Gold And Silver – BRICS And Germany Will Pave The Way

Commodities / Gold and Silver 2014 Jul 19, 2014 - 08:20 PM GMTBy: Michael_Noonan

There is no one singular event that will ultimately loosen the manipulative shackles that the elite's central bankers have maintained on the PMs [Precious Metals], as evidence continues to mount that Western countries, and the US, especially, are going under economically and financially. All central banks are insolvent, kept afloat by lies. The accounting rules have been changes to allow banks to price their assets however the banks choose. Most, if not all central banks assets, [just about all banks, as well] are worthless, or near worthless.

There is no one singular event that will ultimately loosen the manipulative shackles that the elite's central bankers have maintained on the PMs [Precious Metals], as evidence continues to mount that Western countries, and the US, especially, are going under economically and financially. All central banks are insolvent, kept afloat by lies. The accounting rules have been changes to allow banks to price their assets however the banks choose. Most, if not all central banks assets, [just about all banks, as well] are worthless, or near worthless.

The sanctions charade that Obama keeps imposing on Russia is having some degree of affect, but overall, the US moves do nothing more than isolate itself from the rest of the Western world unwilling to risk offending their energy supplier and business partner, Russia. By extension, there are strong ties between Russia and China, and one of the pivotal business partnerships with both is Germany. As goes Germany, so goes Europe.

Austria has already picked sides, with Russia, for the economic writing is on the wall, but this country does not have the same influence/impact as Germany, but the path of least resistance keeps getting clearer.

Germany is not about to jeopardize its long-established business ties with Russia. At least 3,000 businesses are linked to Russia, and they are not being quiet in their displeasure about any sanctions against Russia by the US. Further, Deutschland is increasing its economic ties to and with China. Between these three powerhouse nations, it is all about business and economic growth. With the US, it is all about fiat debt and war with little to no concern about which country[s] the US alienates in order to support its flailing and failing debt addiction.

Throw in the NSA spying scandal the US has and continues to wage against Germany, add the you-will-get-your-[non-existent]- gold when we say you can have it, and the clock it ticking as to when Germany says, "Genug ist genug!" Many measures have been taken that demonstrate a growing rift between these once-solid allies, and the only thing standing in the way of a complete breakaway is Chancellor Merkel, whose days have to be numbered.

The formation of the BRICS alliance continues to solidify, and there is a growing list of nations wanting to join or become associates. Practically everything connected with the BRICS consortium is growth-based development revolving around or tied to gold, and if not gold then something tangible, often energy related. What is missing is the dependence on the toxic US Treasury bonds and fiat Federal Reserve Notes, incorrectly called the "dollar."

The BRICS just keep building, golden brick by energy brick, the House of BRICS, as it were, and in stark contrast to the House Of Paper by the US. While Obama cannot get an audience for his Asian effort to form an alliance that omits China, cannot get an audience from Saudi leaders moving father and farther away from the US and aligning with China more and more, the recent BRICS Summit in Brazil had the presidents from over 20 countries not just in attendance, but heading up their delegations.

You do not see this caliber of commitment from Obama or any Western leader, for a reason. Other than more debt, the West has nothing tangible to offer.

The BRICS have formed their own banking cartel to eventually rival and possibly make obsolete the IMF, given enough time. Russian President Putin is spearheading an energy reserve, alluded to above, that will be as important as the BRICS bank. While Obama plays golf, South America is developing strong economic ties as a united region opposed to the fiat-driven enslavement tactics of the US central banks.

Adious, Obama. If you like your fiat dollar, you can keep it. [For our foreign readers, in promising nothing but positive for "Obamacare," Obama made the statement, "If you like your insurance plan, you can keep it." The numbers who lost their insurance plan, once Obamacare was passed was astounding and a disaster for the public.]

Despite all of the sensationalized news events, none have a lasting effect for driving gold and silver prices higher, as one would expect given the war nature in much of the recent news. The behind-the-scenes and underhanded guiding forces of the elites directing the teleprompter-reading, blame-everything-on Russia, golf-playing president Obama has less and less impact, and his credibility is near all-time lows.

There was another reminder, last Monday, of how the elites and their central banks will not go away quietly, and that was the smack-down of gold, around $3.7 billion sold onto the market at one time. The only sensible explanation in a less and less sensible world is one word, manipulation.

Ukraine may end up being the proverbial final straw in the US game plan that turns even the NATO tide against US utterly failing ally interests. In the recent Malaysian plane shot down, Obama is pointing the finger and blaming pro-Russian factors responsible, while knowing full well and not admitting there is not the slightest bit of evidence, credible or otherwise, that points to Russia, just Obama's say so. The can of worms Obama has opened by inciting the takeover of a duly elected Ukrainian president keeps getting worse.

The seemingly never-ending mosaic of events have yet to coalesce into one that has a more definitive direction that will ultimately drive gold and silver higher. We are now in the second half of 2014, and our conjecture that 2014 may be a repeat of 2013 is still in play.

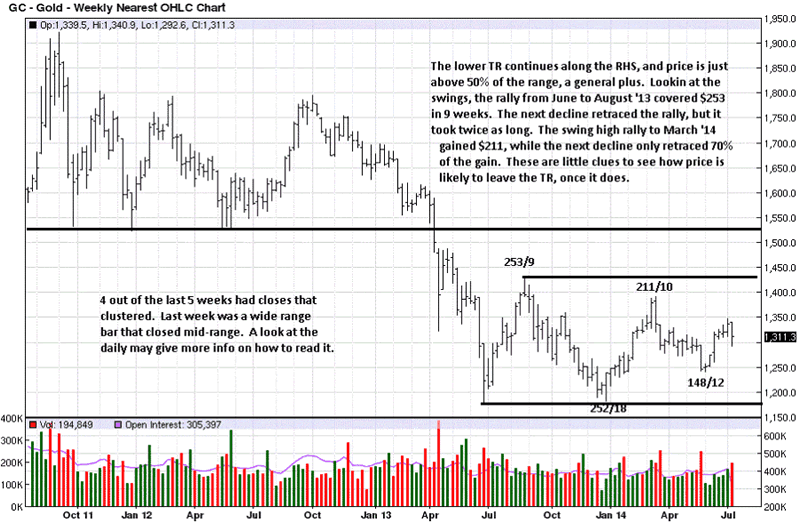

Starting with weekly gold, the lower of two protracted TRs [Trading Ranges], persists with no clear sign of a breakout. This week, we show the extent of price rally and time, viewing each swing up and down. They depict how the corrections lower have been more labored in duration and less in amount. Last week's close keeps gold just above 50% of the range low to high, which is 1306, a general guide to see if a correction can hold a half-way retracement.

The clustering of closes and last week's wide-range bar may have more meaning when viewed on the slightly more detailed daily chart.

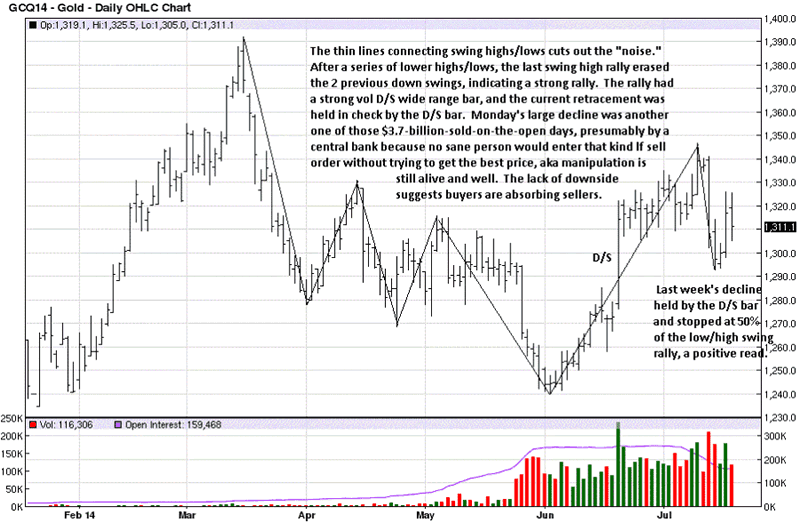

D/S [Demand overcoming Supply] bars are important, especially when [but not always] accompanied with a sharp volume increase. The volume is a mark of strong hands buying that creates the volume as well as the upward ease of movement in price. It is a sign that buyers have overwhelmed sellers and taken control. It is also an early sign of market strength. Subsequent market activity will confirm the validity of a D/S bar.

How? [Good question.]

If a D/S bar is a sign of strength, that observable fact will be confirmed when the bar is retested. A successful retest will be proven when the next decline is held in check within the confines of the bar's range. A retest will hold anywhere from the top of the bar to as much as the lower range of the bar. When a correction holds at/near the top of a D/S bar, the underlying market is strong. Buyers are protecting their positions.

When a correction goes deeper into a D/S bar, the developing trend is not as strong, but it is still showing an ability to hold and likely work higher. Last week's retest of the D/S went well into the bar range but without totally retracing the entire bar. Given that the initial large decline from last Monday resulted from a massive dumping at one time, the reaction has been good, overall.

In addition, as noted on the chart, last week's sell-off stopped at a 50% range retracement. This does not guarantee higher prices, but it puts the probability of rallying higher being greater than continuing lower.

Most all of these observations are based upon logic, using one form of market activity to confirm another, step-by-step. When you read a market this way, you are keeping attuned to what is going on in the market, present tense, without having to know of any exogenous events that may or may not seem to be market related.

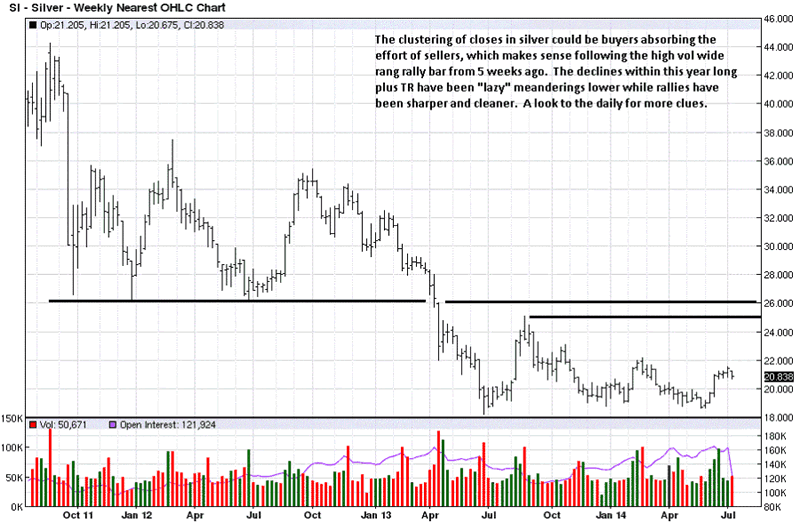

We tend to favor silver over gold during the next rally phase. Both will rally as a pair, but silver is more likely to outperform gold and bring the gold:silver ratio closer than it is. Silver keeps hugging nearer to the 18+ area support area and not rallying higher to the upper resistance area, and that can lead to another lower swing low. This is mentioned as a possibility without assigning any level of probability. If there is one more attempt at a lower low, we would expect it to be brief, but "if" is conditional and not guaranteed.

The daily chart may be more illuminating.

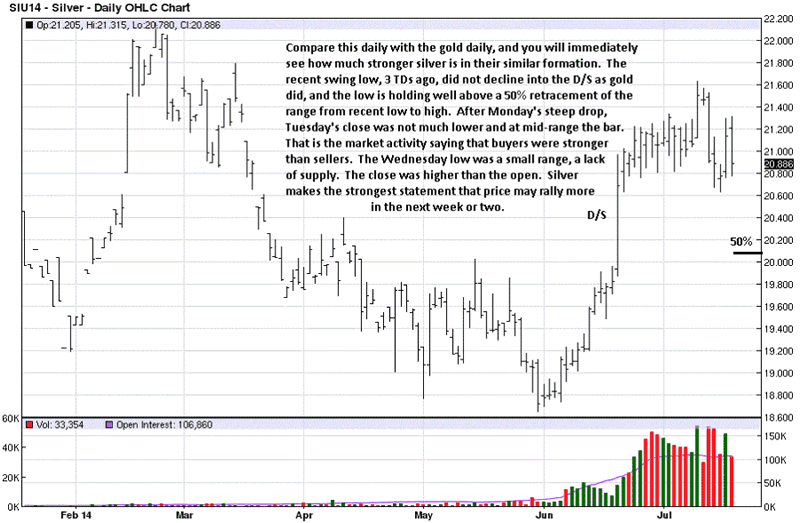

We did not draw in the thin lines connecting the swing highs/lows as was done on the gold chart [daily], because the current activity here is much more obvious, as the comments note. Recall from the explanation of the degree of retracement of a D/S bar will be more indicative of the underlying potential for continuation. Here, last week's rally stopped at the upper reaches of the D/S bar, and well above a 50% of range retracement, making silver's chart performance stronger compared to gold's.

Between the two, the question about further upside is better answered in the silver chart. The probability of higher prices to come is much greater compared to the gold chart. Silver's sideways movement is a weaker correction of its recent gains. What we know about corrections that are weak is that they typically lead to higher prices.

We said that last week in recommending the long side on the breakouts for gold and silver, only to be stopped out on Monday's dumping of gold contracts. It happens, and there is little one can do, except wait for the next opportunity, and they always come along. If this is a developing change of behavior that will lead to a change in trend, the number of opportunities to participate from the long side will grow. Keep one's powder dry for the purchase of futures.

The opportunities for purchasing physical silver and gold are greater now than in the past few years. Keep buying. Keep stacking. A 400% gain in the next 12 -24 months is not a stretch of anyone's imagination. First things first, however, and the first thing we need to see is a breakout of the current TR. There should be no hesitation, however, in the ongoing purchase of the physical metals. None.

It is not a question of an upside breakout for physical gold and silver. Rather, it is more a question of the ongoing breakdown and collapse of the Western banking system and fiat "dollar." That process has been well on its way for several years. It does not happen overnight, until after one night when you wake up, and it will have already happened.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.