Gold and Silver Good Vibrations

Commodities / Gold and Silver 2014 Aug 03, 2014 - 02:34 PM GMTBy: Jesse

"Love does not consist in gazing at each other but in looking outward together, in the same direction." Antoine de Saint-Exupery

"Love does not consist in gazing at each other but in looking outward together, in the same direction." Antoine de Saint-Exupery

As it is in love, so it is in most endeavors involving groups of people. There must be a meeting of the minds, and a commitment to common goals despite any differences.

More simply, it is the priority of caring. It is torn apart and rendered helpless by stubborn grudges, obstinate pride, and the indifference of selfishness and injustice.

I have seen even venerable organizations torn apart by the willful selfishness and jealousy of a relative, but powerfully articulate, few. They took the ship itself down, fighting for every last perk, every last vestige of power.

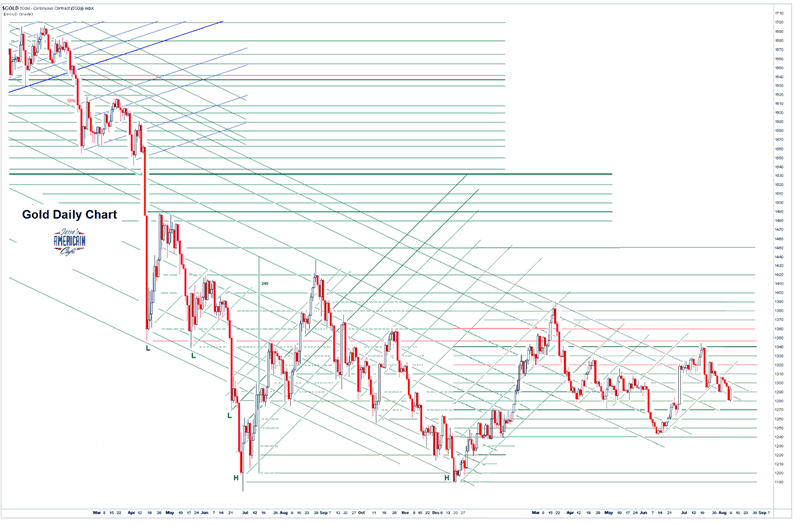

Gold had a bounce back today, while silver tended to linger near the lows for the week. For some reason I had a very good feeling about the action in gold as I watched the tape.

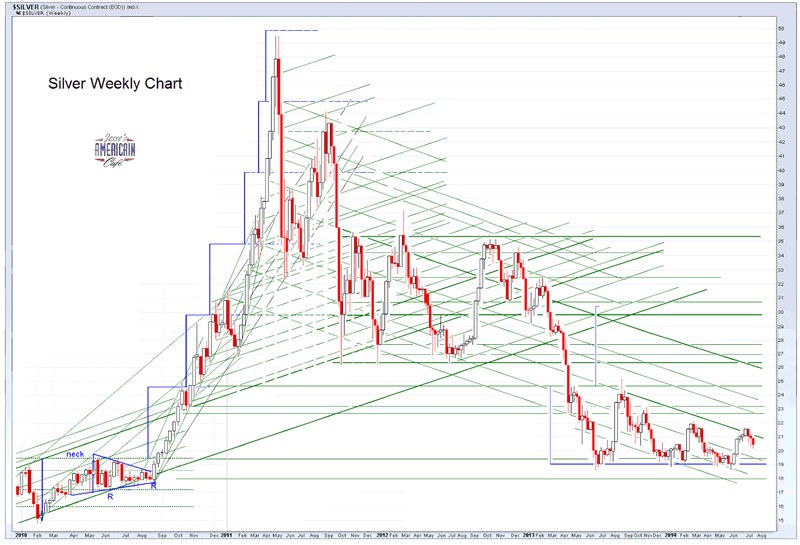

There was nothing particularly remarkable in the price action, except for the obvious capping which is back on, keeping gold below the psychological level of 1300 and silver below 21.

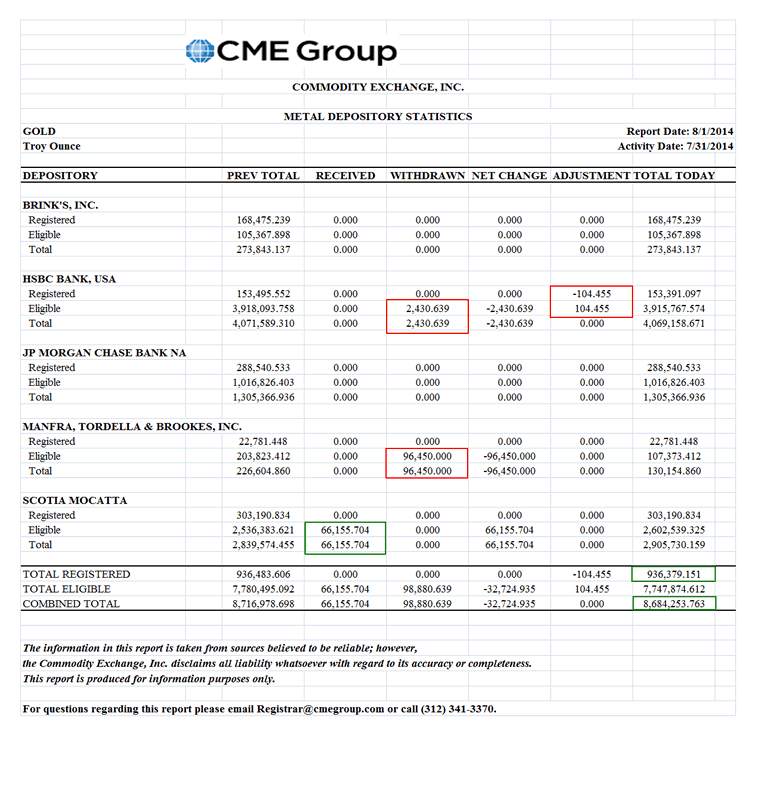

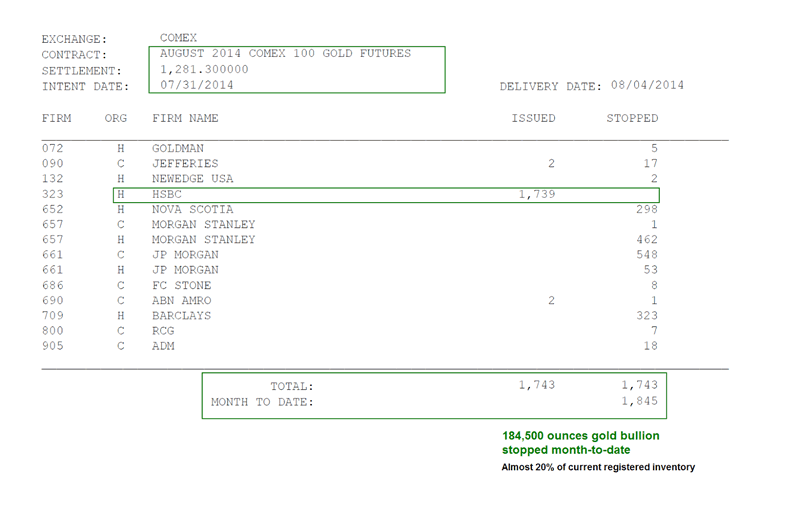

What was surprising is that in the first report for the month of August almost 20% of the registered gold in the Comex warehouses was stood for in delivery at the price of $1281. We won't see what happened today until next week.

This is not to say that the Comex will run out of gold, or that this is some kind of default scenario. As we have seen, the Comex is no longer a delivery market, and most of the metals there just move around the plate within the warehouses and the ETFs and Funds.

Rather it was an indication that a price level of 1281 brought out a lot of buying. So we will take it for what it is worth.

It appears that the silver inventories in Shanghai are exceptionally low.

Geopolitical jitters will continue to dominate, and the US economy will continue to stagger on, given the life support trickled into it by the Dr. Feelgoods at the Fed, and the Dr. Frankensteins in the Congress.

Remember the innocents, and all those who suffer in quiet with their own burdens and trials everywhere. Harshness is the easy course, and a strong temptation, to finally become what we hate. Love is the way of all goodness, and life.

In the beginning, a man will marry a woman because he thinks that she will not change. And a woman will marry a man because deep down she thinks that she can change him. As they get older, a man grows sentimental, and a woman grows much more practical.

But in the end, it is all the same if they are still together, as one looking outward at life together.

Have a very pleasant weekend.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.