AUD-JPY - Watching Commodity Currencies – What Can Be Learned

Currencies / Forex Trading Jul 28, 2014 - 02:30 PM GMTBy: Submissions

ForexKong: It’s pretty common knowledge that the currencies of countries with “commodity related economies” such as Australia, New Zealand and Canada are seen as the “darlings of the currency markets” during times when investors feel safe.

Simply put, large institutional investors are able to borrow money such as U.S Dollars or Japanese Yen at extremely low rates of interest, then use these funds to invest in currencies / countries where higher yields and greater opportunities can be found. Australia with its mining / gold related businesses, as well Canada with its oil as a couple of good examples.

The trouble is, as attractive as some of these investment’s may appear during times of economic expansion and loose monetary policy ( with both The Fed and The Bank of Japan flooding the planet with cheap money ) the currencies of these commodity related economies are not widely held, lack liquidity and are not generally sought during times of contraction and tightening.

To a certain extent you can almost consider them the Twitters and Facebooks of the currency markets. Relatively large, fast moves higher when times are good and investors feel safe – but equally the opposite movement when things start to go south.

Think of it like this. If suddenly the world fell into chaos and you were trapped on holidays in The Caymens, unable to return home to your family and friends. What currencies would you look to have there in your pocket / bank account? A handful of Aussie Dollars likely won’t do the trick.

So what can be learned by following these currencies? Can they give you any indication of future movements in global appetite for risk?

Lets have a look.

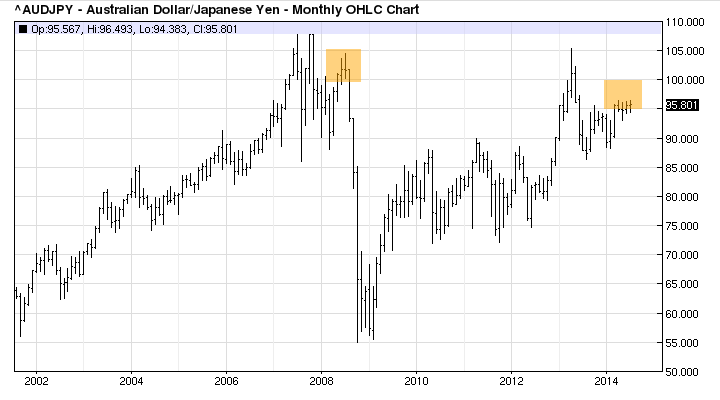

As an extreme example we can see prior to the crash of 2008 that the Australian Dollar had enjoyed a fantastic run while times where good – only to then wipe out six years of gains in a matter of months. Commodity related currencies across the board got completely hammered as fearful investors did all they could to get back to the “relative safety” of the currencies originally borrowed – those being the U.S Dollar and Japanese Yen.

Since Central Banks have been printing money like mad since 2009 investors have enjoyed nearly 6 years of bliss, borrowing said funds at extremely low rates of interest and investing where yields can be found.

I’m not suggesting you’ll see another 2008 scenario play out tomorrow, but by keeping an eye on the commodity currencies you may certainly get a bit of lead time – should things turn.

For further in depth analysis of The Nikkei, it’s correlation to The SP 500 as well currencies and gold – please join us our members area at: www.forexkong.net

© 2014 Copyright Forex Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.