Stock Market Panic Decline Begins

Stock-Markets / Stock Markets 2014 Aug 27, 2014 - 03:02 PM GMT SPX escaped the support of its Ending Diagonal trendline yesterday, putting it at risk of a sharp decline. Yesterday’s peak at 11.27 a.m. put it within an hour of 17.2 days of rally since its low at the close of August 7.

SPX escaped the support of its Ending Diagonal trendline yesterday, putting it at risk of a sharp decline. Yesterday’s peak at 11.27 a.m. put it within an hour of 17.2 days of rally since its low at the close of August 7.

The Premarket is flat with a slight downward bias this morning. There is more bad news out of Europe, but traders appear to be jaded with no news of any significance being reported domestically.

This could be the scenario for the start of the decline…no news or catalyst, just selling.

The break of the Ending Diagonal is, in itself a technical sell signal. I will add more commentary as confirmations are given.

VIX is also flat with a very slight upward bias in the futures. The VIX ETFs are all mildly positive.

It appears that VIX may cross its trendline at 12.25 today. This would be the first level breakout and a signal for aggressive traders to take positions either at that point or above the 50-day Moving Average at 12.69 . Confirmation of the SPX sell signal lies at mid-Cycle resistance at 13.88

The Hi-Lo index is above its mid-Cycle resistance and not yet near a sell signal.

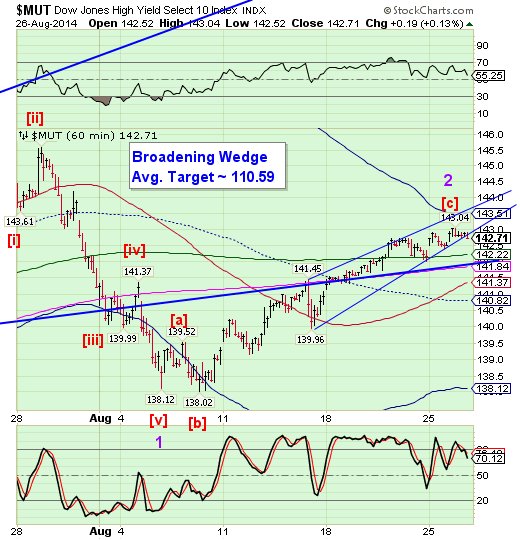

MUT appears to have broken its Ending Diagonal trendline, but is still above the 50-day Moving Average and Broadening Wedge trendline at 141.84. Taking a short position here would also be aggressive, but considering the diminishing liquidity, may prove worthwhile.

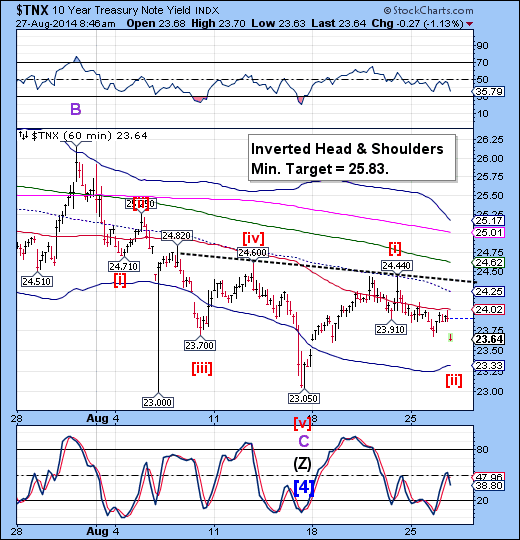

TNX appears to be completing a Minute Wave [ii] this morning. The target may be the hourly Cycle Bottom support at 23.33. Once accomplished, a breakout above the Head & Shoulders neckline near 24.44 should be considered. Rising Rates may be faster than anyone expects.

I recommend you listen to the interview with Ambrose Evans-Pritchard. I don’t necessarily share all his views, as he is more Keynesian than I would prefer, but he has a couple of bombshells that are spot-on, as the Brits say.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.