Stock Market Clear and Present Danger Zone

Stock-Markets / Stock Markets 2014 Jul 24, 2014 - 07:20 PM GMTBy: DeviantInvestor

Ding, Ding, Ding! The bell tolls, not for the 1%, but for the remaining 99% in Europe, the UK, Japan, and the US.

Ding, Ding, Ding! The bell tolls, not for the 1%, but for the remaining 99% in Europe, the UK, Japan, and the US.

What Danger Zone? The powers-that-be must find a way to keep the masses under control, raise taxes, enrich themselves and monetize the debt. The result will be currency devaluations, blood, inflation, distractions (such as downed airliners and new wars), banker bonuses, continued payoffs to politicians, and so much more.

The Stock Markets:

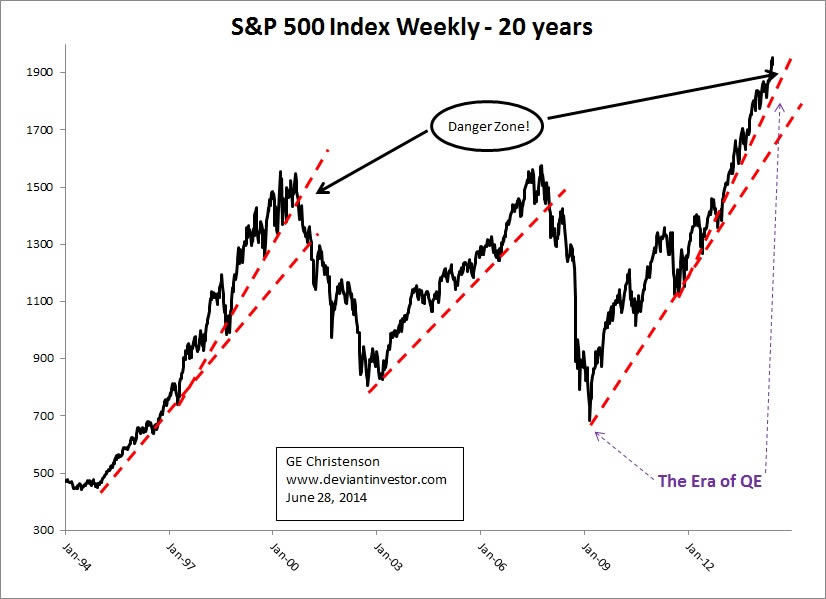

The S&P 500 Index looks toppy and dangerous, as it has for many months. Consider this graph:

There is no guarantee that the stock market will either crash or continue to rally, but the above chart is worrisome, in spite of the massive levitation by the central banks of the world. This is a clear and present danger zone.

The Gold Market:

Gold has been fleeing the western world and is appreciated more in China, Russia, and India. The citizens and bankers in the US, UK, Europe, and Japan value paper debt more than physical gold. Danger Zone!

Paul Craig Roberts and Dave Kranzler on July 16, 2014:

"Between July 14 and July 15, contracts representing 126 tonnes of gold were sold in a 14 minute time window which took the price of gold down $43 dollars. No other market showed any unusual or extraordinary movement during that period."

If gold is an inverse barometer of confidence in debt based currencies, it is important for the status quo to cap gold prices and occasionally to smash it down to discourage gold investing. Or, perhaps some large entity had 126 tonnes of gold just lying around and decided it was time to unload it in exchange for devaluing paper currencies....

Political Conditions:

In the Ukraine a missile destroyed an airliner flying at 30,000+ feet. The story is muddled, but it is clear that "X" and "Y" blame each other and "Z" is a problem. The only beneficiaries seem to be military contractors and warmongers. The "drums of war" are beating louder and faster. One hundred years ago another tiny incident in July 1914 precipitated a world war. Perhaps this Ukraine incident and others are merely diversions to distract the populace from the mess that our politicians and bankers have created. Regardless of whether this incident portends an upcoming war, or if it is merely a distraction, it shows that the conflict in the Ukraine is a danger zone.

Martin Armstrong wrote in March 2014 regarding war and distractions:

"Both sides need a war to distract the stupid majority who really think this is over apple pie and capitalism. It is the diversion that becomes necessary for politics to survive." Or, another way to say it is "God save the powers-that-be and especially the big banks and military contractors." Danger zone indeed!

Chris Martenson interviewed John Rubino in July 2014. John Rubino on the promises that governments have made that financially can't be fulfilled:

"That is why governments around the world are preparing for civil unrest and they recognize that their financial policies for the last thirty years have led us to this point and that any fix is going to involve a lot of trouble."

Economic Conditions:

Alasdair Macleod on July 18, 2014 regarding debt and the General Manager of the Bank for International Settlements (BIS):

"Meanwhile the growing sensitivity of all this debt to rises in interest rates is ignored by financial markets, where risk premiums should be rising, but are falling instead... For someone in his position this is a stark warning."

Zerohedge.com says,

"US GDP has never fallen more than 1.5% except during or just before an NBE-defined recession since quarterly GDP records began in 1947." Since the official GDP number announced a large decrease to negative 2.9%, this is another indication of a clear and present danger zone for the US economy.

John Rubino on debt and the economy:

"Most of what is going on under the surface in terms of bank derivatives, books, and government debt and now consumer debt and just about any other real financial statistic that you would like to look at, they are all getting worse. This means we are heading for some kind of replay of 2008/2009 only with more debt to deal with, bigger derivatives books, and more landmines out there. This one could be much worse than the one we just lived through a few years ago."

John Rubino on junk bonds:

"So you are going to see a lot of people who cannot afford to lose anything of their capital, losing thirty, forty, fifty percent in the next market correction... The pension funds of the world cannot afford that. Retirees cannot afford that. But that is the world we have created."

Chris Martenson on bubbles:

"I think bubbles get as large as the gap between reality and hope. We have a huge gap right now."

Personally, I hope that the middle-east conflicts peacefully resolve themselves, I hope the NSA stops spying on the world, I hope Russia, Europe, China, and the US agree to "make nice" and encourage world peace, I hope the hundreds of $Trillions of global debt just goes away, and I hope that "hope and change" actually brings hope and change. But I also think a "Plan B" that is grounded in the practical and real world is necessary.

John Rubino on the imbalances in our financial and economic worlds:

"Everywhere you look we are building up imbalances that have to be unwound and will cause a huge crisis when they are unwound... When derivatives blow up, they will affect equity prices and that will affect pension fund behavior and that will affect government budgets. You will see everything spin out of control at the same time..."

John Rubino on currency devaluation:

"... and the final solution in every case across the board is going to be a massive currency devaluation because the only way you deal with this debt is to cut it in half by making your currency half as valuable... I think some kind of crisis is baked in the cake and it is going to be resolved through massive devaluation."

This is a clear and present DANGER ZONE:

-

Evaluate your personal and family vulnerability to traumatic changes that must occur, whether in 2014 or during the next few years.

-

Consider your personal and financial risk factors, and make adjustments as needed.

Given your personal circumstances, will gold (and silver) or unbacked paper currencies and debt issued by insolvent governments serve you better during the next ten years of turmoil?

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.