Inflation vs the Deflationary Straw Man

Economics / Inflation Aug 23, 2014 - 12:53 PM GMTBy: Gary_Tanashian

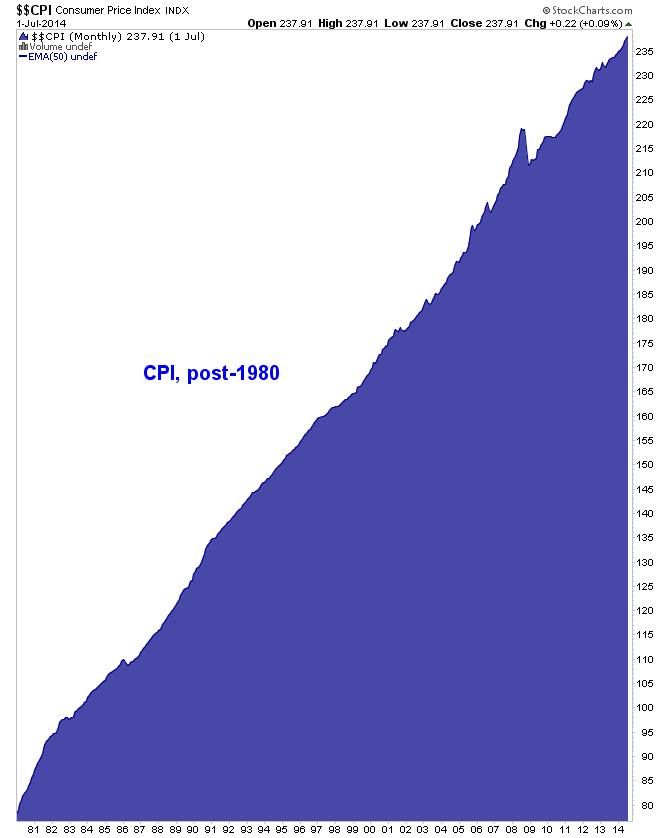

No matter the debates over inflation vs. deflation, increasing employment vs. sound monetary policy or systemic health vs. fragility (and whatever else is flying around in Jackson Hole this week), the CPI marches onward and upward. That is the system and it is predicated on creating enough money out of thin air while inflation signals are (somehow) held at bay.

No matter the debates over inflation vs. deflation, increasing employment vs. sound monetary policy or systemic health vs. fragility (and whatever else is flying around in Jackson Hole this week), the CPI marches onward and upward. That is the system and it is predicated on creating enough money out of thin air while inflation signals are (somehow) held at bay.

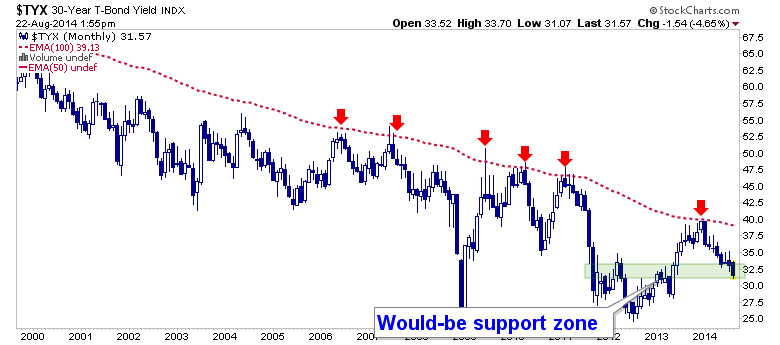

The Straw Man* in this argument lives in the idea that inflation is not always destructive, that inflation can be used for good and honed, massaged and targeted just right to achieve positive ends to defeat the curse of deflation that is surely just around the next corner. Currently, the Straw Man is supported by the reality of the moment, which includes long-term Treasury yields remaining in their long-term secular down trend.

Indeed, right here at this very site was displayed much doubt about the promotion having to do with the “Great Rotation” out of bonds and into stocks (i.e. that the yield would break the red dotted EMA 100 this time). We noted it right at that last red arrow on the Continuum© below. Now, with commodity indexes right at critical support and precious metals not far from their own, the time is now if a match is going to be put to that dry old Straw Man and silver is going to out perform gold, inflation expectations barometers (TIPS vs. unprotected T bonds) are going to turn up and the Continuum is going to find support.

People argue over inflation’s effects and the expectations thereof but the CPI, which is the ultimate measure of inflation’s lagging effects, has never stopped to take a breather. 2008′s liquidation of the system? Child’s play. Inflation, which is what the Fed has been hysterically promoting since 2007, will always manifest in rising prices somewhere. As luck would have it, this time it is manifesting in the stock market to a greater degree than the CPI. ‘All good!’ think our policy makers if the right prices are rising.

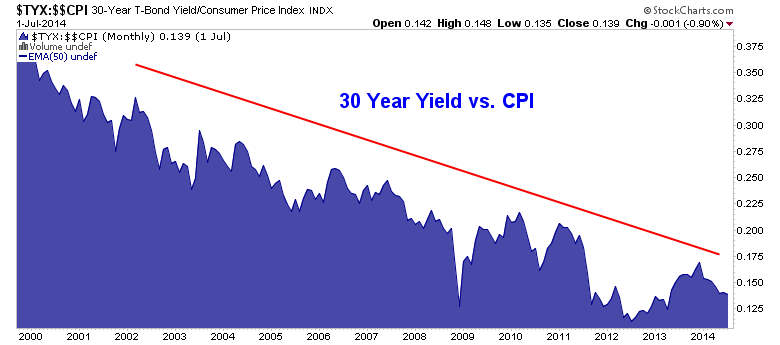

30 year yields vs. the CPI show a bond market that refuses to do anything, over decades, as consumer prices rise.

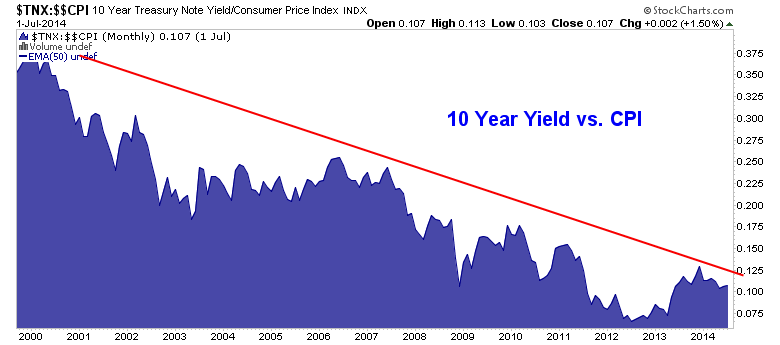

The 10 year is docile as well, apparently seeing deflation right around the next corner.

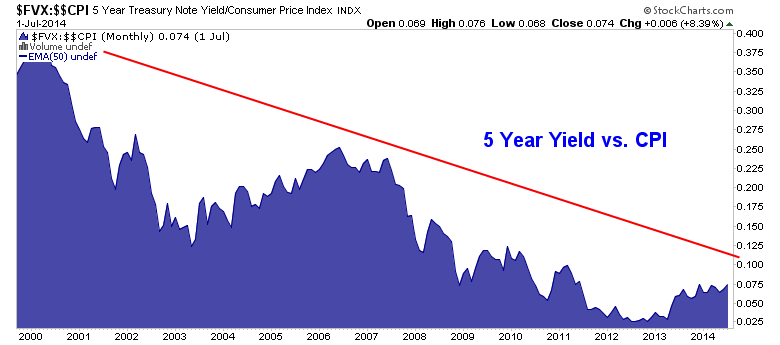

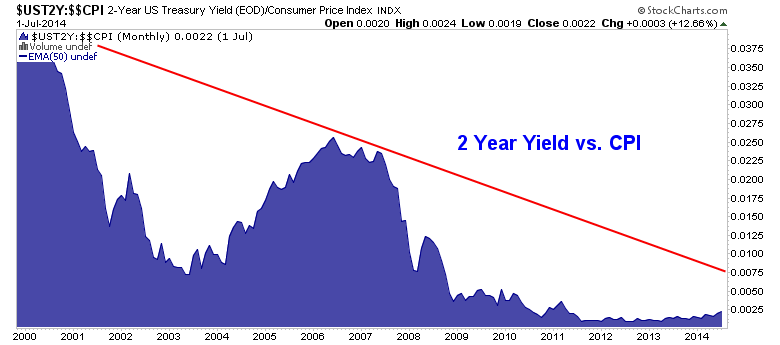

The 5′s and 2′s also are on high alert for deflation.

This is the response of our majestic Treasury bond market, former home of the legendary Bond Vigilantes, who would rise up against inflation. The problem is, considering the decades that the Continuum has been in a downtrend while prices rise, rise and rise some more, I think that (the bond vigilantes) was just another Wall Street Promotion in a long and storied line of them; Great Rotation being the latest.

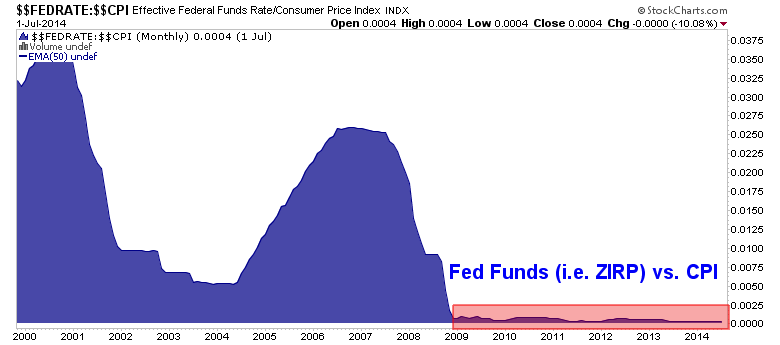

Moving on, despite all of the intellectualizing by various Fed members, media and the best and brightest in the financial services complex alike, the picture below is a view of exactly what the Fed is doing to combat rising prices over the various cycles.

At least Greenspan put up a different kind of Straw Man of his own in 2004, pretending to fight inflationary fire before that whole thing folded in on itself and liquidated in 2008. No matter what the eggheads in Jackson Hole come up with this week, they are inflating and for the time being, the right assets are benefiting.

But the Fed Funds vs. CPI shows they don’t give a damned about a secular rise in consumer prices per the admittedly dramatic ‘portrait view’ of chart #2 above. Why? Find out why the deflation Straw Man has been stood up in the first place over all these years, and we’d probably have the answer to that question.

* From Wikipedia…

A straw man is a common type of argument and is an informal fallacy based on the misrepresentation of an opponent’s argument. To be successful, a straw man argument requires that the audience be ignorant or uninformed of the original argument.

The so-called typical “attacking a straw man” argument creates the illusion of having completely refuted or defeated an opponent’s proposition by covertly replacing it with a different proposition (i.e., “stand up a straw man”) and then to refute or defeat that false argument (“knock down a straw man”) instead of the original proposition.

This technique has been used throughout history in polemical debate, particularly in arguments about highly charged emotional issues where a fiery, entertaining “battle” and the defeat of an “enemy” may be more valued than critical thinking or understanding both sides of the issue.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.