How to Invest in Silver Today for Double-Digit Gains

Commodities / Gold and Silver 2014 Aug 27, 2014 - 02:52 PM GMTBy: Money_Morning

If you've been watching silver for some time, you know it's been in the doghouse.

If you've been watching silver for some time, you know it's been in the doghouse.

After peaking at $49 back in April 2011 the white metal is down 60%, having languished between $19 and $22 for the past two years.

But a confluence of factors is building that make today's silver prices look downright cheap.

Here's how the bull is going to run - and how you can ride it all the way up from here...

The Pattern: Where Gold Goes, Silver Follows

To explain how the precious white metal behaves, I like to use the phrase: silver is like gold - on steroids.

What I mean by that is, when gold starts to move, whether down or up, silver tends to follow its lead. But its losses or gains usually magnify those of gold.

Gold's bull market started back in 2001 from a bottom of $256. It eventually peaked in 2011, turning in a gain of 642%.

Silver bottomed at $4.15 in 2001, than peaked in 2011 at $49, having gained 1,080%. So, from peak to trough, silver's gain was nearly twice that of gold's.

That leverage looks very exciting, but investors need to be cautious and recognize that it works both ways.

Since those highs, gold has retreated 32%, while silver's off by 60%. Again, that's a nearly 2:1 magnification that shows these metals are tied together.

These Indicators Are Undeniable: Silver Bull Market Ahead

In order to gauge how silver is priced relative to gold, one useful tool is the gold-to-silver ratio.

We calculate this indicator by simply dividing the gold price by the silver price which, right now, yields about 67. In simple terms, that means right now an ounce of gold will buy roughly 67 ounces of silver.

Historically, that ratio has been closer to about 16. On that basis, silver is still very cheap.

If we look at the gold-to-silver ratio since the current bull market began in 2001, it averaged closer to 55 before the 2008 financial crisis and stock market panic.

I believe that, as this bull market progresses, the gold/silver ratio will not only return to its pre-Panic average of 55, but will ultimately peak somewhere closer to 20.

What does that mean right now?

Well, if gold were to stay put at $1,300, and the ratio returned to 55, then silver would climb by about 20% to around $23.50/ounce.

But there are several other drivers, in addition to a reversion to the mean of the gold/silver ratio, which are likely to help drive silver a lot higher in the months and years ahead.

The price of silver may be flat on a year-to-date basis, but that's not the case for silver miners.

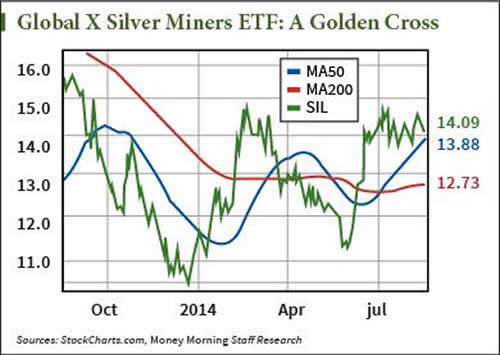

If we use the Global X Silver Miners ETF (NYSE Arca: SIL) as a proxy, the miners are in fact up 25% this year by comparison. That's some outperformance, and it speaks to a burgeoning interest in this sector.

If we use the Global X Silver Miners ETF (NYSE Arca: SIL) as a proxy, the miners are in fact up 25% this year by comparison. That's some outperformance, and it speaks to a burgeoning interest in this sector.

We've also seen a bullish technical signal back in early July. That's when SIL completed a golden cross, with its 50-day moving average crossing up above its 200-day moving average as you can see in the chart at right.

And even though the silver price is flat on the year so far, investor interest is strong. Silver ETFs backed by physical silver added 7 million ounces in the first half of 2014.

Demand Is Up in All Corners of the Market

According to Thomson Reuters, GFMS sales of silver coins are up 4.5% globally in the first 6 months of this year. U.S. Mint sales are near record levels attained in the first half of 2013.

On the industrial side demand has also been robust, with Thomson Reuters forecasting a 23% increase for 2014.

Silver is indispensable in the chemicals sector. Ethylene oxide is critical to the production of plastics, solvents, and detergents, and silver plays a major role here.

Green energy is significant for silver demand as well. Metals Focus, another consultancy, expects the use of silver in solar panels to leap ahead 10% this year alone.

Another potential driver for higher silver prices is the price-setting mechanism itself.

Real Hope for a Cleaner Silver Price Discovery System

After more than 117 years of the silver fix, a new electronic auction-based system will now help set the silver price.

Sadly, that's come in the wake of a lawsuit against HSBC, Deutsche Bank, and the Bank of Nova Scotia for allegedly attempting to rig the price of silver. A similar problem hit the gold price fix, ending with Barclays facing a $44 million fine.

While there's some hope transparency will reign in this new price discovery mechanism, it's still early and there are only three participants, two of which were part of the old silver fix.

The London Bullion Market Association will accredit participants and own the intellectual property rights. Meanwhile, the CME Group will provide the electronic auction platform (to calculate the silver price) and Thomson Reuters will be responsible for administration and governance.

To some extent, it would seem the fox is being put back in charge of the henhouse. But it is still early days, so I'm willing to give the process some time to mature. As more participants join, especially some from outside the realm of banking, odds will improve for true price discovery.

If confidence builds, and true transparency reigns, that too should bolster the price of silver.

We don't want to be left out of the party when the inevitable bull run starts, and here's how we can profit...

Two Silver Mining Investments to Buy Now

If your portfolio doesn't already have a silver lining, it's time to have a closer look.

For direct exposure, consider the iShares Silver Trust ETF (NYSE Arca: SLV). It does a good job of tracking the price of silver, offers plenty of liquidity, and has an expense ratio of just 0.5%.

For a lot more leverage and volatility, consider the PureFunds ISE Junior Silver ETF (NYSE: SILJ). It's basically rocket fuel for the silver sector, as its holdings are essentially small cap silver producers and explorers. You may want to use a wider than normal trailing stop to account for the fund's volatility, and take some profits as they appear.

Remember, silver is cheap based on a number of indicators, and its bull market is far from over.

So the time to take a position is now, before the crowd, to benefit from this "gold on steroids."

Source : http://moneymorning.com/2014/08/26/how-to-invest-in-silver-today-for-double-digit-gains/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.