Their Economy Will Collapse, Including Ours

Economics / Global Economy Jul 29, 2014 - 07:01 PM GMTBy: Submissions

Harry Dent writes: Central bankers think they can keep their economy going by artificial stimulus until they hit escape velocity and grow at normal rates again — but they’re wrong.

Harry Dent writes: Central bankers think they can keep their economy going by artificial stimulus until they hit escape velocity and grow at normal rates again — but they’re wrong.

Here at Dent Research we hold a different view to what drives the economy.

And central bankers are in for three big surprises ahead.

Their economies are NOT going to grow the way they’re hoping, at least not until the early 2020s, thanks to declining demographic cycles and unprecedented debt ratios.

But the surprises I’m talking about are going to come out of left field and slam unexpectedly and so fast into these delusional central banks, that it will leave their heads spinning.

I’m talking about:

• Germany.

• China.

• And the good ol’ U.S. of A.

Between now and 2022, Germany is going right over the edge of a demographic cliff steeper than the one Japan crumbled over in the 1990s. Back then, I was one of the very few who saw the demographic-trend-driven crisis ahead for Japan. Once again, I’m one of very few who sees what Germany faces.

The country is supposed to be the largest and most fiscally sound economy holding up the euro zone. So tell me: How is it going to continue its support of the weaker southern countries when its own economy stalls? It’s not, of course, and the fall out will crush Europe.

In the East, China has inflated a massive infrastructure bubble that its top-down, centrally-planned government has supported with unprecedented stimulus. That bubble is already starting to show signs of cracking. When it bursts, there will be little the People’s Bank of China, or any other central bank for that matter, can do to fight the tsunami.

Mark my words here: Real estate around the world will collapse like dominoes.

Then there’s the U.S. economy. It’s not going to accelerate back into healthy growth, like the desperate Fed hopes. Instead, it’s going to begin slowing again by early 2015, if not sooner. We have a second demographic cliff in the U.S. to thank for this.

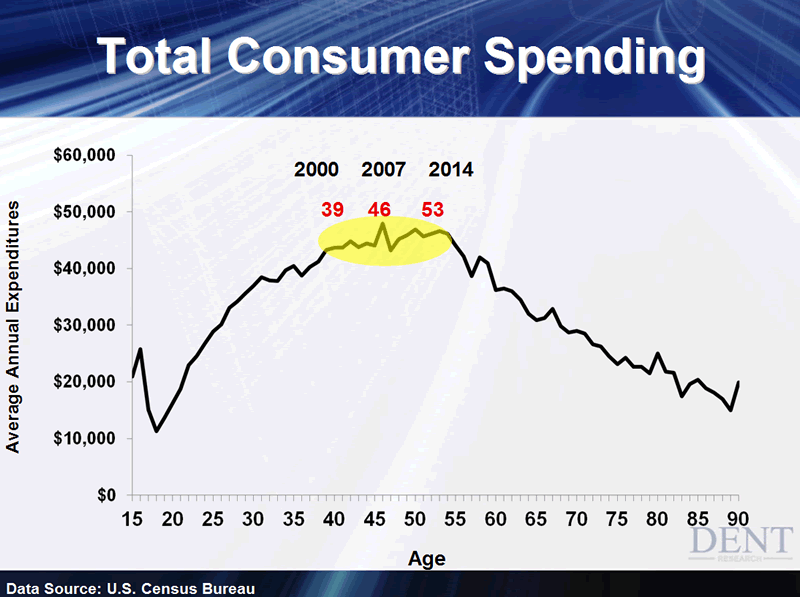

Take a look at this chart. It shows how spending in the U.S. peaks at age 46, a fact that correlates with the general economy and stock markets (as my Spending Wave shows).

Averaging the Consumer Expenditure Survey over 10 years gives us more detailed data…

What this chart shows is that we get the most rapid increase in spending between the time the average person enters the workforce at age 20 and age 39, when they’re buying their biggest homes (I’m averaging here). That happened into 2000.

Then spending moves up more slowly and peaks at age 46, in line with furnishing those homes and getting kids through high school. That happened in 2007.

But spending continues to meander sideways into age 53, when the most affluent peak in their spending. They reach their top a little later than the average person because they went to school for longer, had their kids later, and sent them to school later than the rest. And that’s what will happen next.

And on cue, the economy and stocks first peaked and slowed in 2000, with the housing and tech bubble. They peaked again into 2007 when the larger generation hit its peak in spending.

Now it will peak again. Stocks markets will hit higher highs, despite lower economic growth — until late this year, when spending peaks for the last affluent baby boomers.

This last, artificial recovery and peak is courtesy of the Fed’s endless free money.

Now, the top 20% may seem inconsequential, but they control over 50% of spending. The top 1% control 20% of spending and 50% of wealth. This makes them anything but “inconsequential.” In fact, it’s this most affluent sector that owns most of the financial assets that the Fed’s bubbling up again.

Unfortunately, this affluent sector will undergo a decline in spending by next year, just like most households did after late 2007. As a result, the automobile sector — which also peaks at age 53 — will collapse, much like housing did many years before it, and the latest subprime build-up we’ve witnessed will cause pain as well.

Incredibly, this market continues to bubble up, despite increasingly bad geopolitical news (which is in line with the down leg of our cycle, from 2001 to 2019). Investors are more convinced than ever that the Fed can keep the economy going.

But the economy has already grown at a slower pace than economists and the Fed have expected, despite unprecedented stimulus.

Well, duh! If you understand anything about demographics and debt, that shouldn’t surprise you.

Now the Fed is finally tapering toward zero QE by October or so, just as an even bigger demographic cliff hits the U.S.! Talk about bad timing.

The thing is, the Fed doesn’t reverse its policies on a dime because that would make it look rash or irresponsible (like unprecedented money printing for over five years isn’t irresponsible!).

Besides, thanks to a lag in data, it takes the Fed a while to realize the economy is worse than it is. So I think the Fed will be behind the curve with this next downturn, just as it was in the 2008 demographic slowdown and subprime crisis.

That’s why I think the next big stock crash will start its first dramatic leg down between late 2014 and early 2015. Then the Fed will stimulate again…

Only, the next time, it’ll have much less credibility and the adverse demographic trends in the U.S., in Europe and in China will be much more powerful.

In short, make sure you’re ready. It’s going to be a rough ride ahead.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.