European Stock Markets Look Downright Scary

Stock-Markets / European Stock Markets Aug 09, 2014 - 12:12 PM GMTBy: Sy_Harding

Here’s the situation.

Here’s the situation.

The economy of the 18-nation European Union is about the same size as that of the U.S., with roughly equal impacts on each other and on global growth. Germany, France, and the U.K. are the largest economies in the EU, and the fourth, fifth, and sixth largest economies in the world.

The stock markets of those major European economies have been tracking in tandem with the U.S. market for years, showing similar resilience, making new highs together.

They are still moving somewhat in tandem with each other, being in short-term pullbacks together.

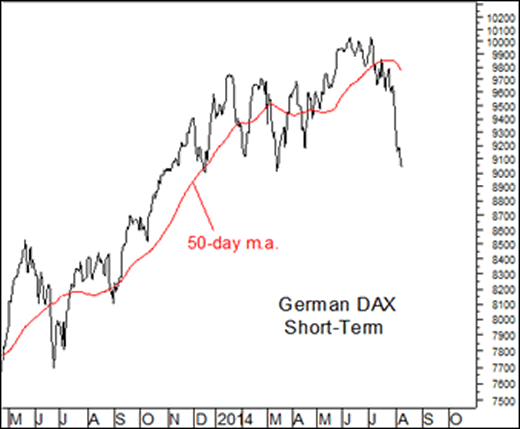

However, while the S&P 500 topped out into its pullback just two weeks ago, and is down less than 4%, European markets topped out two months ago, and on average are already down about twice as much, and still declining. That has them still within the confines of a brief, normal, and overdue 10% correction.

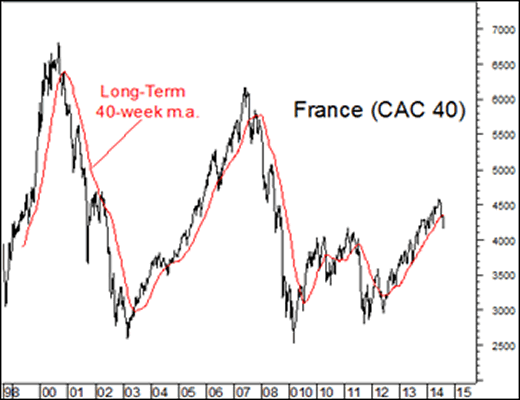

However, in their pullbacks the major markets of Europe have broken beneath not just short-term and intermediate-term support levels, as has the U.S. market, but beneath their long-term 200-day (40-week) moving averages.

That is potentially ominous based on what usually happened in the past after similar breakdowns of long-term support.

The breakdown is blamed primarily on investors being nervous about the situation between Russia and Ukraine.

Let’s hope so, as reports on Friday were that Russia announced (for the second or third time) that it will pull its troops back from Ukraine’s border, and once again that provides hope that the situation is cooling off.

However, the real catalyst for the market sell-off in Europe is more likely that European economies have become seriously problematic again, which is potentially a longer-term problem.

For instance, first quarter GDP growth for the 18-nation euro-zone was barely positive at 0.2%, and Germany’s growth of 0.8% was the primary driver of that.

Reports are beginning to come out on second quarter growth, and this week’s report was that Italy’s economy slid back into recession in the second quarter. And in the last few days, it was reported that factory orders in Germany plunged 3.2% in June, after declining 1.6% in May. Indicating the weakness in the rest of the EU, Germany’s incoming orders from other euro-zone countries plunged 10.4%. Additionally, industrial production in Germany declined 0.5% in June, widely missing the consensus forecast of a gain of 0.3%.

Those dismal reports from Germany raise concerns that its economy may have been no better than flat in the 2nd quarter, raising the possibility that the overall eurozone slid back into recession. Meanwhile, retail sales in the overall euro-zone declined again; Moody’s rating services downgraded U.K. banks from stable to negative; and the economic warfare of escalating sanctions being imposed by western nations on Russia, and retaliatory sanctions by Russia, is not a positive for the economies of either side.

On markets, the pullback has European markets oversold beneath their short-term 50-day moving averages to a degree that should bring at least a short-term rally attempt.

Let’s hope that if U.S. and European markets are to continue moving in tandem with each other, that European markets can rebound quickly back above their long-term 40-week moving averages before the U.S. market follows them into breaks below its long-term supports.

However, as the intermediate-term charts show, that has not happened very often in the past once that important support has given way.

It seems clear that short-term bounces notwithstanding, it is still a time to be very cautious and defensively positioned on both the U.S. and European markets.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.