Stock Market One FINAL High?

Stock-Markets / Stock Markets 2014 Jul 28, 2014 - 12:08 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are in their down phases, and if they make their lows when expected, there will be another steep decline into late 2014. However, the Fed policy of keeping interest rates low has severely curtailed the full downward pressure potential of the 40-yr and 120-yr cycles.

Intermediate trend - One final high needed to produce the start of an intermediate correction.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

ONE FINAL HIGH?

Market Overview

In this issue, we are going to look ahead to see if we can pin-point the intermediate top that is bound to come sooner or later. I have just completed an extensive analysis of my forecasting tools to see if they were finally beginning to show signs of an end to the trend which has, thus far, been characterized by an endless series of short-term moves with very limited retracements. The good news for the bears is that the light is beginning to appear at the end of the proverbial tunnel.

At this point, we are most likely in the final stages of a minor correction and there are indications that one more high in the SPX will be needed to finish the move that started as far back as October 2011 at 1074. Needless to say, if we are about to correct a 900-point move which has lasted almost three years, we should expect a fairly extensive correction both in time and in price. We already know that the long-term cycles should make their lows around October and, although we do not yet have a top, we can approximate that a .382% retracement would pull the SPX back down to about 1650! A .50% retracement would be about one hundred points lower.

These are pretty loose guide lines, but it does give us a sense of what could lie ahead based on what my analysis is telling me, and it will be interesting to see if I even come close! I can assure you that no one will be following this "prediction" more closely than I and, of course, refinements will be made along the way.

Chart Analysis

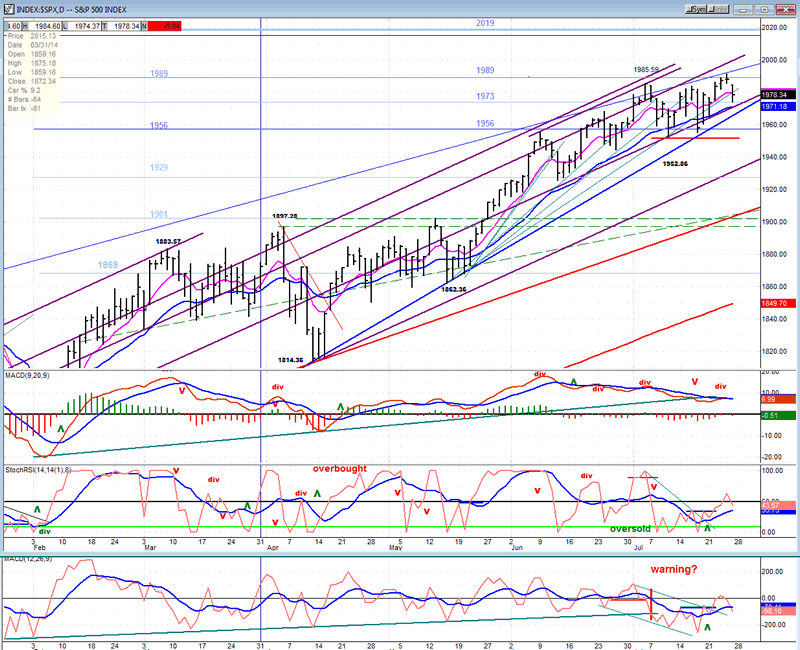

The prediction that we are rapidly nearing a minor bottom is based upon cycle analysis as well as observing the indicator patterns of the daily and hourly charts. We'll start by looking at the daily SPX chart (courtesy of QCharts.com).

Our primary focus will be on the move from 1814.36, since it appears to be the last phase of the entire trend from 1070. Ostensibly, when it completes it will have ended nearly 3 years of uptrend. The move from 1814 had a first and very shallow correction from 1902 to 1962. The next one was even shorter, from 1985 to 1952. Now, the index seems to be starting a move toward the 2019 pivot point, which could be the final high.

The pivots from 1956 to 1989 have served as support and resistance for the SPX as it was working its way higher. (Cir.) 1989 was the last resistance point, and 1973 could well be the final support for the current pull-back. Also controlling the advance, the purple parallel lines have served as support and resistance levels, but the most important support line is the blue trend line from 1814 which has now three points of contact and which will most likely trigger the start of an important correction when it is broken.

I realize that I am making a lot of assumptions but these are not whimsical. They are based on the conditions of my weekly, daily and hourly indicators.

In the daily oscillators shown above (especially in the first two), the blue line smooths the more erratic moves of the red line, producing cyclical patterns which move from overbought to oversold in fairly consistent regularity. This allows me to estimate that it will take about two weeks for the blue lines (which have already turned up) to reach their peaks and to start rolling over. I could be off by several days, but not by several weeks! And, since I have some P&F projections pointing to the 2010-2020 level, I can see how long it takes to reach these targets.

One caveat: Although some small parts of the final top appear to be missing, if the current short-term decline accelerates and breaks the blue trend line, the odds will increase the probability that the final high has already been made. This caveat is appropriate at this juncture because the stock market does not always dot the "is" and crosses the "ts", and traders are mischievous enough to pull the plug when we don't expect it. We are in a nervous market and a negative news report could also be the trigger for the start of a larger correction. The DJIA was especially weak on Friday, closing outside of a 4-mo trend line. Another similar spell of weakness on Monday could breach the long-term log trend line which originates at the very beginning of the bull market. Since the DJIA is deemed to be making a terminal pattern in the form of an ending triangle, such a close could spook the rest of the market!

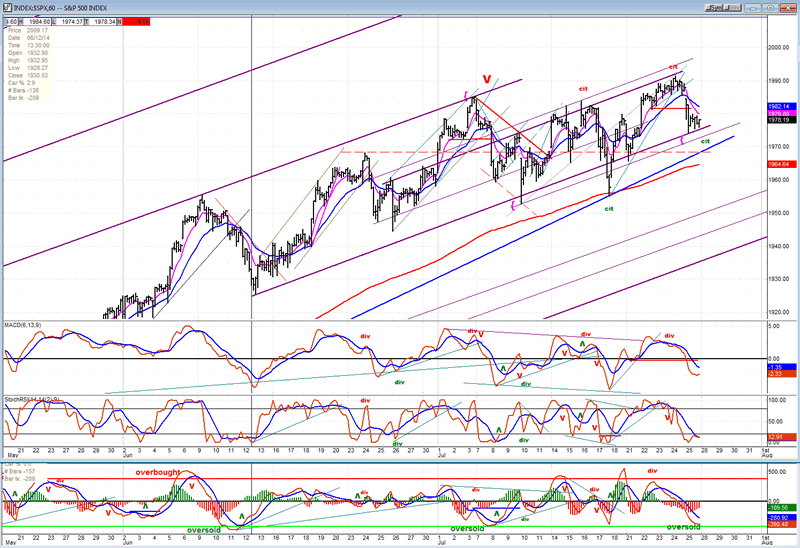

The hourly chart (also courtesy of QCharts.com) does not disagree with the daily. Support is provided by the 1973 pivot point, the purple parallel, the blue trend line and a former peak, etc... An 8-wk cycle was scheduled to make its low at the end of last week and, if it has not already, could extend it to Monday. And the hourly oscillators are oversold and beginning to turn. Considering that the daily oscillators have already started an uptrend, if the hourly ones start to move up at the beginning of the day, we can pretty much assume that we are on our way to making another all-time high in the index.

Cycles

An 8-wk cycle was due at the end of last week. With an 11-day cycle topping over the week-end and a 9-day cycle due to top on Tuesday, the market could be vulnerable to additional short-term correction - another reason to be wary!

Breadth

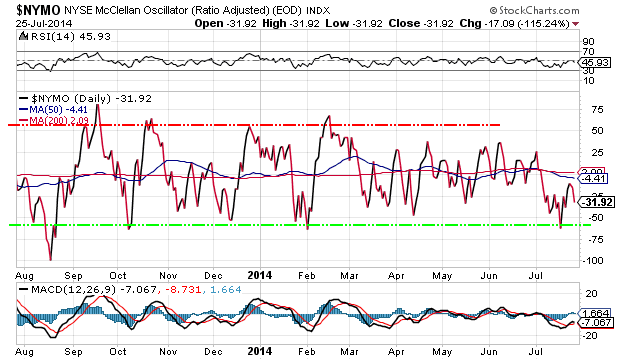

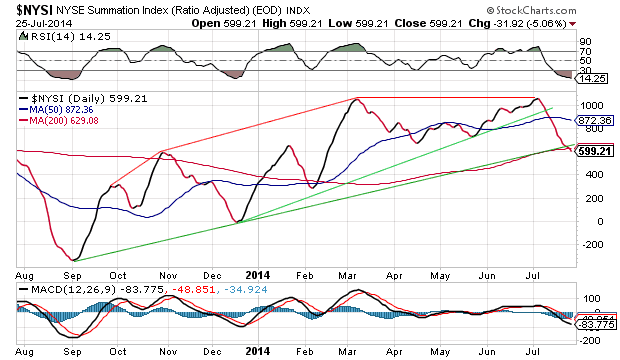

The McClellan Oscillator and the Summation Index appear below (courtesy of StockCharts.com).

The McClellan Oscillator has made a low at a level which is usually respected by short-term corrections. Since it has not yet cleared the zero line but has resumed its downtrend, it is still vulnerable to additional weakness.

This would not be good for the NYSI which is in the process of breaking below an 11-mo trend line and, although its RSI is already oversold, it is still declining and is beginning to display negative divergence with its December 2013 low. The NYMO must get back into an uptrend quickly to prevent a really negative turn of events.

Sentiment Indicators

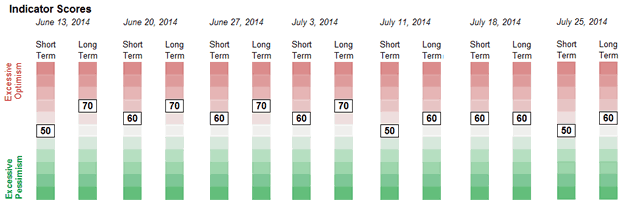

The SentimenTrader (courtesy of same) long term indicator remains at 60 but should climb right back to 70 if SPX makes a new high.

VIX (CBOE volatility Index)

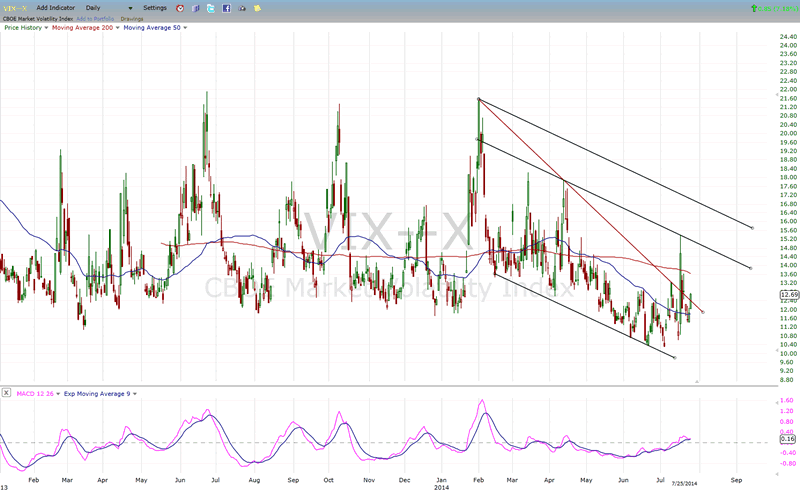

Since hitting resistance and backing off, VIX has gone nowhere, hardly moving up last week while the market was moving down. It is evidently not ready to break out of its declining channel, implying that the SPX stands a good chance of making a new high.

XLF (Financial ETF)

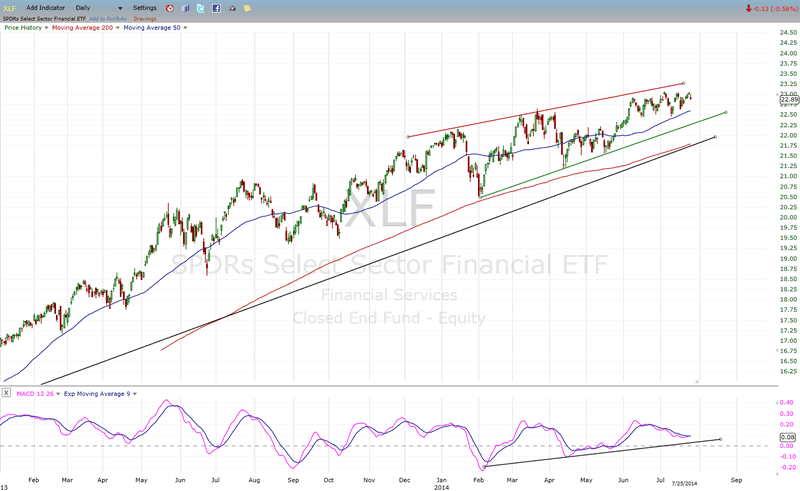

There was little action in XLF last week. Like the week before, its lack of activity has no predictive value.

TLT (20+yr Treasury Bond Fund)

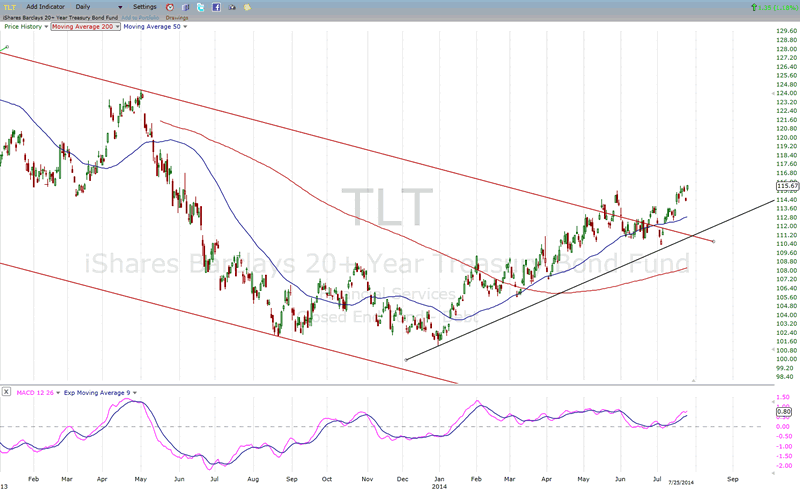

TLT is trying to extend its break out from a large corrective channel. If it is successful, it could be starting an important trend which should accelerate upward when the market starts a long overdue intermediate correction.

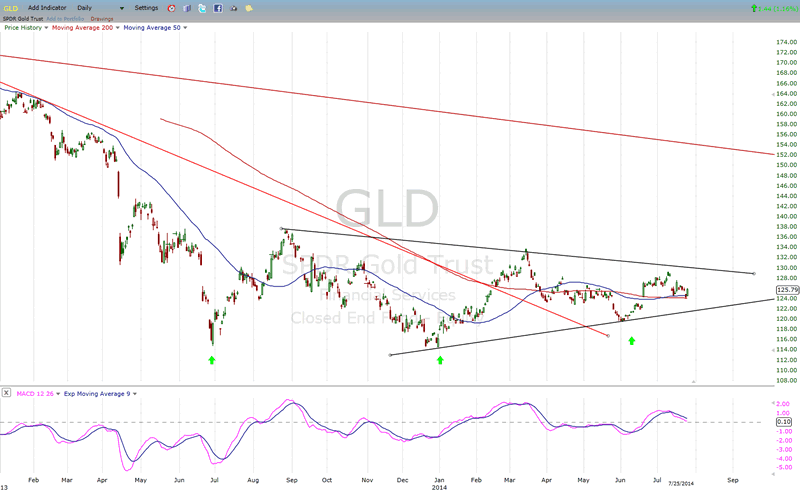

GLD (ETF for gold)

GLD has lost its initial upside momentum which promised a break out of its base. My best guess is that this is only temporary and that it is simply in need of some additional consolidation before it regains it.

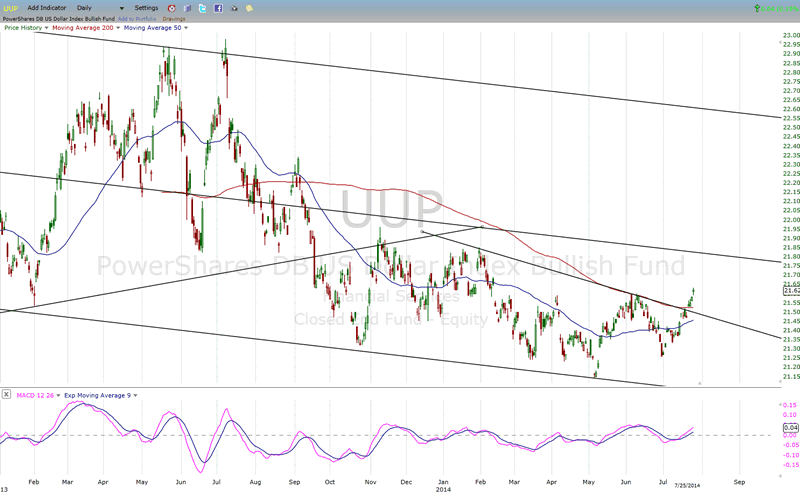

UUP (dollar ETF)

The dollar, by contrast, has manged to overcome its short-term trend line, but its MACD is already pointing to some negative divergence which suggests that this may be only a corrective "C" wave which will soon end and force a retracement in price.

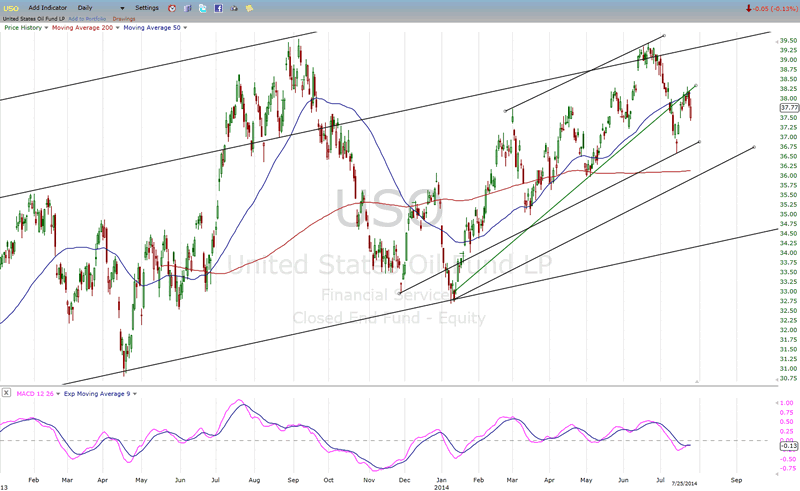

USO (US Oil Fund)

USO has run into the anticipated resistance created by the recently broken trend line. From here, it could go either way and needs to be given a few days to decide on the direction.

Summary

The SPX does not seem to be quite ready to start an important correction, but this may not be the case after it makes a new, and potentially final, high.

The current near-term decline could have ended on Friday, or may do so on Monday. The picture would be drastically altered if serious weakness starts to develop from the current level. The Dow Jones Industrials look particularly vulnerable to do just that, as another one hundred point decline on Monday would put it outside of a long-term log trend line which originated in March 2009. This event could bring about a domino effect in the other indices. While the probability of this taking place is fairly low, let's wait and see what Monday's opening tells us.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.