The Banks Are Manipulating Silver Prices

Commodities / Gold and Silver 2014 Jul 19, 2014 - 09:07 PM GMTBy: Investment_U

Sean Brodrick writes: The big banks have smashed gold and silver lower this week, and after that shellacking, you'd have to be crazy to buy precious metals, right?

Sean Brodrick writes: The big banks have smashed gold and silver lower this week, and after that shellacking, you'd have to be crazy to buy precious metals, right?

Yeah. Crazy like a fox.

If you're smart, you're going to put on your big-boy pants and buy silver right now.

And I'll show you why.

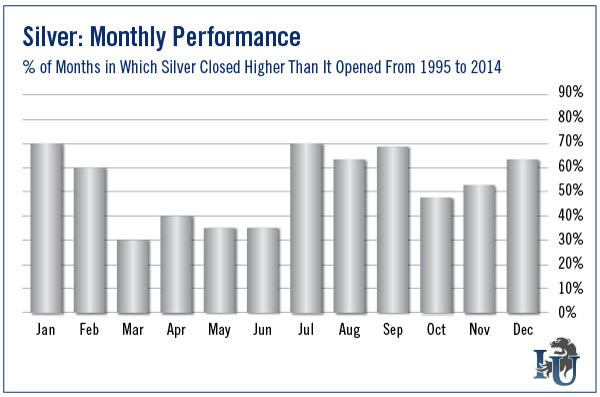

The key is in this monthly chart of silver performance, going back over the past 20 years...

You can see that over the past 20 years, silver has closed July higher than it started 70% of the time. It charged higher in August 63% of the time. September: 68% of the time.

But wait, wait! Twenty years is too long a time frame, you say? Fine. Then chew on this: In the past five years, silver has closed out July and August higher than it started 100% of the time. In September, it closed higher 60% of the time.

So why does this happen? Silver and gold are both subject to seasonal forces. There are times of the year when major income-cycle and cultural factors ignite demand. Prices start to rise in the summer because jewelers stock up for demand that starts with India, then rolls through the globe - the Middle East, China and finally the Western world when Christmas comes around.

'Tis the Season

Ignore seasonal trends at your own peril. Awareness of such trends can line your pockets.

For example, I told you about the seasonal trend for the U.S. dollar in May. And sure enough, the greenback finished the month higher again.

Why, then, did precious metals nosedive this week? The big banks are smashing the price lower in order to scare people to the sidelines.

They did it by selling insanely high volumes of futures contracts - paper silver and gold - on Monday and Tuesday.

Why would they do that? Because the Wall Street banks want to buy precious metals on the cheap, of course.

The manipulation of precious metal markets is more ham-fisted than usual lately. Maybe they're taking us all for chumps.

But that's just this week's noise. I say, forget that and focus on the bigger trend... and see the opportunities that are there for the taking.

I think you should beat them at their own game.

For Long Term, Too

Here's something else the banks know about silver: Demand has been outstripping mining supply for most of the last 20 years. After all, there are more and more uses for silver as both a precious and industrial metal. There is only so much supply.

You may not know that above-ground supplies of silver have fallen to historically low levels. In the year 1900 there were 12 billion ounces of above-ground silver in the world. Today, that figure has dropped to less than 1.39 billion ounces, according to CPM Group.

Do you see how the fuse could be lit on a supply/demand squeeze in silver? I sure do.

Good investing,

Sean Brodrick

Editor's Note: As The Oxford Club's Resource Strategist, Sean knows how to profit from things that come out of the ground, be it metals, oil or natural gas.

He recently spoke to the Club's Marc Lichtenfeld about the 94-year-old man whose invention Sean thinks may have "saved America." This innovation is creating a generation of oil and gas millionaires, and once-in-a-lifetime investment opportunities for ordinary Americans. To hear this incredible story, and learn how you can participate, click here.

Source: http://www.investmentu.com/article/detail/38801/buy-silver-banks-manipulating-silver-prices

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.