USD Topping Out – Nikkei Weekly Pin Bar

Currencies / US Dollar Aug 01, 2014 - 09:58 PM GMTBy: Submissions

Forex Kong writes: The other day’s 100 pip ramp up in USD/JPY has stuck – so far.

Forex Kong writes: The other day’s 100 pip ramp up in USD/JPY has stuck – so far.

Sitting up here at the top end of the range it’s obvious that The BOJ did everything it could “pre U.S GDP debacle” to keep the status quo and defend the line at 101.20.

Please appreciate the significance of this as…..the ultimate “breakdown” in USD/JPY is the signal / breakdown required for this entire “house of cards” to take a serious, serious blow.

The fact that currency markets have literally “stood still” for the past 48 hours as global equities take their first serious hit in months says a lot – affirming “just how desperate” the co-ordinated effort of Central Bankers ( to keep this ball in the air ) has become.

The subsequent breakdown in /ES ( SP 500 futures ) has now broken below major support that “under any normal conditions” would signal what we usually call an “intermediate decline” but again…..considering who we’re up against – I can’t get too excited looking for much further downside short of this thing “popping” higher first.

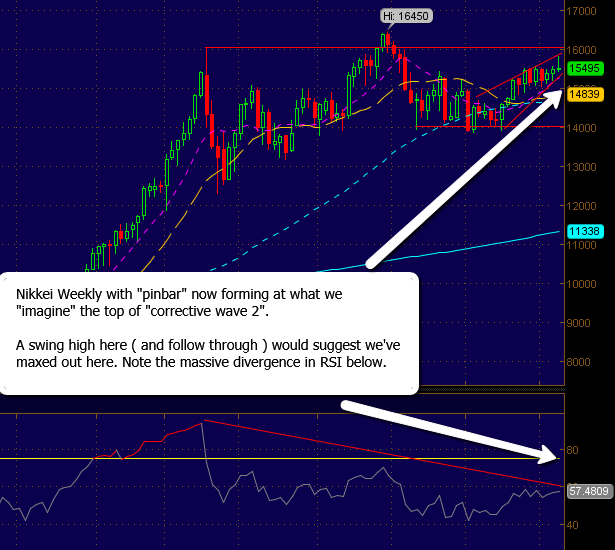

Nikkei ( as suggested the other day ) appears to have “popped and dropped” back into it’s near term range , also generating an interesting looking “pin bar” on the weekly time frame. The likely “top of wave 2″ in our existing framework.

Considering the waves of poor data that continue to flood out of Japan it’s “all but certain” that the recent ramp job was / was purely Central Bank induced, “yet again” keeping this thing afloat as long as they possibly can.

What we begin to understand here now, is just how desperate the situation is and that….more than likely the fallout will be much worse / severe than your average “garden variet” BTD ( buy the dip ) and “everything will be ok” type thing.

Trade wise – considering the massive overbought conditions of The U.S Dollar one has to consider looking long both EUR/USD as well GBP/USD here but again with caution as the “solid up trend in USD” would have this trade originally manifest as “counter trend”.

I’m having trouble imagining the U.S Fed letting USD get much further out of the basement here as every single uptick essentially drives the cost of U.S Debt higher ( being denominated in USD of course ) and “how soon we forget” – The Fed still wants to crush the currency.

For those brave enough to get out and challenge the BOJ here in coming days, I see that many of the long JPY pairs have retraced a touch and could provide for “re entry” here next week including short NZD/JPY, CAD/JPY and entry short USD/JPY up here at the top end “should we see reversal first”.

Otherwise the blatantly obvious trade here is looking at EUR, considering that if USD rolls over here and spends the next 6-8 days retracing ( or perhaps generating a much larger fall ) the biggest returns will be seen vs EU currencies.

AUD has clearly had the wind taken out of it on the “risk off” move over the past couple days but it really depends “against what” with AUD/JPY still firmly under the grasp of The BOJ.

I’ll be looking for entry long EUR/USD above 1.34 after the U.S data release here this morning, and will cover the specifics of several other currency pairs ( if it really even matters in this situation ) over the weekend.

The ponzi either goes another “final round” ( likely trading flat to upward for the rest of August / early September ) or it doesn’t.

That’s really all there is too it.

For further in depth analysis of The Nikkei, it’s correlation to The SP 500 as well currencies and gold – please join us our members area at: www.forexkong.net

© 2014 Copyright Forex Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.