European Bond Market: Bubble of all Bubbles!

Interest-Rates / Eurozone Debt Crisis Aug 28, 2014 - 11:46 AM GMTBy: EconMatters

European Bond Rush

European Bond Rush

Right now investors in European Bonds are running over each other all in an effort to front run what the Big Banks have been begging the ECB to begin a bond buying program similar to the United States’ QE bond buying program.

Tourism has its Limitations

It is hilarious as European yields are already ridiculously low right now, how much lower do they think these yields can go, and if they could go measurably lower what difference would it make, obviously low yields and borrowing costs aren`t what troubles Europe right now. It is the fact that these countries have one business advantage on a global basis, tourism and that is it. These countries that make up the European Union are basically socialist stores of historical wealth, outside of Germany, they just aren`t competitive on many fronts compared with the United States, South Korea and China.

Read More >>>The U.S. Bond Market Is Not Europe or Japan

Big Banks Begging for more Central Bank Handouts!

But let’s be honest the ECB doesn`t need to buy any bonds, the banks are just begging for more handouts of cheap money, and more government programs that they can take advantage of like the primary dealers did with the Federal Reserve`s QE stimulus program. It is all about ‘gaming’ the system, especially when it is too hard to actually do some research - figure out markets, and strategically differentiate between good and bad stocks, asset classes, and investment themes. Just beg the Central Banks for more “stimulus” that they can front run, or game the financial system for risk free returns that takes no real market skill whatsoever.

Big Banks Should Be Begging for Structural Reforms by Governments!

The big banks should be putting pressure on the governments to overhaul their noncompetitive business practices in these European Countries, they should be begging for structural reforms in these countries. However that would be much too hard, when these banks can just beg the ECB for more cheap stimulus programs, like that is going to help any more than the 15 basis point current borrowing costs in Europe!

Mario Draghi even alluded to this in his Jackson Hole speech last week, that he can only do so much for what ails Europe, and the real solution for European growth must come in the form of structural reforms, and making these countries more competitive like South Korea, China and the United States on a global competiveness scale; shoot even Mexico is starting to get their act together compared to Europe.

Read More >>Jackson Hole: How Janet Yellen Is The Wrong Chairperson for the Fed

Who is the Bond Sucker that the Big Banks are going to Sell to?

But like I always say ‘Any idiot can buy bonds with ridiculously low yields’ just who is the greater fool that you are going to sell these duration bonds to over the next five and ten years? Remember bond yields just two years ago before central banks started incentivizing this search for yield insanity? Do you think the Debt-to-GDP Ratios for the European countries have gotten measurably better? Without major structural reforms, and don`t hold your breath anytime soon bond investors, you just got suckered into buying European bonds because you were so freaking greedy, that you have pushed European Bonds into the bubble of all bubbles, for the same bonds that three years ago you wouldn`t touch with double and triple these yields!

Talk about greed getting in the way of rational investing, it is the trick that Grifters use to scam marks; appeal to their greed motive, and then watch as the fools step all over themselves giving their hard earn money to the Grifters! So unless there is miraculously some kind of structural reform nirvana in Europe all the cheap money isn`t going to solve the lack of competitiveness of these countries in Europe on a global basis, weakening the Euro by another 10% isn`t going to cure why no European country can compete with South Korea, China, or the United States. Furthermore, the Debt-to-GDP Ratios are only going to grow much higher than they were when investors thought the European Union was going to collapse and these same bonds that they are currently jumping over themselves to buy were absolutely worthless! [So which story are you going to stick with Bond Investor, were these same bonds mispriced then, or are they mispriced now?]

Rinse, Repeat…then Beg for Bailouts once again!

Anybody buying European Bonds, (I guess all the big banks think they will be bailed out once again when all these European bonds are completely worthless), when European yields quadruple from current yield levels, and all these worthless bonds on the banks books make the subprime mortgage write-downs look like Childs play in comparison. Talk about central banks setting up for the next financial crisis where the big banks all become insolvent again with more worthless assets on their books, all these European bonds at current yield levels are so mispriced that the losses for those that hold these on the books for five and ten years’ time is going to be staggering!

Insolvency Risk Greater than Ever!

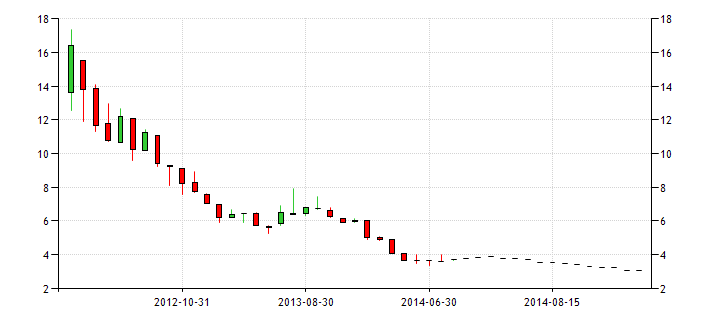

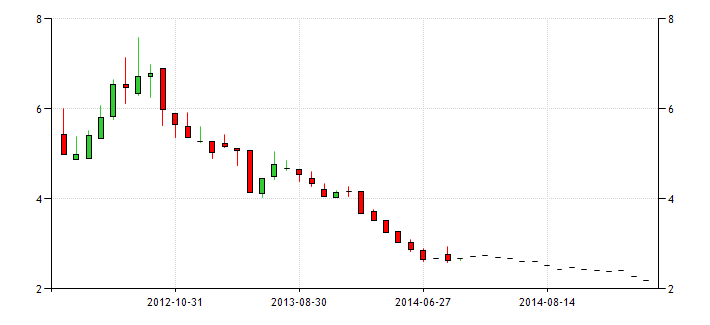

Portugal 10-Year Bond Yield

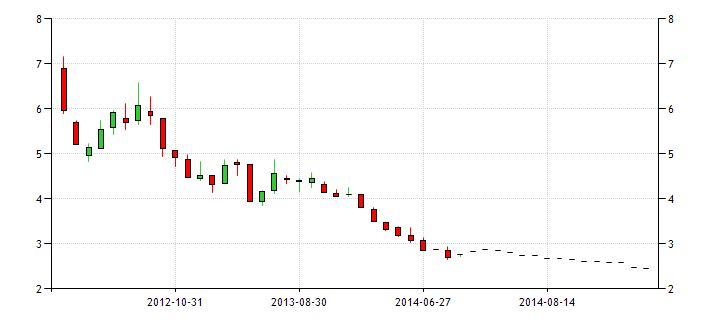

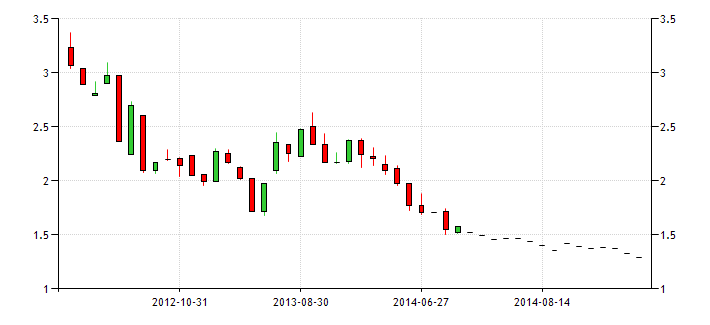

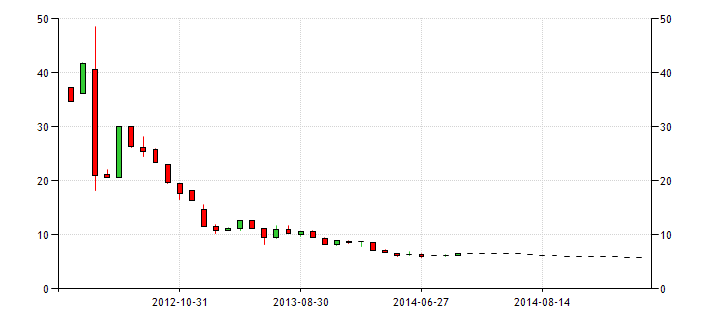

For example, Portugal has a Debt-to-GDP Ratio of 129.00 with a 10-year bond yield in the 3% range; it was 16% in 2012 with a lower Debt-to-GDP Ratio. Italy has a Debt-to-GDP Ratio of 132.60 with a 10-year bond yield in the 2.4% range; it was 7% in 2012 with a lower Debt-to-GDP Ratio. France has a Debt-to-GDP Ratio of 91.80 with a 10-year bond yield in the 1.25% range; it was 3.5% in 2012 with a lower Debt-to-GDP Ratio. How about Greece, it has a Debt-to-GDP Ratio of 175.10 with a 10-year bond yield in the 5.6% range, it was over 40% in 2012 with a lower Debt-to-GDP Ratio. Spain has a Debt-to-GDP Ratio of 93.90 with a 10-year bond yield in the 2.14% range; it was over 7% in 2012 with a lower Debt-to-GDP Ratio. I could literally do this all day across the European Union, one gets for the most part the same results with lower Debt-to-GDP Ratios or slightly smaller with 10-year bond yields which just two years ago were three and four times higher, and the European Union no more competitive on a global basis then they were during the ‘Insolvency Crisis’.

Italy 10-Year Bond Yield

Rising Debt-to GDP Ratios & Bubbly Yields Failing to Properly Price ‘Haircut Risk’!

France 10-Year Bond Yield

The point is nothing has changed idiot bond investors, are you really this stupidly oblivious to risk because the ‘Yield Trade’ is really in fashion right now in financial markets? Where do you think these same bond yields will be in ten years? Do they think that Europe will get their financial house in order? Do they really think half of these bonds are even worth anything in 10 years? Just two years ago, which by my math, there are a lot of two year time periods in a 10-year bond duration, the entire European Union with better overall Debt-to-GDP Ratios compared to present was on the verge of collapse, what has changed besides Central Banks incentivizing you to chase Yield?

Greece 10-Year Bond Yield

Going to need ‘a lot’ of Greater Fools to offload this European Bond Garbage

Spain 10-Year Bond Yield

You do know that Yield is supposed to represent the risks associated with you as an investor getting paid back in full on the debt, do you really think the current yield is representative of the ‘haircut’ you will be forced to take on these bonds if the European Union implodes or dissolves? I love your optimism in finding a ‘greater Fool’ to buy these Grifter Bonds off of you Big Banks, I guess in a couple of years we will be back to 15 Billion Dollar Write-off Quarters like 2008, and more Bank Bailouts for Stupid Investment Decisions or should I say Stupid Risk Taking!

Not Exactly ‘Rocket Scientists’!

Bond Investors are some of the stupidest people in financial markets, this is going to be hilarious watching this all explode in their faces once again! You would think that after the financial crisis which when you break it all down came down to loading up chasing levered yield plays, just ask Merrill Lynch about falling in love with Yield, that investors would be better able to calculate risk in trade configurations. But just as JP Morgan illustrated so succinctly in the ‘Whale Fiasco’ excessive Greed gets the Big Banks every time! Have fun picking up those Yield Nickels in front of the Bond Reset Steamroller when the European Bond Bubble Bursts!

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.