EURUSD To Rally Or Not To Rally?

Currencies / Euro Jul 21, 2014 - 10:09 AM GMTBy: Austin_Galt

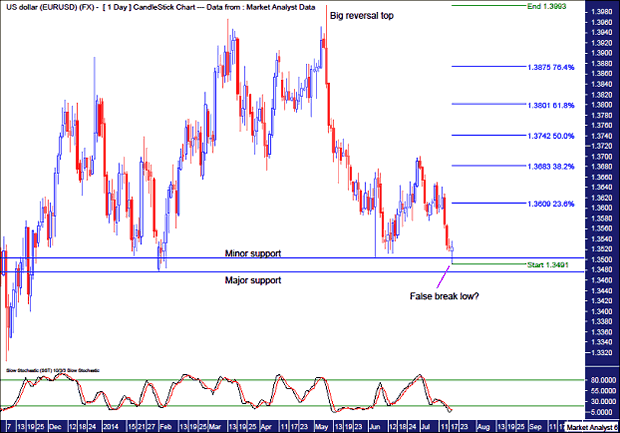

The EURUSD has recently come down to test major support. So now it has to decide whether to bust on through that support or rally from here. Let's take a closer look to see what its decision will be.

EURUSD DAILY CHART

Last Friday 18th July price came down and made a low at 1.3491 before rallying to close the week at 1.3524, thereby creating a little bullish daily candle. Now what is interesting is the region in which this trading occurred. We have minor support from the 5th June low of 1.3503 and major support from the 3rd February low of 1.3477. These can be seen by the two horizontal lines.

This low achieved a couple of things. Firstly, it marginally broke minor support which would have cleared out some stops and sets up a common bottom formation being a false break low. Also, the fact that it rallied back up and closed above the support level is a bullish sign.

Secondly, the low held major support averting the super bearish scenario. Things could get ugly once that major support level is broken.

Now, as I outlined in my previous report, I am bearish overall the EURUSD and the big reversal top in place solidifies that in my mind. However, I still think there is more backing and filling to be done before price makes a significant move down.

I have drawn some Fibonacci retracement levels of the down move from the May top to last week's low. My personal preference is for price to rally from here up to the 61.8% level at 1.3801 or the 76.4% level at 1.3875. I can't decide yet which level I lean more towards. Perhaps that will be made clearer with time.

Also, I have added a Stochastic Indicator which, while not conclusive, does look about to roll back to the upside so that is some minor evidence that a rally may be about to commence.

Summing up, the EURUSD is at a tipping point and could go either way. I vote to rally!

Bio

I have studied charts for over 20 years and currently am a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts there seemed to be a dearth of technical analysts, at least ones that had a reasonable idea of things. So my aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Please register your interest in my website coming soon. Any questions or suggestions, please contact austingalt@hotmail.com

© 2014 Copyright Austin Galt - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.