Gold And Silver Will Rise With US Dollar Demise, Just Not Soon

Commodities / Gold and Silver 2014 Aug 09, 2014 - 05:26 PM GMTBy: Michael_Noonan

What do you get when a bunch of unelected bureaucrats band together? The EU. How is the EU different from the US? There is no difference, except that the US has the illusion of electing bureaucrats. The de facto corporate federal government remains undiscovered by the vast majority of US citizens. Thanks goes to the Rothschilds for setting everything up.

What do you get when a bunch of unelected bureaucrats band together? The EU. How is the EU different from the US? There is no difference, except that the US has the illusion of electing bureaucrats. The de facto corporate federal government remains undiscovered by the vast majority of US citizens. Thanks goes to the Rothschilds for setting everything up.

When one utilizes the axiom, "Follow the money," all roads lead to the Rothschilds and their formula of gaining control of a nation's money supply and then making all the rules. While that is the simplified version, it is no less insidiously true. In the process of gaining control of a nation's money supply, each country's gold holdings were ransacked, and in the case of the US, the then world's largest silver holdings were also stolen.

By following the money in the US, one sees the trail of US Treasury Notes that were specie backed by silver and gold. The nation prospered, and inflation was a non-issue. After the Federal Reserve Act was passed in 1913, the privately owned bank, called the Federal Reserve, began circulating Federal Reserve Notes that were also specie-backed, to circulate alongside US -issued Treasury Notes.

This went on for a few decades, until the 1930s, when Franklin Delano Roosevelt declared a "bank holiday." Why? The US was forced into bankruptcy by the Rothschild elites, and when the banks were closed for a few days, they reopened under direct control of the Federal Reserve central bank. What was little noticed was that the specie-backing of gold and silver for the Federal Reserve Noted were gradually withdrawn, without any word to the public. At the same time, specie backed US Treasury Notes were withdrawn from circulation and destroyed!

The Rothschilds will not accept any competition. The US Treasury Notes were allowed to circulate alongside the Federal Reserve Notes so that the public would accept both and see no difference between the two, so that by the time the US Notes were purposefully taken out of circulation, the remaining Federal Reserve Notes, also labeled as and called "dollars" were readily received as the nation's currency. The first stage of the world's largest Ponzi scheme succeeded. Next was the removal and eventual suppression of the price of gold, an ongoing activity by central banks, with the collusion of the bought-and- paid-for de facto government from that time and up to this day, and for the foreseeable future.

Since the United States has been bled dry of all its gold and silver, and the fiat Federal Reserve Note has just about run its course as the world's reserve "petrodollar" currency, the next grand prize is Russia, the world's richest natural resource country, by far. The attack on Russia and/or confrontation has been going on for decades, also using NATO to encircle that country militarily. The most recent provocation is Ukraine, in a so far politically botched attempt to weaken Russia and paint Putin as negatively as possible.

Why go after Russia? Its leadership role in providing liquid natural gas and other energy supplies to Europe has been posing a threat to the supremacy of the fiat Federal Reserve pertrodollar. China also plays a role, perhaps an even larger one in the "de-dollarization" in world trade that will ultimately plunge the US deep into Third-world living status, and an irreversible change that will shock unprepared US citizens when "dollar" devaluations kick in.

The stranglehold of the Western world's financial banking system by the elites is not about to be easily wrested from them. The willingness to see Ukraine destroyed as a nation, as well as so many innocent lives, is an example of how the elite-led US warmonger will do whatever it takes to try to weaken and demonize Russia and Putin. The fact that Obama stated that the downing of Malaysian flight 17 was Putin's doing, immediately after the event, and parading fawning US generals on national television to also echo that Russia was to blame prove to be totally false. It has since been proven that the US-directed Kiev air military purposefully shot down the commercial airliner, killing all innocent people on board as an act to blame Russia. This is how the elites operate, not caring who or how many people are killed in their pursuit of maintaining monetary control.

Obama has been doing everything possible to start another war in order to keep the fiat Federal Reserve Note "dollar" propped up. Going after Russia exposes the US as nothing more than war-driven inept, but dangerous fools. Now, Obama is starting to drop bombs in Iraq to counter the ISIS terrorists taking over that bombed-out, broken country. Who are the ISIS terrorists? The same group armed and trained by the CIA to fight in Syria. Well-trained and well-armed, these extremists have gone rogue, a consequence of the supposedly hidden agenda of defending the fiat "dollar," people be damned in the process.

The idiotic sanctions Obama keeps on imposing on Russia are now backfiring even more. Putin is striking back, banning food imports from the EU. This is just what the insolvent EU nations need, more weakening of their economies. It is costly for EU nations to be the lap-dog for Obama. Soon, reality self-survival will surface, and EU nations will learn to just say No! Austria already has. France has. Bulgaria is on the fence, depending on how quickly the IMF can put pressure on Bulgarian banks.

Germany has been lacking integrity, with over 3,000 businesses dealing extensively with Russia, with 30%-40% of its energy needs coming from Russia. Russia is using German lawyers to improve Russia's international laws to improve the willingness of foreigners to conduct business with Russia. Why does anyone think Germany will alienate Putin and put their economical strength at risk? Yet, Germany [Merkel] is dragging her feet in breaking away from the model of war and banking suicide, in favor of aligning with greater growth and financial health with Eurasian nations. An inexplicable Why?

The fact that the West is fading fast, choking on trillions in worthless derivatives that are propping up the all but failed Western financial system, and can keep countries like Germany in the fold is a testament to how fierce the elites will exert whatever control they can over each country, mostly by financial threat of destroying the country's banking viability.

Russia to Europe: You want gas? It will cost you. Price? Pay in rubles, yuan, maybe even gold. You want to pay in "dollars?" No sale.

What does all of this have to do with the price of gold? The US/UK central banks are still manipulating prices, refusing to allow any consideration for gold being viewed as money alternative, at least in the West. The BRICS and associate countries ain't buying what the West is selling, in that regard, but the BRICS are buying gold, as much as they can at these artificially low prices. Nothing else matters, certainly not any conventional fundamentals.

Once the grip of the fiat "dollar" gives way, and it is slowly losing ground, then the price for gold and silver will find their more natural value. Not until. When might that happen? It could be weeks, it could be months, maybe even another year or two, but whenever it happens, it is more likely to be an overnight "adjustment," with little or no gradual rise, as many may expect. The price could be $1,300 or $1,800 one day, and the next day it could be $4,500 or $7,500 the ounce. No one knows for certain, but at least you know some of the options. Plan accordingly.

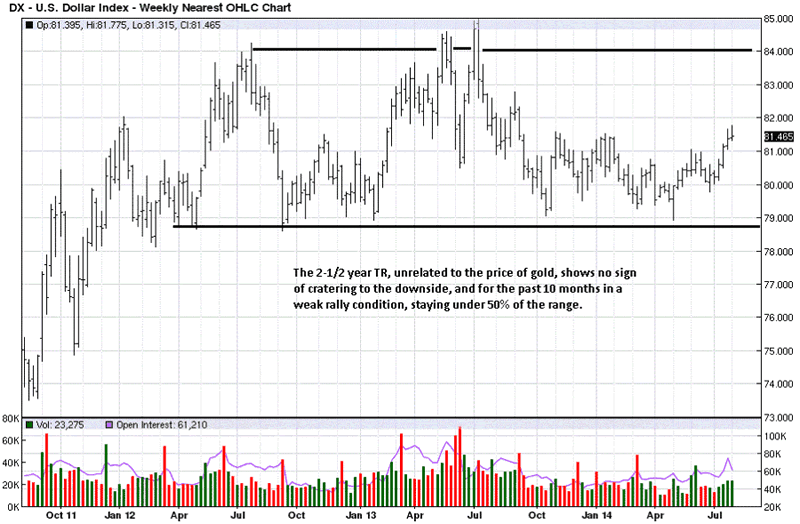

A look at the backed-by-nothing-but-fear-of-consequences-for-not-using-it fiat Federal Reserve Notes, aka the "dollar," show it locked in a seemingly harmless Trading Range, [TR]. Since October 2013, rallies have been weak, staying under the 50% retracement of range area. There are no signs of impending demise for the Index, which is exactly what one would expect from the master manipulators.

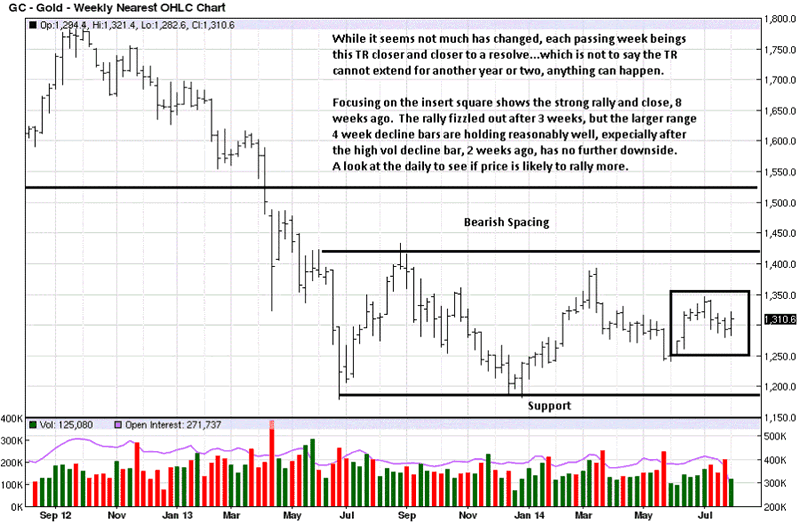

Two things stand out in this chart: 1. price remains locked in a lower end TR, and 2. the entire TR is well under the Bearish Spacing price area. Notwithstanding the comments on the chart, these two obvious, observable facts tells us that gold continues to be suppressed. What is kept invisible as a part of the active suppression are the controlling derivatives and the banker positions that offset the huge down days to keep prices low.

The collapse of the derivatives may be a function of or cause of the "dollar" collapse, and when it happens, it will be the triggering mechanism to catapult gold higher "overnight," literally. Not owning physical gold is a huge risk. Retaining whatever physical already in possession will be a financial life-saver. Keep buying whenever and whatever you can, and do not be concerned about the "When?" question. No one knows when prices will rise. Stay the course.

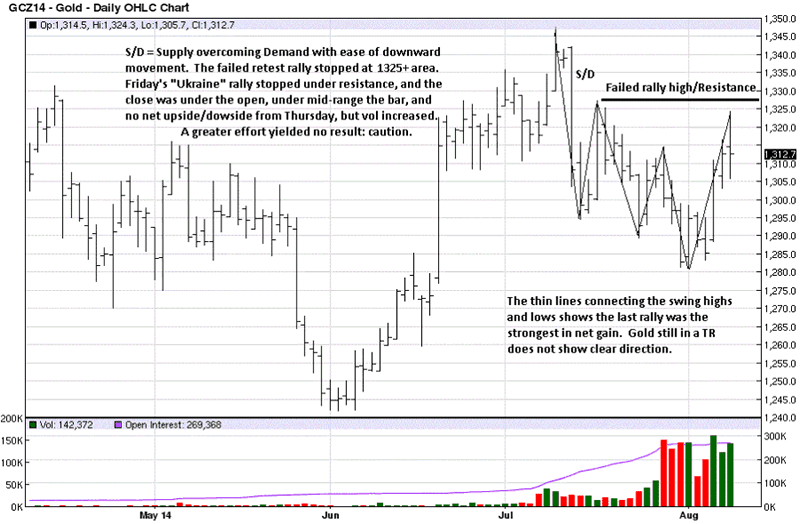

Gold had its strongest rally since the July swing high, but the read of Friday's bar activity suggests sellers won the battle that day. It has not worked to buy high for breakouts in gold, so one must be more select when working the buy side.

What is important to watch for next is how price reacts from Friday's high. If the market is to continue to rally, the next correction should have smaller ranges to the downside on a lessening in volume. This will tell us the selling is weak. As the daily chart stands, it is not giving any clear sign of market strength. That could change next week, but until the change occurs, gold will continue to struggle.

Not much has changed since last week's analysis, except one more week added to the RHS [Right Hand Side] of the developing TR. There are no apparent signs of accumulation on the part of buyers, so more of the same activity can be expected, at least until a clearer change is affected.

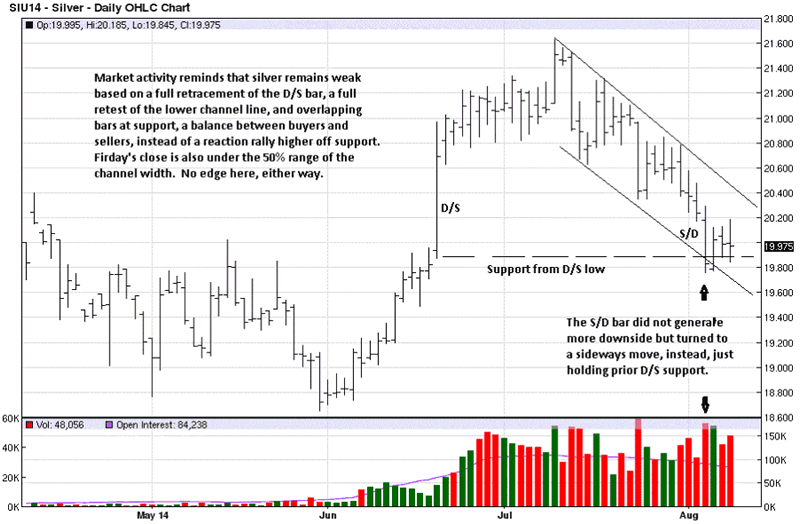

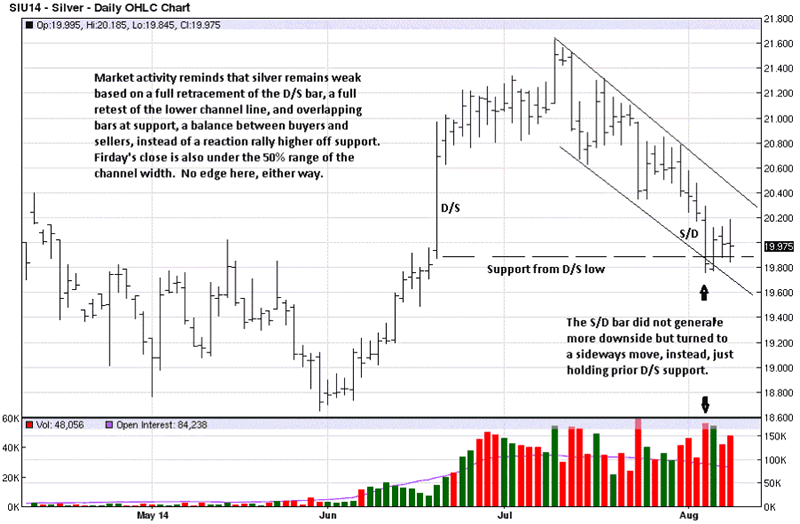

The chart comments are the best summation for how to view silver. This is a great level to keep increasing one's accumulation, with the gold/silver ratio favoring the purchase of silver over gold, for now. Keep on stacking!

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.