Even Mainstream Academia Worried about Massive Bubbles in Markets

Stock-Markets / Financial Markets 2014 Aug 26, 2014 - 11:26 AM GMTBy: EconMatters

Academia Finally Sounding Alarm

Academia Finally Sounding Alarm

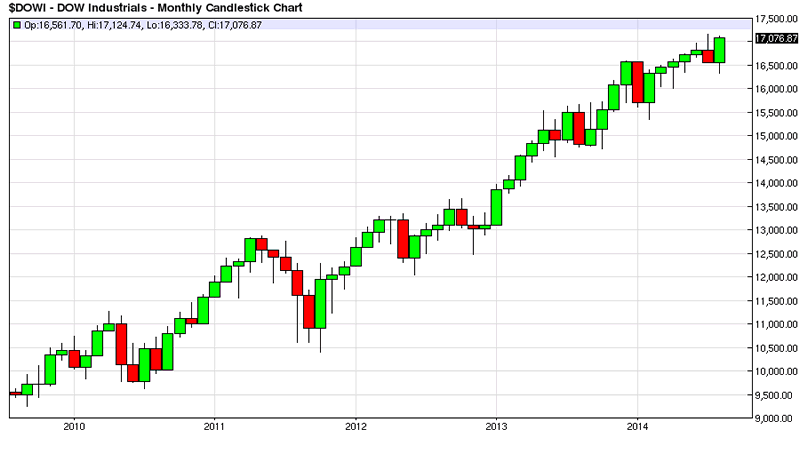

As stocks set new records each month even other academic economists are starting to realize that not only is the Federal Reserve behind the curve, but that they are part of the rising risk concerns that are building in the financial system, and their failure to take responsibility for valuations that are 10% over-valued even on the most optimistic valuations, is alarming given the past bubbles and the damage that has occurred through excessively low interest rates providing far too much liquidity in the system.

Far Too Much Liquidity in the Financial System

Read More >>>The Fed Will Raise Rates in March 2015

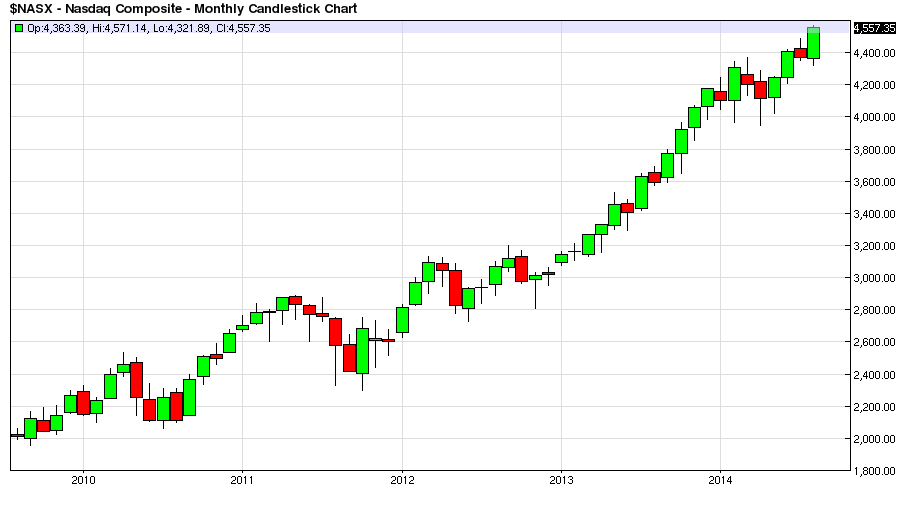

Make no mistake with QE still going on, and a 25 basis points fed funds rate, combined with Japan, China, England and the ECB all providing loads of liquidity to the financial system, risk taking is off the charts, valuations are bubbly in many markets, and the entire financial system is setting itself up for another massive, deleveraging crash once again.

There is just too much liquidity in the financial system, and the US and England are the two economies best able to start reducing overall liquidity on a global basis, the UK with a hot real estate market, and the US with a hot job market and overheated stock market.

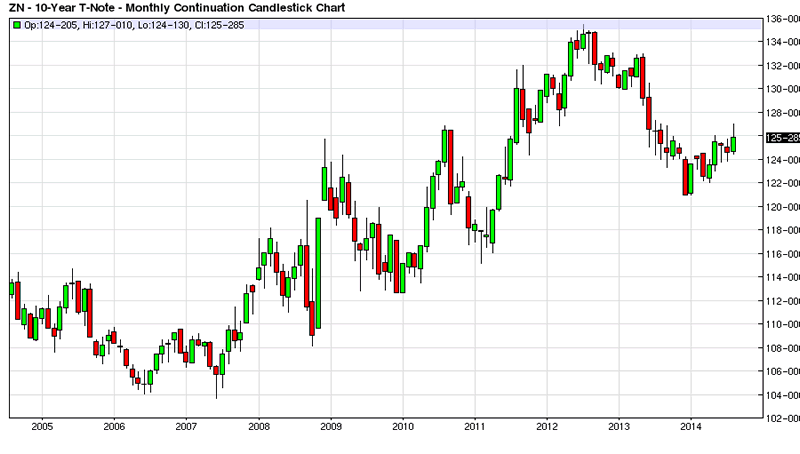

The point is that there is too much systemic risk right now and it is heading in the wrong direction given the fact that Britain and the United States are both performing far too well to continue to have recession era loose monetary policies. It might make sense in Japan and Europe but when you have even well performing economies with ‘recession era level’ of interest rates providing massive amounts of cheap liquidity to the financial system, no wonder we have so many bubbles in bonds and stocks.

Read More >>>The Oil Market QE Premium Is Coming out of Price

Don`t Be Fooled by the Lag Effect

The financial markets are not acting and trading normally, trust me I have seen many market cycles, and there is more liquidity in the financial system than there was in the credit bubble of 2006, this means things are out of hand once again, and the Fed needs to start soaking up this liquidity, and talking much more hawkish, just to ensure two-way markets, as right now there are far too many one-sided, all-in markets with ‘zero perceived risk’, and therein lies the risk problem.

Prudential Regulation is Passing the Buck

The notion floated by Janet Yellen that “Prudential Regulation” will monitor and watch for risky capital allocation strategies is flat out false. As a market participant, I can tell her “Prudential Regulation” as a tool sure isn`t working right now, and there are massive bubbles in many asset classes, the markets don`t even trade correctly and there is far too much liquidity in the financial system.

Moreover, if Janet Yellen truly believes that “Prudential Regulation” will be the answer in avoiding financial markets becoming ‘too risky’ or dangerous from a risk-taking standpoint, i.e., posing systemic risk to the entire highly correlated financial system; if she really believes this is an effective tool, then she needs to step down immediately because she is obviously not qualified for the position of Fed Chairperson! It is dangerously close to an alarming point right here, the bubbles keep building and the Fed needs to take responsibility for creating this systemic risk in financial markets.

Read More >>>The Fed Misrepresenting Inflation to Justify Inept Policy

The Federal Reserve are the only ones that can reduce the risk of another financial crisis by reigning in some of the massive liquidity that is bursting at the seams in all kinds of places with no real place to go. I don`t think they realize just how much liquidity is currently coursing through the veins of the financial markets, it is unprecedented.

The fact that QE was allowed to go on for basically 2 straight years, and the cumulative effects of zero percent interest rates for 7 years has finally come into financial markets with a bang. There was a lag effect, and now the liquidity overflow is out of control, we are starting to build bubbles in asset classes that have no way of long term sustainability. Some markets are as much as 25% overvalued on a five year time frame. There is no way in hell that these positions are going to be solid investments five years from now!

When Economists Recognize there is a Liquidity Bubble, We Have a Serious Problem!

Martin Feldstein, Harvard University professor alludes to what many in the financial community recognize that risk-taking is out of control, financial markets are not two-sided markets anymore, there are massive mispricing`s in many markets, all spawned by too much liquidity in the system.

The Fed needs to wake up to the risk in the system that they have created, they have become complacent because of the lag effect, well there is no more lag effect, liquidity is sloshing around the financial system right now at record levels.

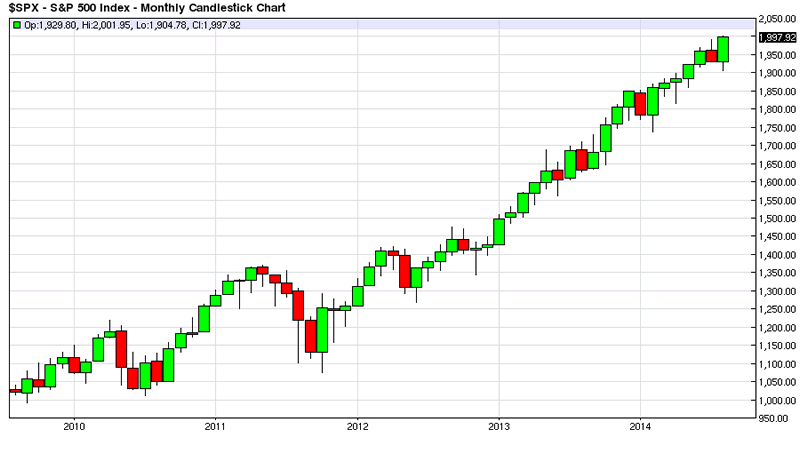

The S&P 500`s latest record 2000 run, and Bond Yields at Recession Era levels because there is so much liquidity with no place to go even in sleepy August ought to wake the doves out of their slumber fogginess. “Prudential Regulation” is not going to soak up the bubbly liquidity in the system, only Fed policy is going to reduce the current risk in the system. Stop passing the buck, and sinking your heads in the sand like ostriches, take some responsibility, and get your act together; we have a massive overflowing liquidity problem here in financial markets!

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.