Interest Rate Policy Global Divergence - Really?

Interest-Rates / Global Financial System Aug 13, 2014 - 12:01 PM GMTBy: Axel_Merk

If you own dollars, the euro or gold, you might want to pay attention to this one.

If you own dollars, the euro or gold, you might want to pay attention to this one.

What could possibly be wrong with conventional wisdom? It shouldn't be a surprise that pundits merely regurgitate what others say. But why would Draghi join the fray? It turns out, he has a vested interest in the 'policy divergence' view, as promoting it might help to weaken the euro. If indeed the U.S. interest rate path is upward, while rates in the Eurozone stay lower for longer, it might justify a weaker euro.

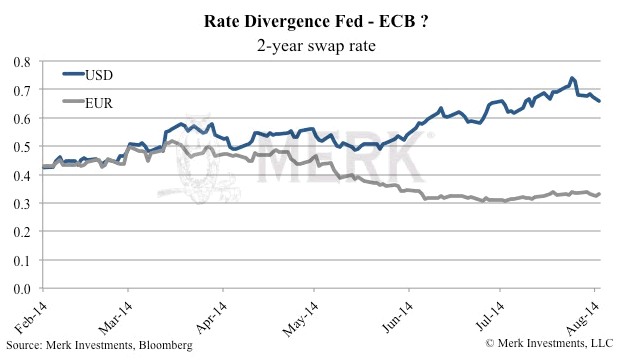

So, sure enough, at first blush, they have a point:

The above chart compares the "2-year swap rates" for the U.S. dollar and euro. In essence, this chart shows the market expects short-term rates to be higher in the US than in the Eurozone over the next two years. It also shows that the gap has generally been widening in recent months.

But this only tells us part of the story. That's because the above chart reflects nominal rates to be rising, but reflects nothing about real interest rates (i.e., interest net of inflation).

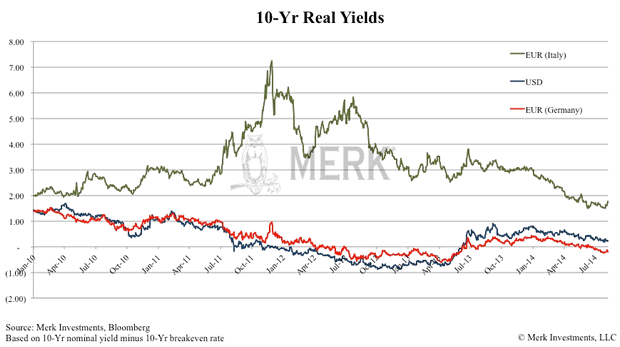

If we only looked at German 10-year real yields versus U.S. 10-year real yields, U.S. yields are higher. However, the Eurozone is more than just Germany (and the ECB's mandate is to keep Eurozone inflation close to, but below 2%). Only Germany, France and Italy have inflation protected securities akin to the TIPS available in the U.S. that are commonly used to determine market expectations for real yields. As the Italian real yield line above suggests, a blend of Eurozone yields will be higher. On a real basis, Eurozone 10 year yields are higher than U.S. yields.

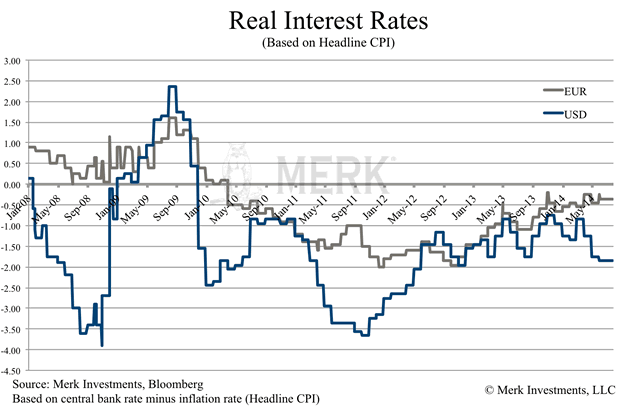

While looking at 10-year real yields is an interesting exercise, let's take the discussion closer to the present where current prices are determined:

The chart above shows that real interest rates in the U.S. are not only lower than in the Eurozone, but also that the divergence has been growing in the opposite direction of nominal rates. The Eurozone is holding steady, whereas U.S. real rates are falling. Please also see our recent analysis on the course of the Fed (Fed Exit a Blue Pill?).

So what is it now? In this currency war, one might be excused for not recognizing who is the most dovish of them all. Basically, the market currently prices in that nominal interest rate hikes might indeed be coming. But our interpretation is also that inflation, at least in the short-term is higher in the U.S. than in the Eurozone. If inflation indeed is picking up and central banks stay put, they will be "behind the curve," meaning real interest rates may continue to be negative for a very long time.

Now let me ask you this: is the U.S. or Eurozone more vulnerable to inflation? In the U.S., the banking system is much healthier than in the Eurozone. While Fed Chair Yellen preaches we can't have inflation given the slack in the economy, former Fed Chair Volcker has said the inflationary experience of the 1970s had proven this argument wrong.

Contrast that with the Eurozone where many banks continue to be impaired. While policy makers work hard to improve the banking system there, the short of it is that - at least in our assessment - it will be much harder for inflation to gain a foothold.

Having said that, if we do get inflation to gain a foothold in the U.S., I have little doubt that it will also be exported to other regions in the world. However, our analysis suggests that inflation may have a much easier time to build in the U.S. than Eurozone.

So while pundits, experts, policy makers - you name it - jump on the bandwagon of a U.S. "exit" and "policy divergence", we can't join the fray:

• An environment where real interest rates are negative, and trending to be more negative, and where Fed Chair Yellen has indicted she will be slow in raising rates is not an "exit." In our analysis, this is financial repression as far as the eye can see.

• We see real interest rates higher in the Eurozone than in the US for the foreseeable future, even as nominal rates might be diverging. Nominal rate increases make for good headlines, but might make for poor investment decisions.

In the introduction, we mention implications for the dollar, euro & gold. If real rates stay negative for an extended period, this may bode well for gold and poorly for the U.S. dollar. And while Draghi has had the upper hand in weakening the euro for a couple of weeks now, this streak may come to an end. If you haven't done so, make sure you sign up for this free newsletter.

If you believe this analysis might be of value to your friends, please share it on your favorite social media site.

If you haven’t done so, make sure you sign up for this free newsletter. Please share this newsletter with your friends.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.