Getting the Most Value from Your “Geriatric Cruiser”

Personal_Finance / Shopping Aug 21, 2014 - 06:23 PM GMTBy: Don_Miller

For many a car lover, retiring rich requires the end of a lifelong love affair. I empathize with them all; I’ve had my own romance over the last 50-plus years.

For many a car lover, retiring rich requires the end of a lifelong love affair. I empathize with them all; I’ve had my own romance over the last 50-plus years.

Cars have a special resonance for people of my generation. George Lucas’ classic coming of age film American Graffiti is proof positive of that. As teens we flocked to auto dealers when new models came out and fantasized about actually being able to own our favorite. And let’s face it: cool cars were chick magnets. In our 20s and 30s, with the help of a friendly finance company, those dreams became reality, and every few years we’d get the new car itch again.

As children left the nest, many of us upgraded to the luxury brands befitting our positions in life. My first luxury car was a Cadillac, though a friend told me I was too young to drive one.

When my parents moved into a senior community in Sarasota, Florida, I asked Dad, “Do all retired people drive white Buicks?”

Dad grinned and said, “No, some drive Toyotas, Chevys, and Fords—practical cars. But yes, most are white.”

My niece calls these cars “geriatric cruisers.” And I should confess to agreeing with that stigma for quite some time. At 74, I’m not quite ready to throw in the towel and buy a geezer-mobile. Nonetheless, our children were horrified when we traded in our Lexus and bought a Toyota Sienna. There’s nothing cool about a minivan.

Let’s face it: for many of us, our car is strongly linked to our self-image. But with age comes wisdom (hopefully). Unless your portfolio is exceptionally flush, retirement is a good time to break up with luxury cars and use some logic. Cars are for transportation, and they are very expensive.

The Real Price of the Crown Jewel of Geriatric Cruisers

A nicely equipped 2014 Buick Regal—the crown jewel of geriatric cruisers in our part of the world—should cost around $40,855 out the door. Let’s put that in perspective for a retiree: If you have a $1,000,000 portfolio earning 5%, you have $50,000 in income. After paying taxes on your investment income, that Buick Regal will wipe out your net income for the year.

Then there’s the cost of operating the vehicle: gas, oil, maintenance, insurance, licensing, and other fees. The biggest ongoing cost, however, is depreciation. Although no one writes a “depreciation check” each month, it’s still eating away at your net worth.

Depreciation is the reduction in an asset’s value over time. For automobiles, the first hit comes in a matter of minutes. Drive the car around the block, and it’s no longer a new car; it’s used.

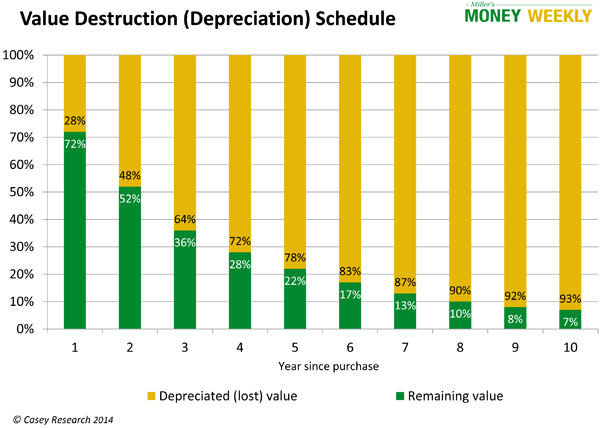

The average first-year depreciation for a car is 28%. While all vehicles depreciate differently, our Buick Regal is estimated to decrease in value by $11,439.40 in the first year. By the end of year three, its accumulated depreciation is $26,147.20, or 64% of the purchase price. Ouch!

The chart below shows a car’s estimated depreciation percentage by year:

Sad to say, but keeping your vehicle in pristine condition won’t prevent rapid depreciation. If you’re lucky, it might net you a few hundred dollars more when you sell it.

The Optimal Time to Trade In Your Car

What would happen if you traded in the Buick every five years and bought another similarly priced vehicle? Over the course of 10 years, your accumulated depreciation between the two cars would be $63,733.80.

On the other hand, if you kept your original vehicle for 10 years, the depreciation would drop off significantly in the last five. If you are a low-mileage driver, after 10 years your accumulated depreciation would be $37,995.15, $25,738.65 less than if you had traded in at the five-year mark. That’s money most retirees would be much better off investing where it will appreciate—not depreciate.

Though hanging onto the Buick for 10 years means your maintenance costs will be higher, you can purchase extended warranties covering catastrophic events and still have a lot of money left over.

I don’t recommend buying the cheapest car you can find. Even if it costs a little bit more, buy the one you really want of those you can afford. Shop for the best price, and enjoy it for as many years as the mileage and maintenance costs make it practical to own.

The real savings comes from reducing your car’s annual depreciation. If you trade the Buick every five years, the estimated annual depreciation cost is $6,373.38. Hold it for 10 years, and it drops to $3,799.52—an annual savings of $2,573.86. If gas costs $4.00 per gallon, your average annual savings could buy 644 gallons. If you average 16 miles per gallon, your savings would buy enough gas for 10,295 miles. If you’re able to drive your car for 10 years instead of trading in after five, the money you save could buy about 102,955 miles worth of gasoline.

Can Financing or Leasing Help?

It’s good practice not to finance a car (a.k.a. rent money) unless you can earn more than the interest costs via solid investments. According to Kelly Blue Book’s website, 2% interest is a reasonable estimate to finance the proverbial geriatric cruiser at 20% down (before fees and taxes). That translates into an $8,171 down payment, plus 60 monthly payments of $583, or $33,285.00.

There are plenty of safe investments where you can earn well over 2%. However, if you decide to go this route, I recommend holding the cash you would have spent in a separate account and using the income to make those monthly payments. That keeps the option of paying the car off early wide open.

What about leasing? Leasing does not reduce the cost of ownership. The lessor charges the lessee (you) for anticipated depreciation, plus a fee for using their money. If you want to own the car at the end of the lease you still have to buy it, and that can be very expensive. Had you financed it and just made your last payment you’d be in much better shape. Driving a five-year-old, paid-for vehicle that you enjoy is quite cost effective.

The Slightly Used Car

Lots of people buy two-year-old cars that have already taken the biggest depreciation hit: approximately 48%. It’s a good idea. Still, note that the 48% depreciation rate represents what a dealer would pay for a two-year-old car, not what he would resell it for. Expect to pay a little more to cover the dealer’s profit.

Be a good shopper. You want low mileage and good condition so you can drive a slightly used car for many years. Be sure to get a CARFAX report and check it thoroughly.

Many dealers offer “Dealer Certified” used cars. They advertise multi-point checklists that they use to certify vehicles. I have friends who owned dealerships tell me that some dealers certify a car by purchasing an extended warranty and adding it to the price of the car. If you are going to spend thousands of dollars for a used vehicle, have it checked over yourself. Being a good shopper also means checking the extended warranty:

- What does the dealer warrant as part of the certification, and how does that compare to what a good warranty policy would cover?

- What would it cost if you bought a separate warranty yourself?

I’ve bought extended warranties on used vehicles and found it best to go to the local dealer for that particular make. If you buy a Buick, go to a Buick dealer and ask for a quote from Buick on their extended warranty packages. Then frequent that dealer for oil changes and routine maintenance, and get to know the service manager by name. Should a problem arise, it’s good to have built a relationship.

I know many wealthy people who can afford to buy all the luxury cars they want but prefer to own more practical, middle-class automobiles. Once you retire, it’s time to come to grips with the need for reliable, comfortable transportation at a reasonable cost. The more capital you have working for you instead of depreciating at near warp-speed, the richer your retirement will be.

In our free weekly missive, Miller’s Money Weekly, my colleagues and I share practical ways to make your retirement richer, healthier and more dynamic. Whether you’re retired, planning a second career, or just enjoy no-nonsense guidance on buying a new car, investing in gold and real estate, funding your children’s college educations, slashing your tax bill and everything in between, you can receive our free e-letter directly in your inbox every Thursday by signing up here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.