Bitcoin Price at Beginning of a Move up?

Currencies / Bitcoin Aug 09, 2014 - 11:48 AM GMTBy: Mike_McAra

In not too many words: we support long speculative positions in the market, stop-loss at $550, take-profit at $880.

In not too many words: we support long speculative positions in the market, stop-loss at $550, take-profit at $880.

Coinbase, a San Francisco based Bitcoin exchange, announced yesterday that the Wikipedia Foundation had received over $140,ooo in Bitcoin donations during the first week this option was available to donors:

Since it was founded in 2001, Wikipedia has provided tremendous value to the world by making it easy and free for anyone with an Internet connection to consume information. We were particularly excited to enable the Wikimedia Foundation to accept bitcoin donations because we feel that the decentralized, inclusive nature of Wikipedia is well aligned with Bitcoin and we wanted to help the Bitcoin community contribute to the democratization of information.

Today, we are thrilled to announce that in the first week of accepting bitcoin, the Wikimedia Foundation has received over $140,000 in bitcoin donations.

Wikipedia is run by a non-profit organization and has been able to operate ad-free because of the generosity of donors from across the world. For donors worldwide, bitcoin is a convenient donation method that ensures 100% of donated funds go to the cause. Donors can also enjoy significant tax benefits by donating bitcoin. As inspiring non-profits such as the Wikimedia Foundation continue to adopt bitcoin as a payment method, we look forward to seeing you and the community show strong support as well.

Even if this is not a major market event, we still see it as a sign that there is an audience willing to make donations using their bitcoins. This might as well prompt other non-profit organizations to consider accepting Bitcoin.

This also shows another way to put Bitcoin to good use. With the technical development of Bitcoin and with improvements in the security department we would expect to see a further shift in perception of Bitcoin by the mainstream audience. We’ve already seen less of a discussion about the illegal ways to use the cryptocurrency and more about the opportunity it might hold for the payment system and for international money transfers.

For now, let’s focus on the charts.

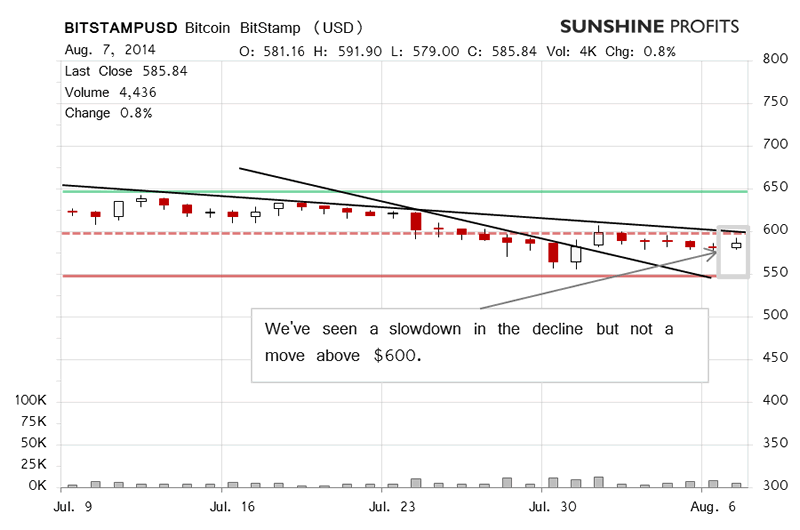

On BitStamp, we saw a move up but it was not strong as the trading was down from the day before, which doesn’t quite confirm the appreciation. Yesterday, we wrote:

We haven’t seen much change which, following our remarks from yesterday, means that we would prefer to stick with our pre-determined investment strategy. The recent increases in volume might not be sustained today (this is far from certain as the day is not over yet) but even if this is the case, it seems that we’ve seen a period of trading picking up without a clear and strong move of the exchange rate in either direction.

In fact, the volume was down. Today, Bitcoin has edged up (this is written before 9:30 a.m. ET), the volume might be up at the end of the day (this is not certain, though) but the action we’ve seen doesn’t seem representative of a strong move. As a result, it seems that there hasn’t actually been much change in the market.

We’re above one of the possible recent short-term trend lines but below a second. At the moment $600 (dashed red line) looks like the level to observe as far as appreciation is concerned.

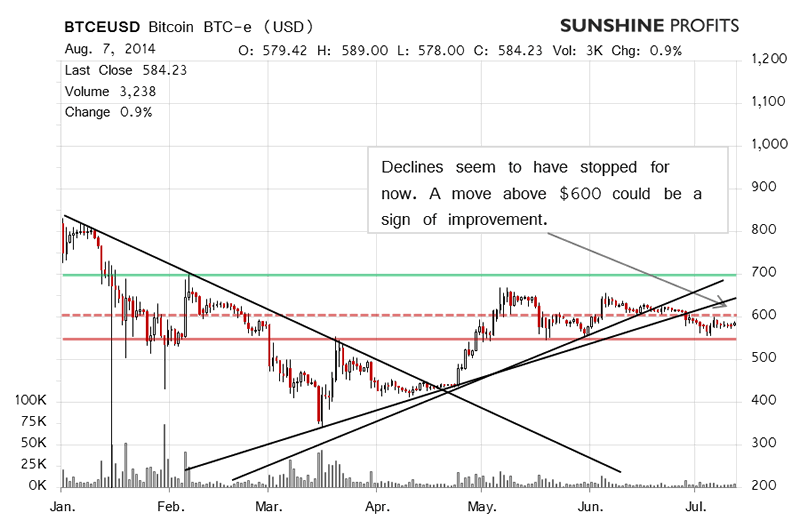

On the long-term BTC-e chart, Bitcoin is above our stop-loss level at $550 (solid red line) but still below $600. Right now Bitcoin seems to be edging up toward $600 (dashed red line), a level which might be the starting point of another move up. Will this move last? This is probably what Bitcoin investors are considering at the moment. We provide our opinion on that in the next few paragraphs.

If you recall, yesterday we wrote:

The fact that we haven’t seen action recently, there has been no strong move down and Bitcoin has been consolidating for about two months now suggest that we might see a stronger move in the future. We would expect more volatility and a more decisive move up to follow in the next couple of weeks.

This hasn’t happened just yet. The volume was up yesterday but it wasn’t strong. Today, Bitcoin’s been going up and down on volume which hasn’t been strong. Today’s move might turn out to be another day of appreciation but we haven’t seen enough to be overly optimistic just at this moment.

To answer the question on whether the move will last, this might be the case if we see a surge in volume. Our bet is on a move up and we expect Bitcoin to appreciate in the next couple of weeks. An explosion in volume could be a signal that this move has in fact started.

Summing up, in our opinion long speculative positions might be the way to go now.

Trading position (short-term, our opinion): long, stop-loss at $550, take-profit at $880.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.