Gold Price Trend Like Watching Paint Dry...

Commodities / Gold and Silver 2014 Aug 01, 2014 - 10:13 PM GMTBy: Alasdair_Macleod

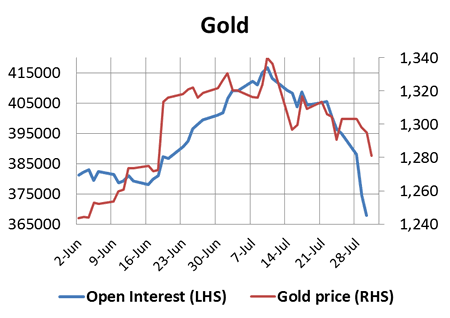

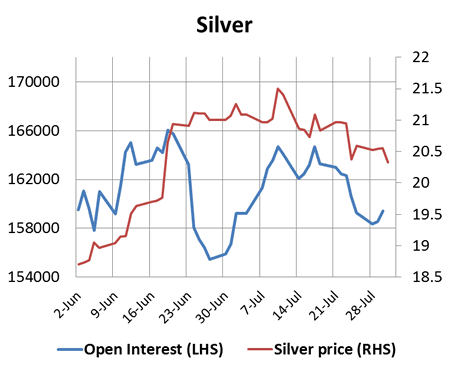

That was how it felt watching all markets this week until yesterday when they sprang into life. Gold fell from $1304 at the London opening last Monday to a low point of $1281 yesterday, down 1.8% on the week, while silver fell from $20.60 to $20.35, down only 1.2%. These moves were relatively small compared with action elsewhere. Here are the charts showing price and open interest for gold and silver on Comex.

That was how it felt watching all markets this week until yesterday when they sprang into life. Gold fell from $1304 at the London opening last Monday to a low point of $1281 yesterday, down 1.8% on the week, while silver fell from $20.60 to $20.35, down only 1.2%. These moves were relatively small compared with action elsewhere. Here are the charts showing price and open interest for gold and silver on Comex.

Note how Open Interest in gold has collapsed by nearly 49,000 contracts since the peak on 10th July. This is principally due to the August contract winding down, with only a portion being rolled into December. Silver's OI on the other hand has held up relatively well, and its performance relative to gold has been remarkably strong.

In both cases the swaps category, which is mostly foreign banks, has recently accumulated large short positions. It will be interesting to see to what extent these positions have been closed down when the Commitment of Traders Figures for the second half of this week are released next Friday.

Precious metal markets weathered two important announcements on Wednesday. First, the Fed's FOMC completed its two-day meeting, and unexpectedly one committee member, Charles Plosser, dissented from the agreed statement in more hawkish tones. And secondly, the first estimate for Q2 GDP at 4% annualised was significantly higher than market expectations, as if to drive Mr Plosser's point home.

The impact of these developments was dramatic, sending the dollar higher against all currencies, but most notably the yen. Bond yields rose from recent lows, and equities fell sharply with a 300-point fall on the Dow yesterday. Less rationally commodity prices fell, with WTI crude falling through the $100 level to $98. So it is hardly surprising that gold and silver were marked down along with everything else.

Much of the fall was in US trading hours, so was a paper-driven gut reaction, and coincided with end-of-the-month book-squaring. It will be interesting to see if over the course of today physical demand for precious metals returns in London at these lower prices.

We may find in retrospect that this week was pivotal. China's equities were sharply higher (up over 7% since 21 July) on recent PBOC moves to ease liquidity strains, and the Japanese yen has started falling again having failed to break the ¥101 level. This may signal a return to the yen's bear market, which would be consistent with Japan's economic fundamentals. This being the case we can expect yen carry-trades to profitably finance global bull markets for the foreseeable future. It should also rekindle Japanese demand for gold.

Next week

Monday. UK: Halifax House Price Index. Eurozone: Sentix Indicator, PPI.

Tuesday. Eurozone: Retail trade. US: Factory orders, IBD Consumer Optimism, ISM Non-Manufacturing.

Wednesday. Japan: Leading Indicator. UK: Industrial Production, Manufacturing Production. US: Trade Balance.

Thursday. UK: BoE MPC Rate Decision. Eurozone: ECB Deposit Rate. US: Initial Claims, Consumer Credit. Japan: Bank Lending Data, Current Account.

Friday. UK: Construction Output, Trade Balance. US: Non-Farm productivity, Unit Labour Costs, Wholesale Inventories. Japan: BoJ MPC Overnight Rate.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.