Gold Positive Fundementals as Western Economies Face Stagflation Threat

Commodities / Gold & Silver May 12, 2008 - 11:58 AM GMTBy: Mark_OByrne

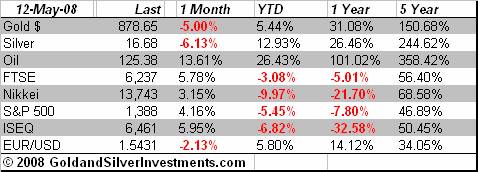

After last week's more than 3% gain in gold, gold surged to nearly $890.00 in early trading in Asia prior to succumbing to subsequent profit taking. The London AM Gold Fix at 1030 GMT this morning was at $887.25, £453.91 and €573.60 (from $863.50, £434.64 and €556.74 on Friday).

After last week's more than 3% gain in gold, gold surged to nearly $890.00 in early trading in Asia prior to succumbing to subsequent profit taking. The London AM Gold Fix at 1030 GMT this morning was at $887.25, £453.91 and €573.60 (from $863.50, £434.64 and €556.74 on Friday).

It is hard to see gold falling significantly this week unless there is a sharp fall in oil prices and strengthening of the dollar – both of which seem unlikely. However, gold has surprised to the downside in recent weeks and further consolidation may be needed prior to challenging $900 again. With oil remaining well bid above $125 and geopolitical risk in Nigeria, Lebanon and Iran still of importance, gold looks likely to be well bid at these levels.

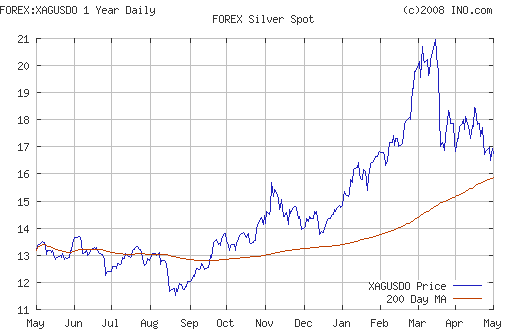

Technically, gold acted very well last week with a fall to support at $850 and then a strong bounce and higher weekly close. Silver did likewise (up 2.6% for the week) and a possible positive harbinger for the week to come was the strong rally in the XAU and HUI gold mining indices (up 6.3% and 5.9% respectively). The PGM's of palladium and particularly platinum were also stronger with UBS launching a platinum ‘note' for those wishing to speculate in platinum without owning the underlying physical asset.

Gold seems well supported above previous resistance at the record nominal highs of $850 and at the 200 day moving average at $831 and the short term trend is now up again.

Today's Data and Influences

The market awaits a host of Fed speakers (including Bernanke) scheduled over the coming week to see their opinions regarding the risks to growth and the burgeoning threat of inflation. There are, in addition, several key economic releases this week, in a very busy week, that could test the dollar's recent bounce. There is nothing on the economic calendar today and gold will likely take its cue from the wider markets.

The long term technical charts remain positive and absolutely nothing has changed with regard to the long term fundamentals of the gold bull market which will ultimately be dictated by the laws of supply (falling) and demand (rising – particularly investment demand).

Stagflation Threat

Stagflation remains the primary threat to western economies and financial markets and yet bizarrely stagflation remains taboo in much of the financial community. Oil is at $125 and some including some in Goldman Sachs are now calling for oil to reach $200 per barrel. The CRB Commodities Index reached new record highs proving the commodity bears wrong once again and showing that inflation is not some short term phenomenon that will conveniently and happily disappear as soon as it arrived. Certainly, not with the central banks helicopters continuing to print paper money like snuff at a wake. Unfortunately, after every good wake comes a serious hangover and this seems the fate of many western economies.

Gold in a bubble according to those who never predicted gold's rise in first place

Those who never correctly predicted oil at over $100 and gold at over $1,000 in the first place continue their mantra that oil and gold are overvalued and are ‘bubbles'. They were absolutely wrong before and their opinions should not be given any more credence now. These same commentators have never understood the supply demand fundamentals driving the commodity markets and continue to focus solely on the speculative element in the commodity markets. While there is indeed speculative elements in these markets as there are all markets, it is more than arguable that there is less speculation in the precious metals markets than in most markets.

Gold is not in a bubble. It may be in a bubble when it reaches it's not non inflation adjusted high of some $2,400 per ounce in the coming years (depending on global macro fundamentals at this time) There is little or no hot fast money as was seen in the NASDAQ boom when mass participation and day trading was evident. Or even in the property and ‘buy to let' mania of recent years.

Gold remains the preserve of the risk conscious and the knowledgeable. It is slow monthly and quarterly money and allocations from individual investors, pension funds and institutions pushing up prices because they want a finite currency and hard asset and need diversification as many remain overweight equities (some dramatically so) and overexposed to property markets.

An important fact unacknowledged by the bears (one of many) is that of $1,000 of investable products across all financial markets in recent years a mere $3 was invested in commodities - and gold is a subset of that 0.3 % allocation to commodities. While this allocation is increasing significantly, it is doing so from a tiny, tiny base and thus remains a fringe investment at best. This is changing and will continue to do so especially given the risky macroeconomic and geopolitical outlook.

Silver

Silver is trading at $16.78/16.83 per ounce at 1200 GMT.

PGMs

Platinum is trading at $2048/2058 per ounce (1200 GMT).

Palladium is trading at $434/439 per ounce (1200 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.