Gold Still Looking Good

Commodities / Gold and Silver 2014 Jul 29, 2014 - 04:05 PM GMTBy: Aden_Forecast

No sooner had gold taken a back seat to the soaring stock market, when it did an about face!

No sooner had gold taken a back seat to the soaring stock market, when it did an about face!

Tensions in the Middle East and Ukraine pushed gold up. The Fed then fueled the rise by again affirming a low interest rate policy. But a firmer dollar and better economic news then put downward pressure on the metals again.

We've felt that 2014 could end up being the turnaround year, from a bear market to a bull market. And that a bull market ascent could develop in 2015.

This is still a likely scenario.

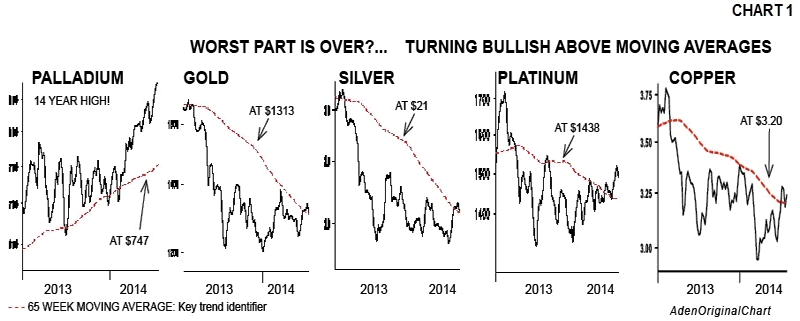

The metals all rose in this direction this past month. Gold, silver, palladium, platinum and copper all rose above their 65 week moving averages (see Chart 1).

This is a great first step!

For the first time in 18 months this moving average has been surpassed. And it's happening during a roaring bull market in stocks and a solid rise in bonds.

Palladium has been bullish all along and it's been by far the best precious metal. Palladium recently reached its 2000 highs.

Granted, palladium got a boost from the Ukraine-Russia tension, and during the long mining strike in South Africa because they're the world's two largest palladium producers.

But the auto industry is bubbling, which is also bullish. U.S. auto sales are headed for their biggest year since 2007 and China is similar. Palladium is used in the automotive sector for pollution control devices, and there's a shortage. Plus, palladium is about 15 times more rare than platinum.

Palladium continues to be a good investment.

Gold Shares: Leading

Gold mergers and acquisitions have been revived this year, after falling to the lowest level in 10 years in 2013 as companies struggled with the drop in gold.

This is not surprising. This sector has been in bad shape.

Interestingly, worst hit were the junior shares. And now these shares have been leading the rise.

Junior mines fell 80% from 2011 to 2013, the worst fall since the 2008 crash. But since juniors are higher risk than seniors, it makes them a good leading indicator when they begin to outperform.

Gold shares have now also risen above their 65 week moving average, as you can see on Chart 2.

Gold shares fell to their lows last December. They were totally bombed out, and that low ended up becoming the head formation of a head and shoulders bottom.

We've been showing this bottom formation for quite a while, probably to the point where you wondered if it would ever finish!

Well, it's starting to now. With the HUI index currently above its 65 week moving average, and near the neckline of the H&S bottom, it shows that a bottom is likely in.

That is, if the HUI gold shares index can now stay above 234, it will be off and running!

Gold shares are a good buy

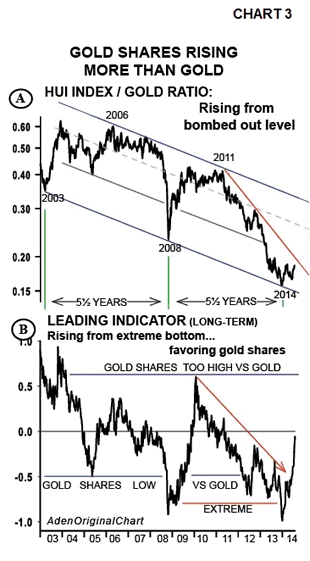

Gold shares have been rising more than gold during the past month. When gold shares are better it's saying, risk is worth it because they're more speculative than gold itself.

Note on Chart 3 how HUI is just starting to rise more than gold. The ratio is rising from a bombed out area.

Interestingly, this ratio tends to form a major low every 5½ years, and in each case, gold shares rise more than gold for several years.

With its leading indicator (B) now breaking clearly above an over 4 year downtrend, it's showing gold shares have the potential to rise much more than gold this year and next. This coincides with the 5½ year pattern!

We recommend buying and keeping the shares, as well as the metals.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.