Will Gold Price Drag Down the Mining Stocks?

Commodities / Gold and Silver Stocks 2014 Jul 18, 2014 - 07:03 PM GMTBy: Jordan_Roy_Byrne

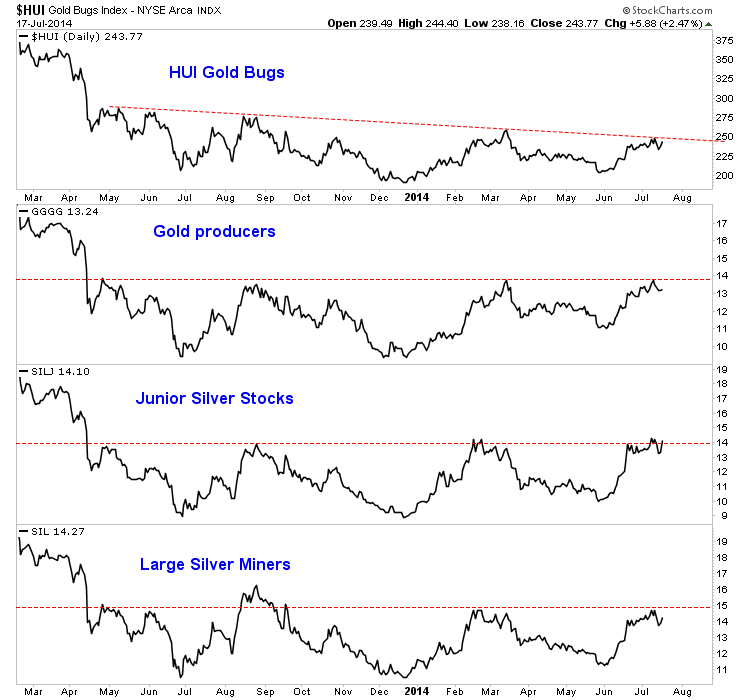

We know that the gold and silver stocks lead the metals at key turning points. The stocks started their bear market well ahead of Gold. This year the stocks have exhibited excellent relative strength. Gold and Silver are up less than 10% this year while GDX is up 27% and GDXJ is up 43%. In recent days GDX and GDXJ reached 10-month highs relative to Gold. SIL hit a 10-month high relative to Silver while SILJ, the silver juniors hit an 18-month high against Silver. The outlook for the miners remains positive but the miners are awaiting and need more strength from Gold.

We know that the gold and silver stocks lead the metals at key turning points. The stocks started their bear market well ahead of Gold. This year the stocks have exhibited excellent relative strength. Gold and Silver are up less than 10% this year while GDX is up 27% and GDXJ is up 43%. In recent days GDX and GDXJ reached 10-month highs relative to Gold. SIL hit a 10-month high relative to Silver while SILJ, the silver juniors hit an 18-month high against Silver. The outlook for the miners remains positive but the miners are awaiting and need more strength from Gold.

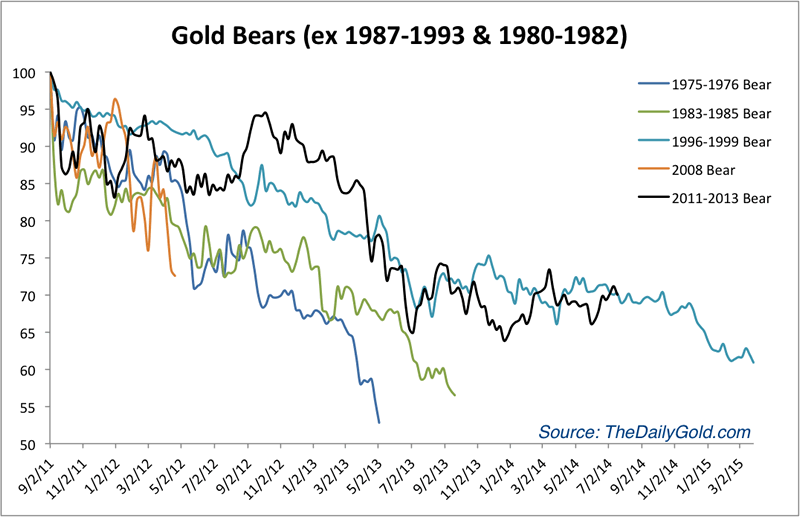

Unlike the gold miners and Silver, Gold never reached a bear market extreme relative to its history. The chart below plots the bear markets in Gold and excludes the most severe bear in terms of price (1980-1982) and time (1987-1993). The bulls can say that Gold has bottomed because the miners did in December 2013. However, the bears can say the current price action is remarkably close to that of the end of the 1996-1999 bear. Until Gold takes out the March highs on a weekly basis then the bears have to be respected.

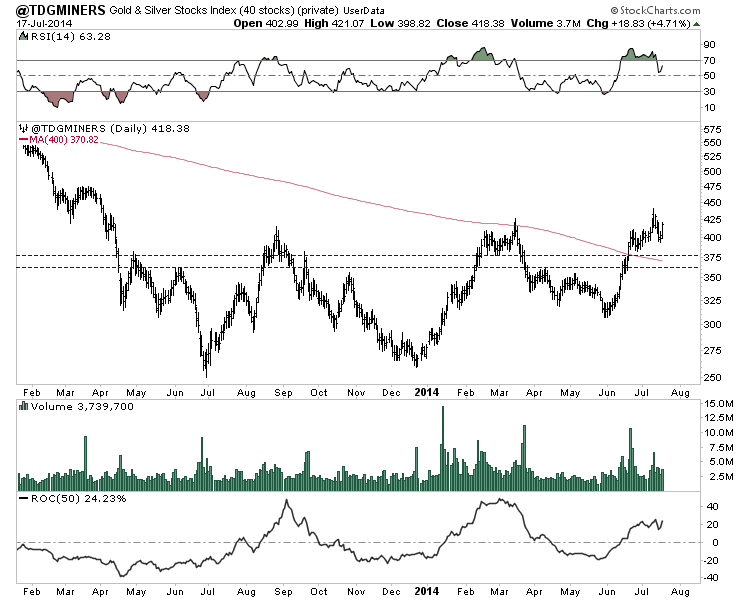

Our top 40 index which has a median capitalization of $750 Million, has already made a higher high and a 15 month high. Though it’s not too overbought it has surged over 30% in about five weeks. The index stopped at the 400-day moving average in March but has advanced above it in recent weeks. On Thursday the index closed at 418. The 400-day moving average is at 371. That is an 11% decline from Thursday’s close. The 50% retracement of the recent advance is at 374.

We know that the miners are very close to a big breakout while Gold could move lower before it moves a lot higher. Back in 2001, the gold stocks bottomed more than four months ahead of Gold. After Gold confirmed its bottom, the miners surged 68% in two months. While the miners are close to a major breakout, perhaps it won’t happen until Gold is ready to rise. The miners could retrace half or even 62% of the recent gains and remain in a strong technical position. That could coincide with weakness in Gold which has formed a bearish reversal on the weekly chart.

Another point is the majority of important breakouts in the miners from 2000 to 2010 occurred in September. Last week we mentioned taking advantage of dips. Now we have one and it could be on the larger side. Taking advantage of upcoming weakness could be critical as it would be in advance of potentially the most important breakout in the miners in many years.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.