The Picture of America's Old and Sick Economy

Economics / US Economy Aug 10, 2014 - 02:48 PM GMTBy: Jas_Jain

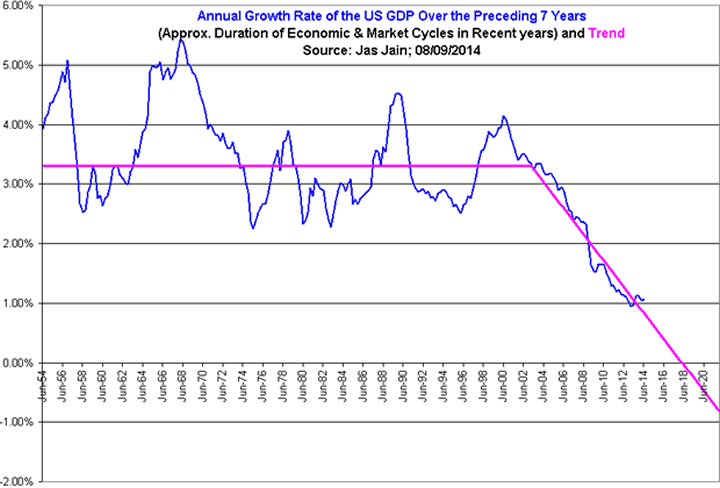

As I reported in January 2005 ("Debt") the secular growth in the US GDP ended in late 1990s and all the growth since then has been a result of accumulation of the consumption debt (fiscal deficits plus household debt), as opposed to growth based on incomes, savings and investment, and I predicted that this build up in consumption debt would act as a big drag on the future economic growth. Now, the results (based on the latest GDP data with revisions) are in. Figure below shows the annual growth rate for the preceding 7 years (to smooth out the variations due to the business cycles).

The behavior has completely changed beginning in the 2001-2007 cycles. So, the very weak growth that we are witnessing today began in the previous cycle under GW Bush and has continued during Obama's tenure. The key players during these two cycles have been Greenspan and Bernanke. The key contributor has been the increasing debt burden that began under GW Bush driven by fiscal and monetary stimuli. The downtrend in the graph is unmistakable evidence of my thesis on debt build up and the drag on the future growth. Also, the US economy appears old and sick despite all the growth in gadgetry and the social media.

What Would Negate the Down Trend In the Graph?

If there is no recession in the US until after the end of 2016, i.e., Janet Yellen's forecast about the economic growth is close to the mark. My forecast is that most likely the next US recession would begin by 2015Q1, but under no circumstance I can see a scenario whereby there is no recession by the end of 2016. Under my scenario and as per the trend line shown in the graph the next recession would mark the beginning of a depression because conditions around the globe, especially the debt build up, are far worse than in 2007. There is very little margin for error by policymakers in many countries.

It is the debt, stupid!

By Jas Jain , Ph.D.

the Prophet of Doom and Gloom

Copyright © 2014 Jas Jain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.