Inflation - Are Commodities Talking to Us?

Commodities / Agricultural Commodities Jul 28, 2014 - 06:09 PM GMTBy: Ned_W_Schmidt

Markets often do talk to us, if only we would listen. Our ears serve as only part of listening. An open mind is also required. Regrettably, minds receptive to new thoughts and questions have been somewhat outmoded in the investment world for many years. Why else do so many seem to ignore what commodities are saying?

Markets often do talk to us, if only we would listen. Our ears serve as only part of listening. An open mind is also required. Regrettably, minds receptive to new thoughts and questions have been somewhat outmoded in the investment world for many years. Why else do so many seem to ignore what commodities are saying?

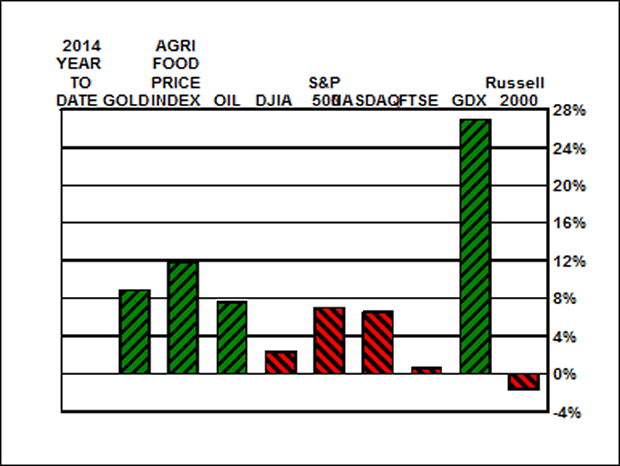

As we ponder chart below right, we again note that market trends about which we have previously talked continue in place. Thus far in 2014, with almost 60% of it now past, commodities are performing better than the financial markets. On the right in the chart, the GDX, an ETF of producing Gold mining stocks, has soared far above the crowd's favorites. The difference between the return on the GDX and the Russell 2000 suggests that some investors missed the train, the plane, and the ferry as 2014 opened.

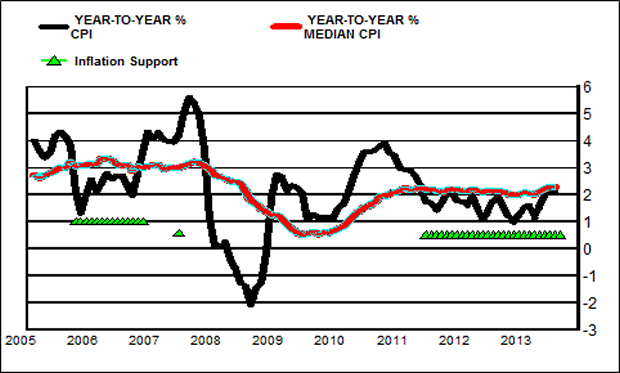

Commodities may be saying that complacency on prices might be inappropriate. In the chart below is plotted the year-to-year percentage change for the U.S. consumer price index, black line, and a like measure for the median U.S. CPI as prepared by the Cleveland Federal Reserve Bank.

As we noted last we visited, the year-to-year percentage change on the median CPI being positive and above the percentage change in the headline CPI has preceded a rising trend for U.S. inflation. In the early example shown in the chart, the year-to-year percentage change for the headline CPI rose fairly dramatically after those two conditions existed. A similar situation exists today. Is a dramatic rise in U.S. inflation, as measured by the CPI, about to occur again?

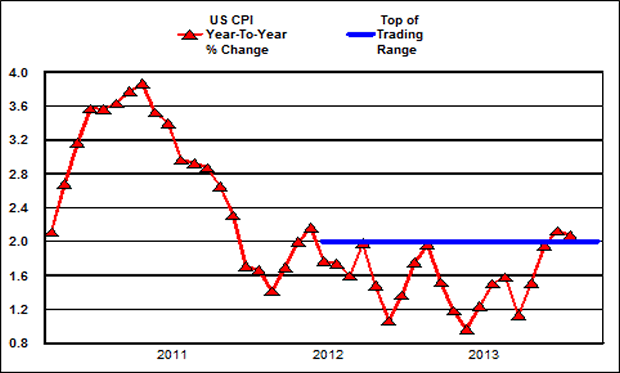

Perhaps the chart above may provide some insight into the answer to that question.

In it is plotted the year-to-year percentage change for the U.S. headline CPI. Readily apparent is a formation that is not an unusual occurrence and often quite reliable. In first part of graph inflation rose to a high, almost doubling, and then "crashed". It then went on to move into a lateral patten that persisted for about two years. The top of that "trading pattern" is highlighted by the blue line. The normal expectation when price moves up out of such a lateral patten is a further advance for prices. As can be observed in chart, the last two monthly reports for the U.S. CPI place the year-to-year percentage change above the top of the lateral pattern. Is U.S. inflation about to break out to the upside? For other examples of this formation phenomenon take a look at a two-year chart for AEM and GOLD.

The markets and the data do seem to be sending a message on prices, one unfavorable to U.S. financial assets. When the U.S. consumer price index was considered, we found two situations that suggest higher inflation in the U.S. is a real possibility. Arguing with the market's message is rarely fruitful, as is following the consensus view.

Ned W. Schmidt,CFA is publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food Super Cycle, and The Value View Gold Report, a monthly analysis of the true alternative currency. To contract Ned or to learn more, use either of these links: www.agrifoodvalueview.com or www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.