The Gold War - Thinker, Trader, Holder, Why?

Commodities / Gold and Silver 2014 Aug 20, 2014 - 11:00 AM GMTBy: John_Mauldin

By: Grant Williams

By: Grant Williams

Sometimes, just sometimes, you need to stop for a second, take a step back, and reconsider the simplest pieces of any puzzle.

David John Moore Cornwall was a real-life spy. A spook. An agent. He worked for Britain’s MI5 and, later, MI6 intelligence services.

Whilst there, Cornwall began a little hobby that, in today’s world, would be unthinkable for a serving intelligence officer: writing novels about the secret world in which he lived and worked.

He chose a nom de plume with a certain je ne sais quoi: John le Carré. The hero of le Carré’s first two novels, Call for the Dead andA Murder of Quality, was George Smiley, a somewhat ordinary spy who grew up in a middle class family and attended an “antiquated Oxford college of no real distinction” but who, apparently, had“the cunning of Satan and the conscience of a virgin.”

Smiley was everything other spies of the time — fictional ones, at least — weren’t:

(Wikipedia): The spy novel writing of John le Carré stands in contrast to the physical action and moral certainty of the James Bond thriller established by Ian Fleming in the mid 1950s; the le Carré Cold War features unheroic political functionaries aware of the moral ambiguity of their work, and engaged in psychological more than physical drama. They experience little of the violence typically encountered in action thrillers, and have very little recourse to gadgets. Much of the conflict is internal, rather than external and visible.

Unlike the moral certainty of Fleming’s British Secret Service adventures, le Carré’s Circus spy stories are morally complex. They emphasise the fallibility of Western democracy and of the secret services protecting it, often implying the possibility of East-West moral equivalence...

In 1979, the BBC adapted what is perhaps le Carré’s most famous novel for television, casting the great Alec Guinness as Smiley in a seven-part miniseries that changed the face of television.

The series, Tinker, Tailor, Soldier, Spy, was a smash hit in a time before box sets and gratuitous action scenes; and despite its measured, almost glacial pace, millions tuned in each week to watch le Carré’s masterpiece of cross and double-cross unfold before their eyes.

The fictional Smiley operated during the very real Cold War between NATO and signatories to the Warsaw Treaty Organization of Friendship, Cooperation, and Mutual Assistance. (Those communist countries LOVED a good, long title. We in the West called it the Warsaw Pact, and it essentially included the Soviet Union, Bulgaria, Czechoslovakia, Yugoslavia, East Germany, Hungary, and Poland. You know, all the powerhouses.)

Looking back on it now, the Cold War was more Ali vs. Cooperman than Batman vs. Superman; but at the time, the world lived in fear of a cataclysmic resolution to the conflict. It seems like a lifetime ago; but those years between 1946 and 1991, when communism finally gave up the ghost, were fraught with fears over a rogue USSR.

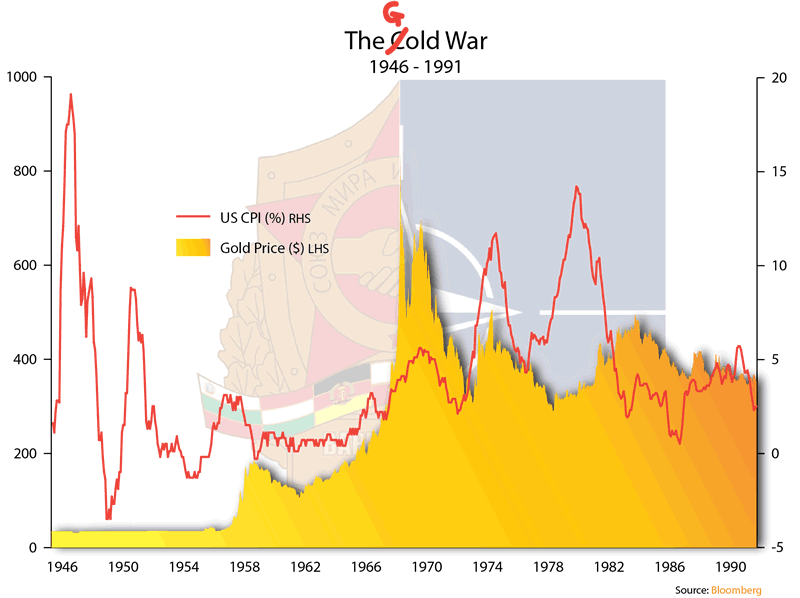

Throughout the entire episode, the price of gold — the ultimate barometer of fear — performed as one would have expected it to — once Richard Nixon removed the shackles on August 15, 1971, of course.

Fear of conflagrations along the borders of the Soviet Union led to consistent buying of gold year after year and decade after decade. Yes, there were flare-ups, during which gold saw large spikes; but as “immediate” dangers eased, so did the price — exactly as one would expect.

To be fair, it wasn’t all about “those darn Russkies.” No. The gold price was certainly helped higher by an irritating inflation problem (as you can clearly see from the chart on the previous page). Once Nixon closed that damn window, gold wasted no time in playing catch-up and responding to inflationary pressure as well as to perceived Cold War threats; but either way, once the downward pressure of a fixed price was removed, gold exploded higher — rising 82% in the first 12 months and 419% in the space of 4 years.

There are a couple of interesting points to make about the action of the gold price during those darkest of postwar days (points I’ve made before, but will expand upon this week).

Let’s begin with Asia.

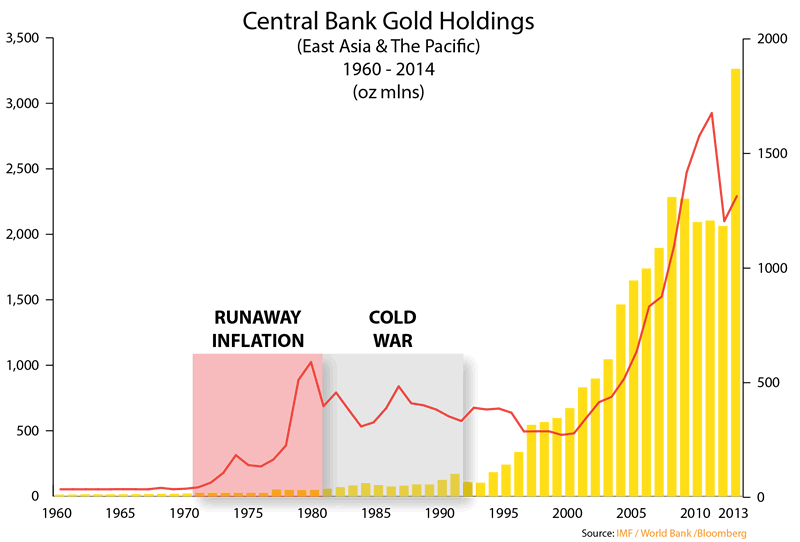

During the 1980s and 1990s, Asian central bank reserves (particularly gold reserves) were nothing to write home about. Thanks to the IMF and the World Bank, we can see exactly what they were:

As you can see, the huge run-up in the gold price during the 1970s occurred against a highly inflationary backdrop and the ongoing Cold War; but, crucially, WITHOUT THE PARTICIPATION OF ASIAN CENTRAL BANKS. (The IFC — part of the World Bank — classifies “East Asia & The Pacific” as China, Indonesia, Japan, Laos, Mongolia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam, as well as the Pacific Islands).

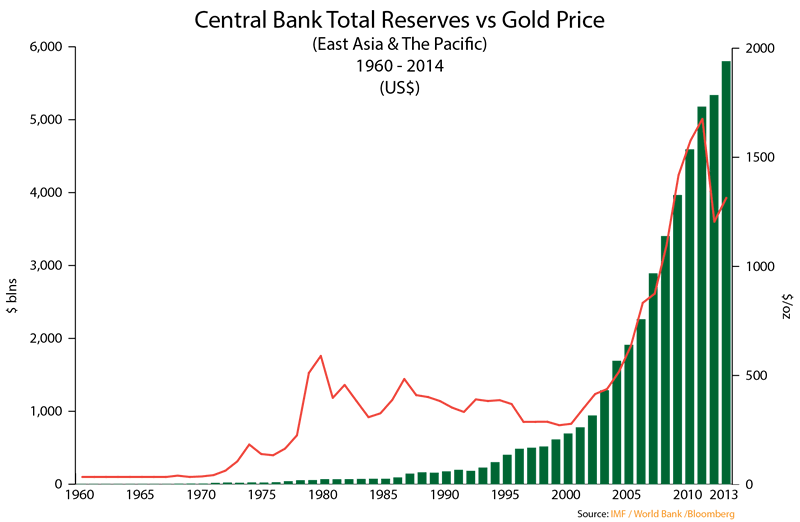

If we switch our focus to those same countries’ total reserves, however, a completely different story emerges. From the mid-1990s onwards, total currency reserves soared from $300 billion in 1994 to $5.8 trillion by the end of 2013.

That relentless climb has given Asian nations two things they didn’t have the last time we saw gold being chased higher by the terror of surging inflation and the spectre of a large-scale conflict between opposing blocs: extraordinary purchasing power and the need to diversify their massive holdings of US dollars.

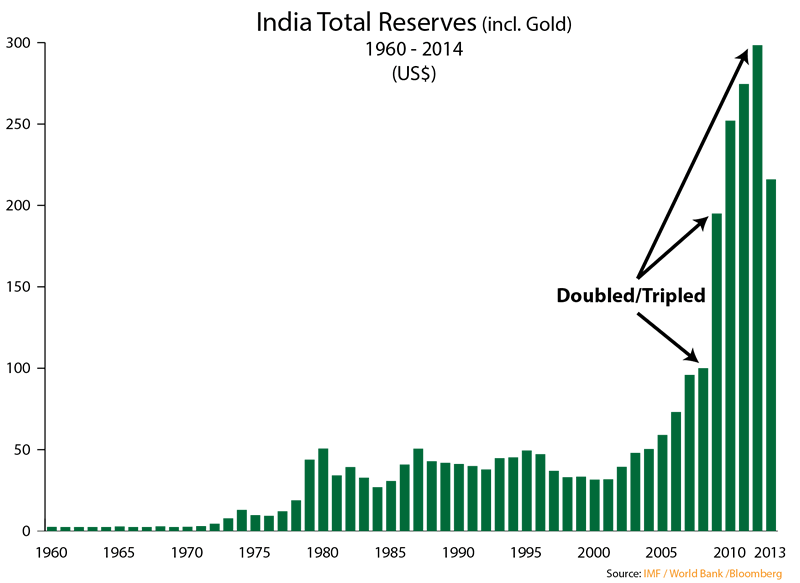

If we throw India into the picture (India is classified as part of South Asia by the IFC/World Bank, along with Bangladesh, Bhutan, the Maldives, Nepal, and Sri Lanka — countries we will leave out of this discussion for now), we can see a microcosm of that build-up in purchasing power laid out very clearly indeed:

Indian reserves doubled between 2008 and 2009, and by 2012 they had tripled to almost $300 billion.

Why is India so important on its own? Well, for one very good reason:

Click here to continue reading this article from Things That Make You Go Hmmm… – a free newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.