Europe Economy Is Tanking, QE Is Coming

Interest-Rates / Quantitative Easing Aug 18, 2014 - 11:07 AM GMTBy: Anonymous

Last year the world kind of forgot about Europe. After ECB head Mario Draghi vowed to “do whatever it takes” to get the Continent growing, the markets calmed down, money got cheap and plentiful and functionally-bankrupt countries like Greece, Italy and Spain stopped making scary headlines. To the casual observer it began to look like the euro project might actually succeed.

Last year the world kind of forgot about Europe. After ECB head Mario Draghi vowed to “do whatever it takes” to get the Continent growing, the markets calmed down, money got cheap and plentiful and functionally-bankrupt countries like Greece, Italy and Spain stopped making scary headlines. To the casual observer it began to look like the euro project might actually succeed.

Then the mirage evaporated. Five years into a recovery that should, if it followed the normal script, be in danger of overheating, the major eurozone countries are actually slipping back into recession. Germany and Italy clocked in with -0.2% GDP growth in the second quarter, while France was exactly zero. For countries that continue to pile new debt on top of already unsustainable mountains of old debt, zero growth isn’t stasis, it’s death. And the media is starting to catch on. The following headlines appeared in the DollarCollapse.com breaking news links list in just the past two days:

France finance minister “I refuse to raise taxes to close any budget gaps”

End of the Wirtschaftswunder? Germany’s sudden slowdown

UK exports to EU are ‘dead in the water’

Broken Europe: economic growth grinds to a standstill

German yield below 1%: 4 takeaways

Washington Post: Europe stuck in ‘greater depression’

Germany is itself a victim of EMU’s austerity fanatics

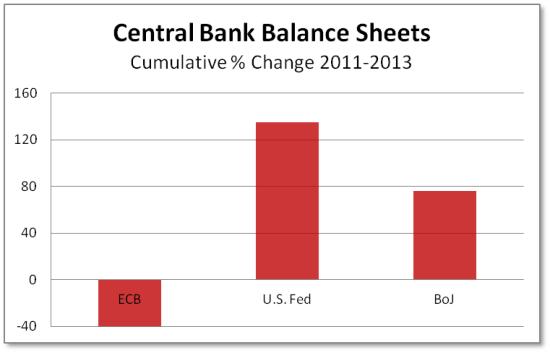

What happened? The appropriate answer depends on the time frame of the person doing the asking. The immediate problem is that Draghi talked a good game but didn’t actually do very much. While the US Federal Reserve and the Bank of Japan were flooding their economies with newly-created currency, the European Central Bank actually took euros off the market between 2011 and 2013.

The predictable result of less money in circulation is a stronger currency. Between 2012 and 2014 the euro appreciated against the dollar by about 10%, in effect raising the price of eurozone exports by that amount.

That’s the immediate problem. The longer-term and more serious issue is that a system based on ever-rising debt will find it increasingly hard to grow because yesterday’s borrowing is a hindrance to tomorrow’s productive investment. Put simply, money that goes to pay interest can’t be used to build factories. So Europe, with its hyper-generous entitlements and ridiculously stringent labor laws was always going to implode. The only question was when.

Why the current slowdown is a shock to both economists and pundits can be summed up in one word: Germany. A lot of experts seem to get that Italy and Greece, with their charmingly child-like but ungovernable people, are natural economic basket cases and that France, with its clueless socialist government, is nearly as bad. But Germany was the country that had managed to combine the nanny state and the state-of-the-art factory into a model for the rest of the world. It was the Atlas that would support the eurozone on its broad shoulders.

The point they’re missing is that Germany was only able to put up the stellar numbers of the recent past because its banks were lending billions of euros to Spain, Greece and Italy, who turned around and bought lots of German goods. In business the lending of money to customers who then buy your stuff is known as vendor financing. It works beautifully as long as the customers can pay their debts but crashes and burns when the customers default.

That’s what is happening to Germany. Now that the peripheral eurozone countries can’t borrow to buy BMWs and pharmaceuticals, Germany’s export-driven growth is slowing down. Meanwhile, a lot of the money German banks have lent to those countries will, one way or another, migrate back to the liabilities side of Germany’s balance sheet, making its debt, deficit and interest cost figures look far worse than the global financial markets were led to believe.

Anyhow, this is all leading to a completely predictable conclusion, which is that Mario Draghi will soon have to put his printing press where his mouth is. “Whatever it takes” will turn out to mean a eurozone quantitative easing program that resembles those of the Fed and BoJ, though on an even bigger scale. The implicit (maybe explicit) goal will be to crater the euro.

This will work, because it usually does — for a while. A year hence the euro will be down by 20% versus the dollar and yen, Europe will have stabilized, sort of, and the US and Japan (with their now-overvalued currencies) will be tipping into recession. And the Fed will be gearing up for a debt monetization binge that will make the ghost of John Maynard Keynes smile with pride.

This will go on until, as Jim Rickards puts it, the world’s governments figure out that competitive devaluation is a zero sum game and that the one thing they can all devalue against is gold. A “monetary reset” will result, with the major currencies once again becoming simply names for given amounts of gold — at $10,000 an ounce.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.