back a trading company with monopoly trading rights over the Mississippi River and France's claims to land in Louisiana. Shares of the new company were offered to the public. His monopoly allowed him to also mint royal coins for 9 years as well as act as the royal tax collector.

As time went on, the people started using the newfound money, and as it changed hands, trading and commerce flourished. As the scheme continued to work, the Duc renamed the bank, the Banque Royale, and by 1719, it had issued 1,000 million new banknotes, increasing the money supply 16 times the previous amount. (6) Hmm, rapidly increasing the money supply to make people feel richer? Now where have I heard that before?

As you read this quote from Charles MacKay's well known work, Extraordinary Popular Delusions & the Madness of Crowds, remember that this book was first published in 1841:

"The public enthusiasm, which had been so long rising, could not resist a vision so splendid. At least three hundred thousand applications were made for the fifty thousands new shares, and Law's house in the Rue de Quincampoix was beset from morning to night by the eager applicants...Dukes, marquise, counts with their duchesses, marchionesses, and countesses, waited in the streets for hours every day before Mr. Law's door to know the result....they took apartments in the adjoining houses, that they might be continually near the temple whence the new Plutus was diffusing wealth."(7)

The "apartments" "near the temple" have been replaced by one's speed of light computers next to the exchanges, which work off a strategy of starting and ending each day owning nothing, meanwhile leaving today's counts and countesses still believing they live in a financial world lead by long term investors. Only when the busts phase sets in with earnest, will they begin to wake up to learn that 2% of the 20,000 or so trading firms that made up 73% of all U.S. equity trading volume have left them holding the bag. (8) (9)

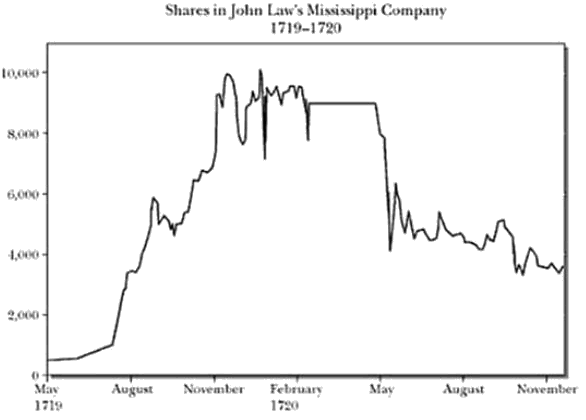

But let's return to the 1700s. By the fall of 1719, the shares in the Mississippi Company were growing in value like a gambler on a roll. The people of France were enjoying a life of luxury very different from where they had been a mere 4 years earlier. Shares hitting 2,830 livres in August were 4,800 by late September, then skyrocketed to 6,463 in late October, and 8,975 in late November. (10)

By 1720, a single share had reached 10,100 livres. What could go wrong!

At the height of societal excitement to "get in", a wealthy aristocrat, Prince de Conti, wanted to cash out his shares. Law did not permit the sale. De Conti then rounded up all his Banque Royale notes and demanded that his notes be turned into coins. It wasn't long before the public was trying to break down the doors of Banque Royale, and went from their love affair with shares of the Mississippi Company and their newfound wealth, to a desire for hoarding gold coins. (11) The collapse of the Mississippi Company's value and bank run on the Banque Royale ruined thousands of middle-class French citizens.

Needless to say, Law was never again seen in a positive light by the people of France who had been caught up in his experiment of "unlimited riches" with the backing of the state. Thank goodness we are much too smart for such a thing like this to happen today.

Early Years of American Finance and The Continental

When Americans speak of the founding of the nation, they do not speak of the early days of the nation's finances. Most likely, it is because they have probably never been taught about the following piece of history.

The total value of the money supply of the United States at the start of the Revolution was $12 million. In order to finance the Revolution, the Continental Congress launched America's first paper currency for $2 million and before it was printed concluded that another $1 million was needed. Before the end of year (1775) the amount of paper money printed had reached $6 million, increasing the nation's money supply $6 million in less than a year. (12)

The next few years saw a dramatic increase of the "Continental" paper money.

Congress issued $6 million in 1775, $19 million in 1776, $13 million in 1777, $64 million in 1778, and $125 million in 1779. In 5 years, the nations money supply had grown from $12 million to $225 million.

This behavior lead to rapid inflation and the devaluation of the paper money in terms of specie (coins). In 1776, the Continentals were worth $1 for every $1.25 of specie. The new money continued falling in value, hitting a 6.8:1 ratio in 1778, and 42:1 by December 1779. By early 1781, less than 18 months later, one needed 168 paper Continentals to exchange for one dollar in specie. (13)

With these experiences in the minds of the first generation of Americans, we can see that their experience lead to action by our nation's leaders. The following was stated in the December 16, 1789 edition of the Pennsylvania Gazette:

"Since the federal constitution has removed all danger of our having a paper tender, our trade is advanced fifty per cent."

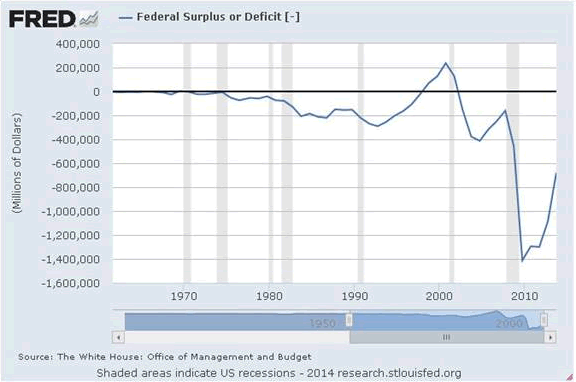

Historian Louis Hacker described the period as one "of unexampled business expansion, one of the greatest, in fact, the United States has had...The exports of the country mounted from $19 million in 1791 to $93 million in 1801." In 1792 the federal deficit was 28 percent of expenditures. By 1802, the deficit had disappeared altogether, and had been replaced with a surplus equal to the government's total spending. (14) Can you even imagine such a thing in an age where political leaders see going from overspending a trillion in a year to overspending $600 billion in a year as progress!

[Source - Federal Reserve Bank of St Louis]

Look at the chart above. This research was done by one of the 12 banks that comprise the Federal Reserve System. Since the 1970s, one can see that the United States government has spent more than it has brought in, other than a few brief years in the late '90s. September will mark 6 years since hearing of the need for a $700 billion bailout to save the financial system. Trillions in additional bailouts and stimulus programs have taken place since 2008. As just stated, our political leaders seem pleased that our deficit has been reduced to around $600 billion. When will we come to a point as a society, where we will openly discuss how the power to print "unlimited" money might fail...again?

Does anyone in leadership in the financial sector, whether private or public, remember this saying?

"If your outgo exceeds your income then your upkeep will be your downfall."

Where Is the Scheme Today?

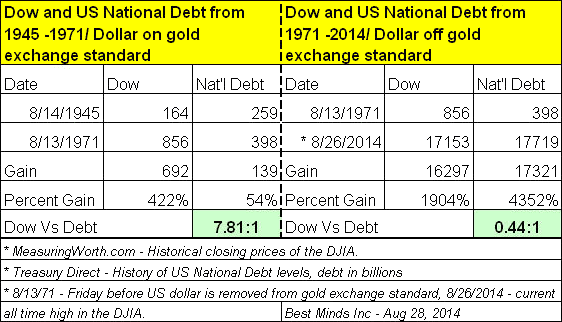

The scheme today started in 1971, when the dollar was removed from the gold exchange standard. To make sure we understand how significant this event was in the history of finance, let's look back at a few things that took place before we arrived at 1971.

Through the rise and fall of ancient empires, coins were used. The quality of the coin could be reduced in value by adding more dross or a lower grade metal as a way to stretch the empires money. However, paper money and central banks were yet to come. After the Roman Empire fell, it would take until the1600s before history would see the first central bank. As already mentioned in this article, this was the Amsterdam Wisselbank founded in 1609. The first English national debt of long maturity was floated in 1692 to finance a war with France, and subscribers to this loan were given the right by the English government to incorporate themselves as the Bank of England in 1694. (15) The first paper money sanctioned by a government was France in the early 1700s, which as we have seen, lead eventually to the collapse of the Mississippi Company's stock, and a run on the Banque Royale by the people of France.

Now let's leap to the 20th century. On September 20, 1931, the Bank of England would no longer fill the request to exchange their gold for any nation demanding payment in gold rather than in paper money, the pound sterling. This was another first in history. The economist Moritz J. Bonn at the time wrote, " [It] was the end of an age. It was the last day of the age of economic liberalism in which Great Britain had been the leader of the world. Now the whole edifice has crashed. The slogan 'safe as the Bank of England' no longer had any meaning." (16)

As the most documented war of all time was coming to an end, World War II, world financial leaders were working on a plan to kick-start the global economy. Economists Dexter White (American) and John Maynard Keynes (British) were the two individuals brought in to draft a solution. Both would espouse substantial inflation (the massive increase of money, i.e. debt) as the basis of rebuilding the world economy. Keynes envisioned a new international monetary unit called the bancor. World financial leaders did not embrace this idea at the time, and in the end, it was the US dollar fixed at a value of $35 per gold ounce that would become the basis for this new global monetary order. (17) (18)

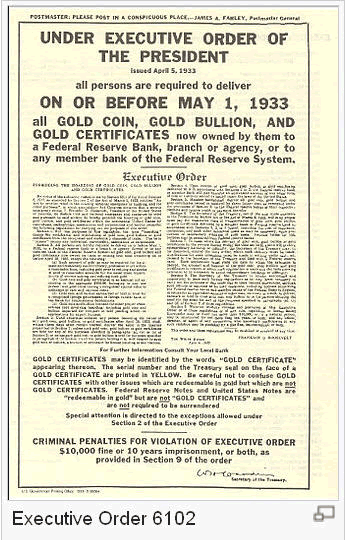

The US government had already made it illegal for Americans to hold gold as a form of money in 1933 - something that had been a form of money back through ancient empires. Instead, central bankers would now place American dollars in their banks, since these dollars could be exchanged for gold if demanded. In other words, the dollar was as "good as gold" (19) Everyone had already seen what could happened when too much money was printed up for the gold that was suppose to back it, as the Bank of England had shown in 1931. So it was no surprise to those who had studied financial history when it happened again in August 1971 with the American dollar.

So on August 15, 1971, right before I entered my freshman year of high school, President Nixon announced to the American people and world, "We must protect the American dollar as a pillar of stability around the world". What was the solution to protecting the US dollar as a "pillar of stability"? The same solution delivered to global financial markets and banks in 1931. The US government would no longer honor its promise to exchange dollars for gold by those nations losing faith in our own government's increasing debt load, or concerned about the stability of the American dollar. On its 40th anniversary in 2011, the dollar had declined to a point where it was only worth 19 cents of its 1971 value. (20)

"Infinity and Beyond" is a Lie

Sadly, living through the last 40 years of history where no major industrial nation has backed their currency by gold, the devaluation of currencies has been in a race to the bottom. We all need currency (whether electronic or paper) to live out our own individual lives day to day. The world that brings so many things to our homes and businesses is an extremely complex interdependent global system. Adding more and more debt only increases risks across the entire system.

Yet, after 1971, every financial crisis had to be explained as anything other than the devaluation of the currency, and inflation was anything but the printing of money and increasing of our national debts. If this was explained clearly to the public, it would be obvious that the only bank given the power to print the American dollar, the Federal Reserve, was at the root of our of nation's growing financial problems. The same applies to the printing presses of central bankers worldwide, and the nations they serve.

We are all watching a tragicomedy unfold, that will eventually bring far more tragedy than comedy.

The results are always the same once the public has come over the next financial mountain in history; destruction of wealth and changes that impact everyone, whether rich or poor.

These changes will come. History has shown that repeatedly. Promoting the idea that "investors" are excited about the latest central banking scheme to continue markets at "all time high" levels has a limited shelf life. This is only feeding the public a lie, that today's global Mississippi Scheme is on track to bring even greater riches to those who put their fear behind them, forget everything in history that brought us to this point, and place their trust in the idea that never ever will central bankers let a problem show up in financial markets again that can not be solved by more debt, more central planning, and more direct intervention.

"Equities Reach Record $66 trillion as S&P 500 Hits 2,000" ~ Bloomberg, Aug 27

"Rallies from Brazil to Japan and the Standard & Poor's 500 Index's first trip above 2,000 sent the value of global equities to a record $66 trillion....

'Geopolitical events are significant and major new attacks are tragic, but they're not enough to unsettle the global economic forces in play, especially in America,' said Patrick Spencer, head of U.S. equity sales at Robert W. Baird & Co. in London. 'Draghi gave clear indication that he's standing ready with further measures to stimulate growth and that's helping overall sentiment.'...

The value of equities globally has soared from $25 trillion in March 2009. Stocks were valued at $63 trillion at the 2007 peak, according to data compiled by Bloomberg."

"IMF paper warns of 'savings tax' and mass write-offs as West's debt hits 200-year high" ~ UK Telegraph, Jan 2 '14

"Much of the Western world will require defaults, a savings tax and higher inflation to clear the way for recovery as debt levels reach a 200-year high, according to a new report by the International Monetary Fund.

The IMF working paper said debt burdens in developed nations have become extreme by any historical measure and will require a wave of haircuts, either negotiated 1930s-style write-offs or the standard mix of measures used by the IMF in its "toolkit" for emerging market blow-ups."

Escaping from reality is enjoyable when decisions and life are hard, and you need a brief rest. Living outside reality only means being awakened back into a world that is much harsher when thrust upon us.

When Booms End, Busts Begin

If you are not spending hours connecting the dots of these powerful world trends, and seeking to understand how to make changes for the financial landscape ahead, I would strongly suggest the paid research newsletters and trading reports available with a six month subscription to The Investor's Mind. Money is always moving. Bulls become bears and bears become bulls.

The cost of good research and critical thinking has become extremely small considering the money that can evaporate during the downside of financial schemes.

Sources:- My Oct 31, 2013 article, Who Needs God, We Have Bankers, and David Stockman's June 6, 2014 article, Draghi's Horrible Threat: "Are We Finished Yet? The Answer Is No!"

- Devil Take the Hindmost: A History of Financial Speculation (1999), Edward Chancellor, pg 9, used in The Investor's Mind, Feb 2007, A New World Order: Explorers, Speculators, and Debt Managers

- Financial Reckoning Day: Surviving the Soft Depression of the 21st Century (2003), William Bonner with Addison Wiggins, pg 72

- Ibid, pg 78

- Picture located at Mississippi History Now, John Law and the Mississippi Bubble:1718-1720, http://mshistory.k12.ms.us/articles/70/john-law-and-the-mississippi-bubble-1718-1720

- Financial Reckoning Day, Bonner, pg 81

- Extraordinary Popular Delusions & the Madness of Crowds, Forward by Andrew Tobias (1980, originally published in 1841) Charles Mackay, pg 15

- Broken Markets: How High Frequency Trading and Predatory Practices on Wall Street Are Destroying Investor's Confidence (May 2012), Sal Arnuk and Joseph Saluzzi, location 484 of 5286 in Kindle Edition

- Treasury's War: The Unleashing of a New Era of Financial Warfare (Sept 2013) Juan Zarate, location 6441 of 9698 in Kindle Edition

- Financial Reckoning Day, Bonner, pg 81

- Ibid, pg 84

- History of Money and Banking in the United States: The Colonial Era to World War II (2002), Murray Rothbard, edited by Joseph Salerno, pg 59

- Ibid, pg 59-60

- The Creature from Jekyll Island: A Second Look at the Federal Reserve, Third Edition (1998), G. Edward Griffin, pg 322

- A History of Interest Rates, Third Edition (1996) Sidney Homer and Richard Sylla, pg 126

- History of Money and Banking in the United States, Rothbard, pg 431

- Ibid, pg 480-483

- The bancor has been in discussion since 2008 by world bankers. On the Research page of the Best Minds Inc website, I posted an IMF white paper, Reserve Accumulation and International Monetary Stability (April 13 '10) on March 23, 2011. The following is stated in this IMF white paper: "From SDR to bancor - Limitation of the SDR (Special Drawing Rights) as discussed previously is that it is not a currency.... A more ambitious reform option would be to build on the previous ideas and develop, over time, a global currency. Called for example, bancor, in honor of Keynes, such a currency could be used as a medium of exchange..."

- Chart at Executive Order 6102, Wikipedia, http://en.wikipedia.org/wiki/Executive_Order_6102 (20) Forty Years Ago Today Nixon Took Us Off the Gold Standard, Fox News, August 15, 2011

* Contact my office if you have an interest in public speaking, media interview, or consulting.

* Riders on the Storm: Short Selling in Contrary Winds (Jan '06) was a research paper I wrote on how investors are deceived, and contains interviews with industry famous contrarians. It can be downloaded for free.

Doug Wakefield

President

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller Parkway

Suite 110

Denton, Texas 76210

www.bestmindsinc.com

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Copyright © 2005-2014 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.